Mobile advertising has certainly come a long way, even to the point where it’s more used than traditional desktop advertising — and some companies may change their approach as a result.

VentureBeat has reported mobile advertising has seen a significant increase, based on findings from a recent report from Opera Mediaworks.

The platform has already seen a large amount of attention from companies, serving 90 percent of the top global advertisers and reaching out to over 800 million unique mobile users. However, Opera noted an even larger growth for the medium, with a five-times increase between today and a year ago. Video ads have jumped the highest in that time, going from 2.5 percent early last year to nearly 13 percent now. And that video is responsible for a large amount of revenue for publishers, accounting for 55 percent.

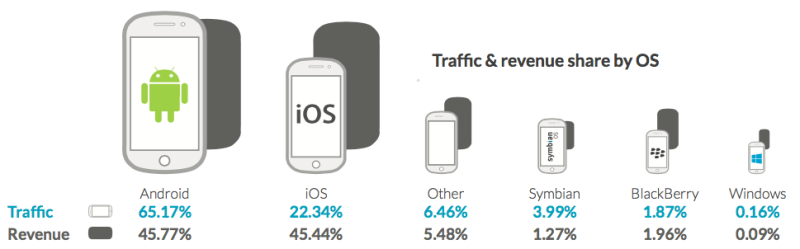

As you can see in the chart above, Android takes up the biggest portion of that revenue, with 65 percent of traffic accounted for, and 45 percent of revenue. iOS is in second place with only over 22 percent of traffic, but about the same amount in terms of revenue. Meanwhile, Windows had such a low count that it couldn’t even muster one percent in either category.

“What we get excited about is TV for the next generation,” said Opera CMO Will Kassoy, speaking with VentureBeat. “The number one action that consumers do after a brand campaign is click to watch more video.”

While the numbers don’t represent the entire mobile advertising ecosystem, they show that video has made quite an impact, between a number of mobile advertising acquisitions and its increase over the competition by a staggering 20 percent.

“We hit a major milestone in Q4,” continued Kassoy. “We surpassed $100 million in revenues for the quarter for the first time. We’re the largest independent ad network, and our reach is now over one billion monthly impressions.”

The U.S. has the largest count with this change in video ads, followed by other nations like Canada, the U.K. and Australia. This is mainly due to the size of infrastructure, and quality of video offerings. As you can see from the chart above, the growth of video in both impressions and revenue delivered to publishers and app developers is incredible, and not likely to stop anytime soon.

Social networks play a part in this advertising, too. It’s the biggest leader for impressions and revenue, followed by general music, video and media, communications services and games.

As for what division got the most attention in video, movie and television entertainment unsurprisingly lead the charge, followed by other, food and drink, and automotive, as indicated by the chart above. Games fell into the lower count here, probably due to developers focusing more on game content than commercials (though some apps still do it).

“The key question is how do you drive marketing effectiveness and efficiency,” said Kassoy. “The brands that are more advanced and sophisticated are moving from awareness — like TV— to some form of engagement . . . which would lead to learning more about a product or service, and ultimately to a purchase.”

AdWeek has reported that Google is already adapting to the shift to mobile advertising, seeing as how desktop numbers have dwindled. “The purchase funnel is officially dead,” said Jerry Dischler, vice president of product management at Google. “What we’re seeing are these short bursts of activity that we’re calling micro-moments. We see the new challenge for marketers is to be there at those moments anytime, anywhere.”

With smartphones accounting for more than half the searches across ten countries (including the U.S.), Google wants to take more of a focus on mobile, a plan it intends to reveal later today at the AdWords Performance Summit, which can be seen here.

This includes expanding location-based tools for more businesses, as well as gauging the success of a mobile ad. “We’ve been building on it since December — we expect by the end of the year that this will work for thousands of advertisers in more than 10 countries,” said Dischler.