There’s plenty of excitement over VR, but right now the market is mostly virtual since the high-end devices have yet to launch. As a consequence, predictions about the future of VR are subject to change as more data becomes available. Recent surveys and new data present a changing picture of VR, and keeping abreast of the latest changes is important for marketers and anyone else trying to devise strategy for the next year or two.

The latest study by Horizon Media, polling 3,000 people in the US, had some interesting figures on the state of the VR market. Asked about Samsung’s Gear VR, the Oculus Rift, and Google Cardboard:

- Only 33 percent of the respondents knew about one of those devices.

- However, 36 percent of the people surveyed said they were interested in owning a VR device.

- Cost is definitely a factor, as only 25 percent of users are willing to spend more than $250 on a VR device at this point.

- Young men have greater interest in owning a VR device, with 47 percent of men vs. 25 percent of women.

- Age groups break down to 54 percent of 18-to-34-year-olds vs. 44 percent of 35-49 (25 percent of 50-64).

- They are also twice as likely to say they would pay $250+ for a device, 31 percent of men vs. 16 percent of women; 30 percent of under 50 vs. 15 percent of 50-64).

- Men are three times as likely to have already tried VR technology, 16 percent of men vs. 6 percent of women.

“Samsung Gear VR and Google Cardboard are low-cost alternatives that lower the barrier to entry,” Horizon Vice President-Trendsights Kirk Olson said. “That benefits marketers because the sooner we see more consumers using VR devices, the sooner we’ll understand what they’re truly good for. Not just what they can do, but what they can do that consumers care about. The ‘caring’ part is the key to creating meaningful and effective consumer connections.”

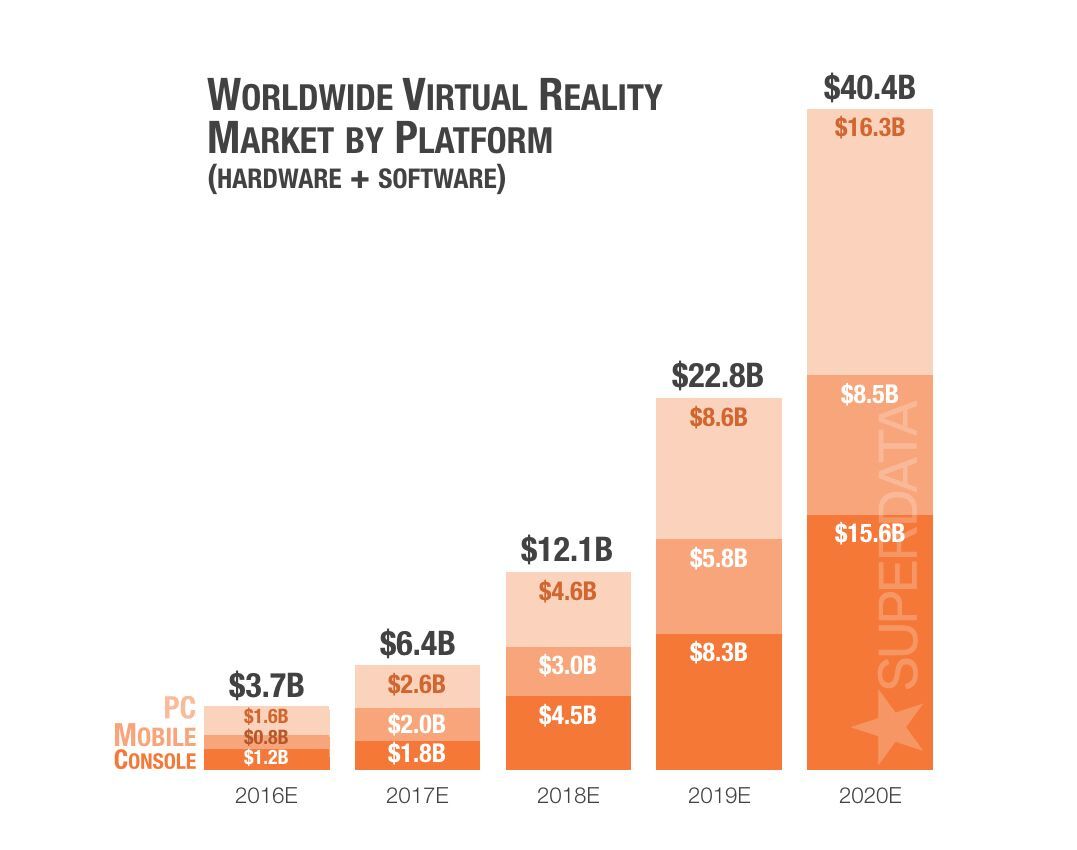

SuperData Research has revised its forecast for the VR market, lowering the short-term growth but keeping its longer term predictions intact. The firm anticipates the total market for VR content to reach $40 billion by 2020E. Over the next five years, SuperData expects the number of households that owns at least one VR device to increase nine-fold. Mobile will lead with 16.8 million devices sold and PC initially lags at 2.0 million devices until high processor requirements and prices decrease. PlayStation VR sales are currently forecast to reach 2.6 million by the end of this year after anticipation heightened once Sony announced a big reveal at this year’s Game Developer Conference.

“After conversations with key hardware and software companies, we are confident that our forecasts have been adjusted to more accurately reflect the VR market’s potential,” said SuperData Director of Research and VR lead Stephanie Llamas. “As expected, mobile device adoption will be highest due to accessibility to hardware, lower price points and forced adoption. This will be the key audience for entertainment, the second largest segment, while VR gaming’s $6.9 billion market in 2020E will mostly center on PC and console.”

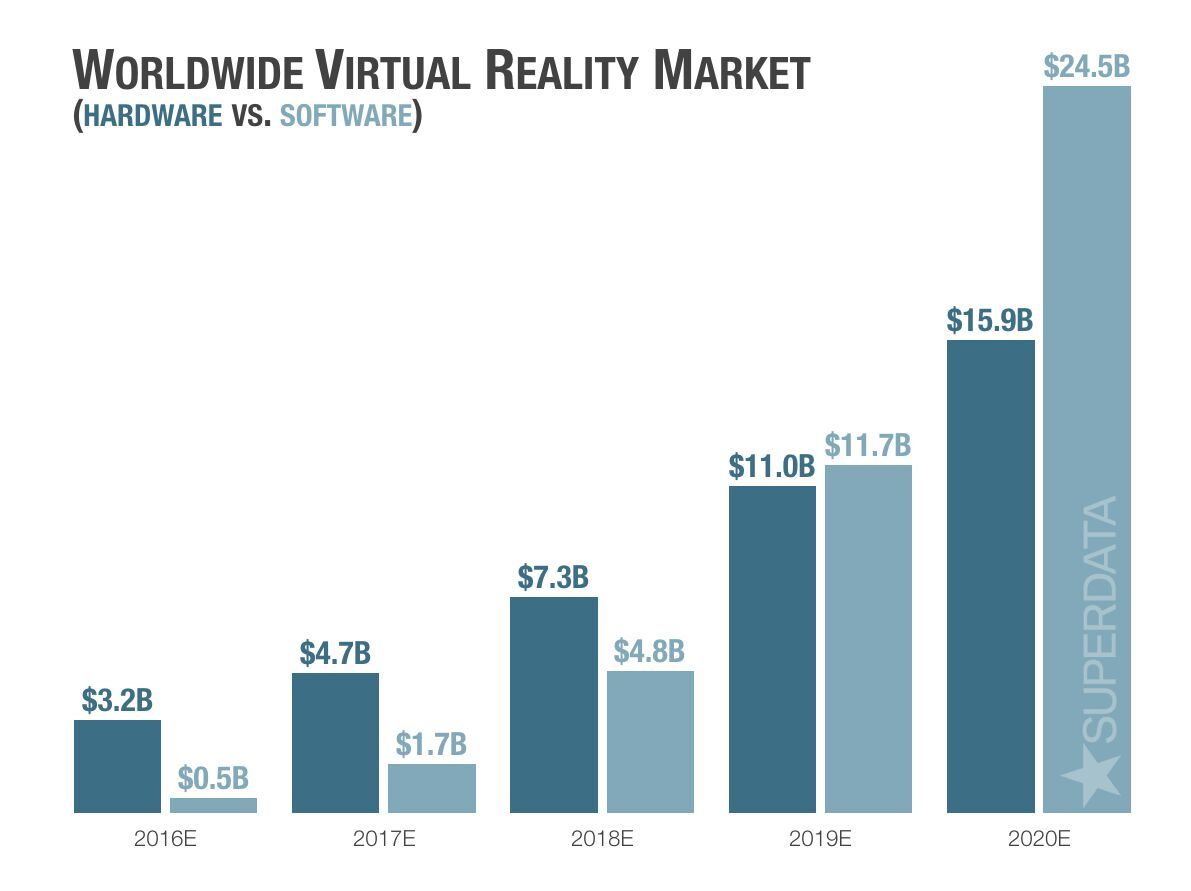

According to Llamas, “John Riccitiello’s ‘gap of disappointment’ (an initial lull in adoption that eventually grows an increasing rate) helped us understand VR hardware’s place within a historical context.” Hardware adoption has always grown exponentially and, as a result, the new forecasts reflect this trend. “There is a lack of content in the beginning of a new media cycle, which is something that VR is facing now,” Llamas said. “Software revenue will begin with just a half a billion dollars in revenue, growing slowly year-over-year until acceleration begins with $24 billion in 2020. Now that developers see VR’s potential they are clamoring for first-mover advantage leading software revenue to outpace hardware by 2019.”

Key data points on the current market for Virtual Reality from SuperData Research:

- Total VR market revenue will reach $40 billion over the next five years, at a CAGR of 61.3 percent.

- Almost 200 million households worldwide will own at least one VR device by 2020.

- Mobile manufacturers are on track to sell 17 million VR devices in 2016E, as console hits almost 3 million and PC another 2 million.

- VR manufacturers will see slow device adoption to start, but will show quick linear growth once John Riccitiello’s “Gap of Disappointment” passes in 2020.

- Initially gaming will claim three-quarters (77 percent) of the VR software market, eventually giving way to non-gaming content developers.

[a]listdaily spoke with SuperData Research’s director of research and VR lead Stephanie Llamas about some of the latest research on VR.

Is your lowering of VR estimates for this year reflective of lower hardware revenue, lower software revenue, or both?

In regard to why we lowered the revenue, it is a combination of both. We overshot Google Cardboard in the beginning but now that they’ve been a bit more forthcoming with their adoption rate, we have more to reference. We also realized later that there just isn’t going to be enough content at first to warrant a higher estimate.

According to the Horizon Media study, only some 33 percent of people are aware of the major VR devices. Do you think these devices are going to need some marketing sooner rather than later?

Yes, they will need marketing. Samsung has been at the forefront of the effort by “forcing” adoption – sending out the Gear VR with S7 pre-orders. They also have a location in NYC where you can play with the headset in a storefront window so people will “watch the watcher” as they call it and get them excited to try. It really comes down to trying the device. If you don’t try the device, you have no idea what to expect. But once you do, it’s mindblowing.

Do you expect to have a better picture of the VR market in the next couple of months, after there’s some high-end VR hardware in consumer hands?

We will definitely have an even sharper picture of the market throughout the year. Our forecasts continue to adapt to new information we get from conversations with industry leaders and newly available data. We are also working on a consumer insights product to learn more about consumer sentiment and intent, so that will give us a better picture of how people who have and haven’t tried it view VR.

Horizon Media’s study showed VR discussions on the Internet revolve around gaming 93 percent of the time. Does this finding match your research?

That finding indeed matches our research, where you’ll see gaming makes up 77 percent of software revenue this year.

As we go into the summer and fall, what key indicators will you be looking at to gauge how well the VR market is doing?

We are mostly interested in how much money is being invested, hardware and software sales figures and the consumer research we do to gauge brand recognition, intent and behavior.