Worldwide digital games market has seen a significant increase, rising 7 percent year-over-year to a total of over $5.5 billion dollars.

Fallout 4, which managed to earn over $100 million in digital revenue within its first three days of release, is of the bigger success stories in the industry right now. That ties in with its overall sales numbers, which cleared over $750 million.

Although not everyone saw success over the month’s popular MMO DOTA 2 managed to drop out of the top five due to a number of bugs and a lack in tournament play — there were many interesting new venues that could lead to some shake-ups in 2016. These include Nintendo entering the mobile game market, as well as Tencent vowing to give the growing virtual reality market a try, which could lead to a $5.1 billion increase in 2016. Those are broken down into more detail by Van Dreunen below.

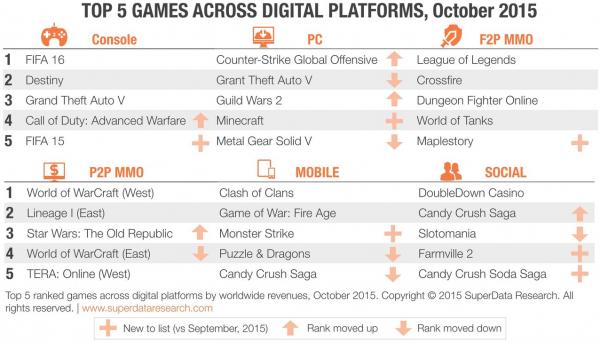

The top-selling digital titles by category for the month are as follows:

FIFA 16 continues to show dominance on consoles, while Grand Theft Auto V still has great presence even a year after its release on Xbox One, PlayStation 4 and PC. Meanwhile, League of Legends and World of Warcraft still have heavily popularity and DoubleDown Casino is still the top dog on the social front.

Van Dreunen also provided a number of observances from the report:

Van Dreunen also provided a number of observances from the report:

The worldwide digital games market hits $5.5B, up 7 percent year-over-year

In the lead-up to the holiday season, total digital games sales hit their highest point for the year so far. With the exception of pay-to-play MMOs, all segments managed to grow their revenue. Digital console revenues rose 14 percent year-over-year to $375 million, driven in particular by a spending increase in North America. The growing install base for both the PlayStation 4 and Xbox One drove digital console earnings by 41 percent. Global digital PC earnings were up 6 percent, totaling $622 million, as gamers in Asia pushed sales by 53 percent, proving themselves more accustomed to purchasing full PC games upfront. The size of the global mobile gaming audience maintains its momentum: the total monthly active users was up 13 percent year-over-year, totaling 2.3 billion in October. As emerging economies like India open up to mobile gaming, the growth curve behind average spending is slowing, increasing only 7 percent to $2.1 billion.

Bugs and a tournament hangover cause Dota 2 to drop out of top 5. FIFA 16 dominates

Valve’s popular DOTA 2 saw a decline in revenue and player numbers fell for the second straight month. Bugs have been pestering the game since its latest update, cooling audience excitement together with a comedown following the all-time-high around The International 2015 tournament. This rare moment of weakness allowed Nexon’s Maplestory to take DOTA 2’s place, knocking itout of the five top-grossing free-to-play MMOs. Expansions for Guild Wars 2 and Star Wars: The Old Republic, allowing both games to move up in their respective segments. As publishers held off on major new releases until late October and early November, legacy tiles with strong additional content sales won out on PC and console. EA’s FIFA 16 earned 52 percent of its October digital revenue from additional content, and strong sales of FIFA Ultimate Team card packs also boosted the year-old FIFA 15, earning it a spot on the top-five digital console titles.

Fallout 4 earns $100 million in digital revenue its first three days on the market

Bethesda’s hotly anticipated game launched on Nov. 10, selling 1.87 million digital copies in three days, with 1.2 million of those copies were on PC. As Bethesda managed to cultivate enthusiasm among an enthusiastic community of modders, a slew of mods further drove the success of the title. On launch day, the game had 440,000 concurrent users on Steam, a record for any game not published by platform owner Valve. The game’s success is proof that PC gamers are willing to spend $60 on the right title and do not exclusively wait for deep discounts.

Nintendo places first bet in pursuit of $6.2 billion Japanese mobile games market

In Miitomo, launching in March 2016, players create a Mii avatar that answers friend’s questions and interacts with other’s Miis. Most expected the first game from the Nintendo and DeNA partnership to be a mobile version of one of Nintendo’s best-known franchises. Miis are in fact an extremely recognizable Nintendo IP for the audience the company most needs to win back: Casual Wii and DS users who later moved on to mobile games. Miitomo is a natural fit for Japan, where local messaging app LINE is ubiquitous. Japan’s mobile games market is the highest grossing in the world, making the territory an ideal place for focus before Nintendo develops mobile games with more international appeal.

Overwatch is coming to consoles but won’t be free-to-play

Blizzard’s upcoming first-person shooter will not follow in the footsteps of the publisher’s free-to-play Hearthstone: Heroes of WarCraft and Heroes of the Storm. Instead, the game will start at $40 on PC and $60 on PS4 and Xbox One when it launches next year. Free-to-play games on consoles are still few and far between, so rather than venture into uncharted territory, Blizzard is opting for guaranteed revenue by charging upfront. While the premium model will limit the game’s audience at launch, Overwatch still has the potential to be a top-tier eSport. Of the five games with the largest eSports prize pools, two (Call of Duty and Counter Strike: Global Offensive) are both premium-priced first person shooters.

Tencent enters the virtual reality void as the global market approaches $5.1 billion in 2016

Tencent has announced VR support for the miniStation, its upcoming Android-powered microconsole. The gaming and Internet giant, which owns League of Legends developer Riot Games, will likely control China’s largest non-mobile VR platform. Tencent owns stakes in Epic Games, whose Unreal Engine is being used to power many upcoming VR games, and AltspaceVR, which focuses on virtual gatherings. Tencent’s VR project also benefits from a lack of competition in China. The Playstation VR will not be a major platform in the market due to limited PS4 adoption, and the high-end PCs needed for the Oculus Rift and HTC Vive are out of reach for most Chinese consumers.