The financial transaction involving Activision last week was massive and complex, which led to confusion in the media reporting on the event. ‘Activision goes independent’ was part of many headlines, perhaps leading to an impression that Activision is no longer a public company. The exact opposite is true — Activision is more of a public company than before. The deal leaves Activision in control of its own future at the cost of adding a sizable amount of debt. How exactly has Activison changed, and how might this affect the future of the company

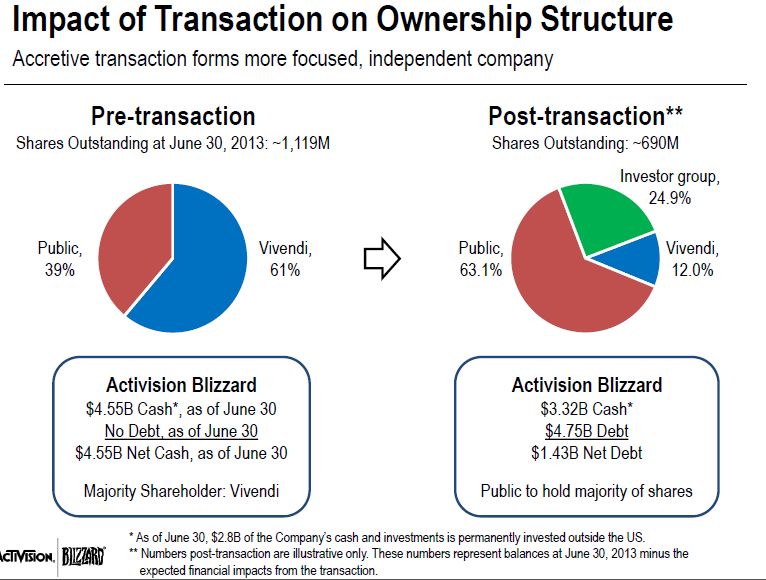

The deal itself has been under negotiation for months, and in the offing since the merger of Activision with Vivendi’s games unit (most importantly Blizzard Entertainment) back in 2008. The merger at that time left Vivendi with 61 percent ownership of Activision-Blizzard, with the remaining 39 percent of shares held by the public. The catalyst for the current buyout was the expiration of a clause in the merger agreement that required Activison directors to approve any debt greater than $400 million, preventing Vivendi from taking Activision’s cash or borrowing against the company.

Vivendi is seeking cash because it a massive debt problem, owing more than $15 billion, and it wants to reduce that debt. Unable to find a buyer for Activision in the last year, Vivendi has accepted the deal put forth by an investment group led by Activision CEO Bobby Kotick and chairman Brian Kelly. Here’s how the deal works: Activision is borrowing $4.75 billion from banks and using $1.2 billion of its own cash, along with $2.3 billion from an investment group, to reduce Viviendi’s share of Activision to 12 percent. The investment group will own 24.9 percent of Activision, while 63.1 percent will now be owned by the public.

The investment group included $50 million each from Kotick and Kelly, along with investments from Fidelity Investments and others including Chinese game giant Tencent. The deal has increased the value of shares held by the public, which is why Activision stock jumped more than 15 percent to its highest point since 2008.

There are several good things about the deal, especially from the view of Activision’s leadership. The deal puts the complete control of Activision in the hands of its board of directors. Shareholders have seen a good increase in the value of their shares. Importantly, the deal still left Activision with substantial cash, and a manageable debt load that’s roughly equal to about four years of profits (at the current profit levels). On the negative side, the cash on hand is mostly overseas (some $2.6 billion out of about $3 billion) which would incur substantial taxes were Activision to repatriate it. The company will only have about $400 million in US cash handy when the deal closes.

Activision has already committed extra resources to marketing this fall, and the lesser amount of cash available shouldn’t be an issue in funding those efforts. The company should be raking in substantial amounts of cash in the latter half of this year. As long as Activision maintains its current profitability, the new debt load should not affect operations. Business should proceed as normal this year and the next.

It’s the longer term picture for Activision that’s murkier. The deal weakens Activision’s ability to acquire new companies or to substantially invest in major new areas. A deal for TakeTwo, say, would be more difficult now. The debt service shouldn’t be a problem if Activision continues to generate the same sort of profits it has for the past several years, but there are signs that may be changing.

The most important dark cloud for Activision concerns Blizzard, the source of most of Activision’s profits. Activision announced that subscribers to World of Warcraft had fallen by 600,000 in the last quarter, down to 7.7 million overall. The game reached its high point in 2010 with 12 million subscribers. Blizzard is taking steps to move the game to free-to-play, but it’s unknown when and if that might happen and whether it would revive the game’s ability to generate profits. Moreover, Blizzard just junked its new MMO in development (codenamed Titan) and will start over. Don’t expect something to come out of that project for several years.

The Activision deal is great for Activision’s leadership and good for current investors, but it really has no great impact on the company’s business for the near future. Longer term, Activision will be fine if it can continue to produce hits like Skylanders. Bungie’s Destiny looks like it has a fair shot at being such a blockbuster. If Blizzard can maintain profits on World of Warcraft long enough to create a new game of similar scale, that will be a key to Activision’s success. The new consoles arriving soon need to sell well, because while Blizzard’s revenue is almost all from PCs, Activision’s business is mostly console-based. Expect Activision to buckle down and continue pressing ahead with no particular change, except perhaps a greater sense of urgency. The consequences for Activision of a major product stumble, if one ever occurs, just became greater.