Both native and programmatic advertising tools have been beneficial to marketers and companies alike over the past few years, but what would happen if the two merged into one natural ecosystem We’re about to find out.

According to a report from the Business Insider, a new specification from the Interactive Advertising Bureau (IAB for short) under the name OpenRTB 2.3 makes this possible.

With it, the company hopes to provide the “ability to serve up sponsored content that matches the look and feel of a publisher site in real time through automated processes.”

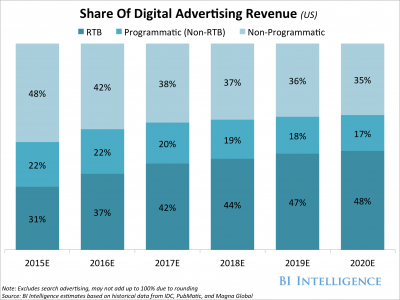

Additional research from BI Intelligence indicates that this has been coming for some time, with programmatic advertising reaching a “tipping point.” Its stats indicate that programmatic transactions will reach a majority percentage of 52% in non-search digital-ad spend, along with 30.6% of total digital ad-spend going to programmatic real-time bidding, or RTB for short. Meanwhile, 21.7% will go to non-RTB programmatic

As you can see from the chart, the differences between RTB, programmatic and non-programmatic bids are set to go through some changes over the next few years, with a decrease in RTB and a rise in non-programmatic means. So, a fusion between native and programmatic could be likelier than expected.

There are some takeaways from the report, including the following:

- More companies and marketers are picking up on programmatic ad-buying and selling programs. Over 80% of agencies and brands already purchase display ads programmatically, while an even greater proportion of publishers are pursuing programmatic channels as part of their sales strategies, according to surveys and our own conversations with industry participants, according to Business Insider’s report.

- Spending on programmatic advertising is growing very fast, at around 20 percent at an annual rate.

- Real-time bidding has become rampant with companies through programmatic means, with a five year CAGR estimated at 24 percent. RTB revenue will top over $26 billion by year-end 2020, up from $8.7 billion this year. Mobile RTB and video RTB are growing even faster, at roughly 2X the rate of programmatic overall.

- “Trading desks” are being downsized in favor of programmatic expertise taking over in the natural ecosystem. This may speed growth in programmatic spending among agency clients.

- Here’s how pricing is breaking down: for premium and guaranteed placements they are on the upswing, while prices continue to plummet for miscellaneous inventory.

The big conclusion from this report indicates that this could open a few doors as far as advertising circles are concerned, even though some companies would have to get used to certain results and methods. This fusion of two different advertising types could introduce some great new ideas for consumers.