According to a recent IAB Europe report, CMOs prioritized brand safety in 2022 and now see technical innovation as key to keeping their brands safe. But has the nature of brand safety changed in the generative AI age?

Brand Safety Dominated CMOs’ Agendas In 2022

The IAB Europe‘s Brand Advertising Committee most recent brand survey revealed that over two-thirds of respondents agreed that brand safety was a key priority for the industry in 2022. Furthermore, according to the report, 53 percent believe that the industry has done a good job of tackling brand safety over the past 12 months, a meaningful increase from the 36 percent who agreed in a similar survey conducted in 2019.

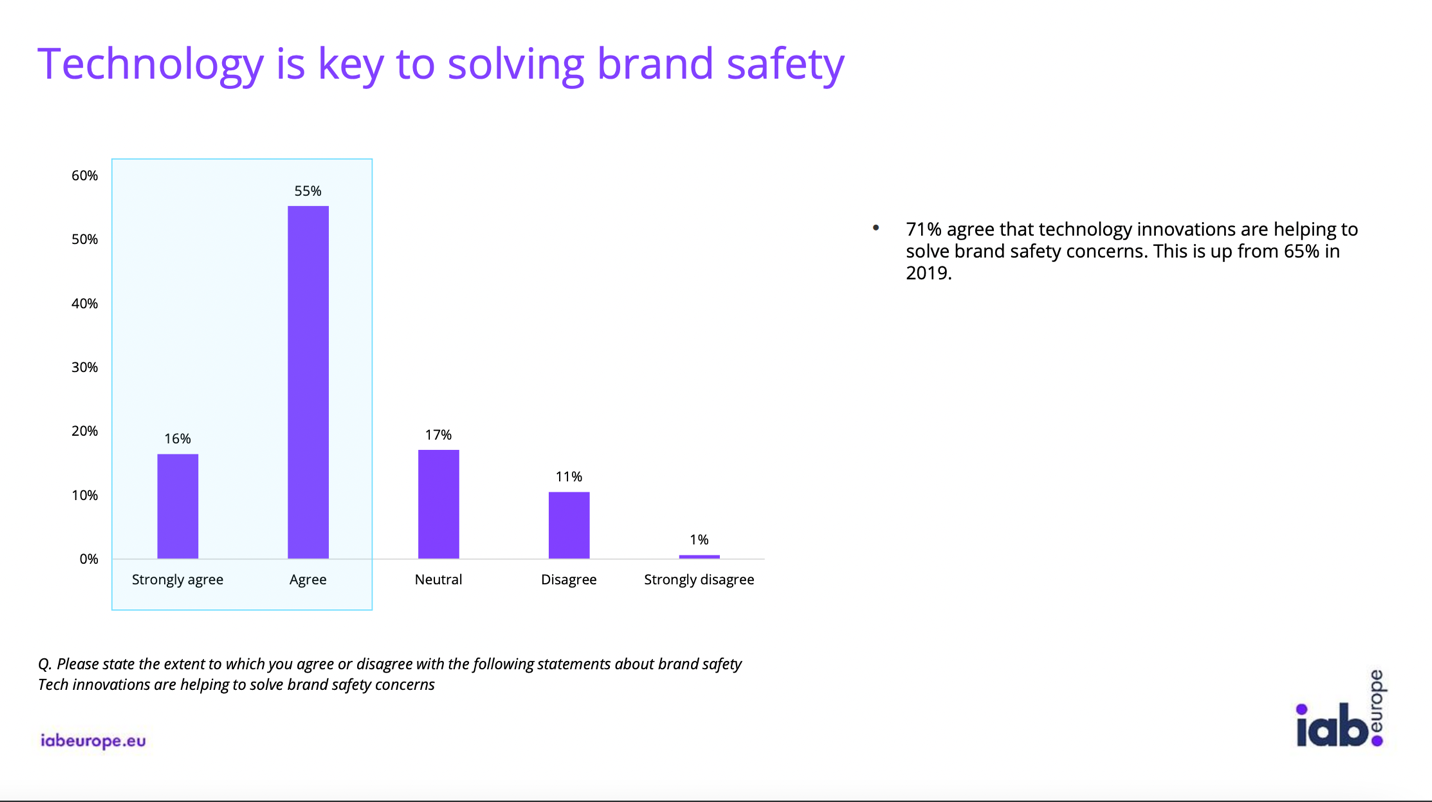

Much of that shift may be attributed to brands’ use of innovative technologies to track brand risk across multiple platforms. The IAB survey found that 71 percent of respondents cited technology innovations as critical to their ability to solve brand safety concerns, up from 65 percent in 2019. In addition, respondents cited innovations like machine learning and natural language processing as essential to their brand safety strategy.

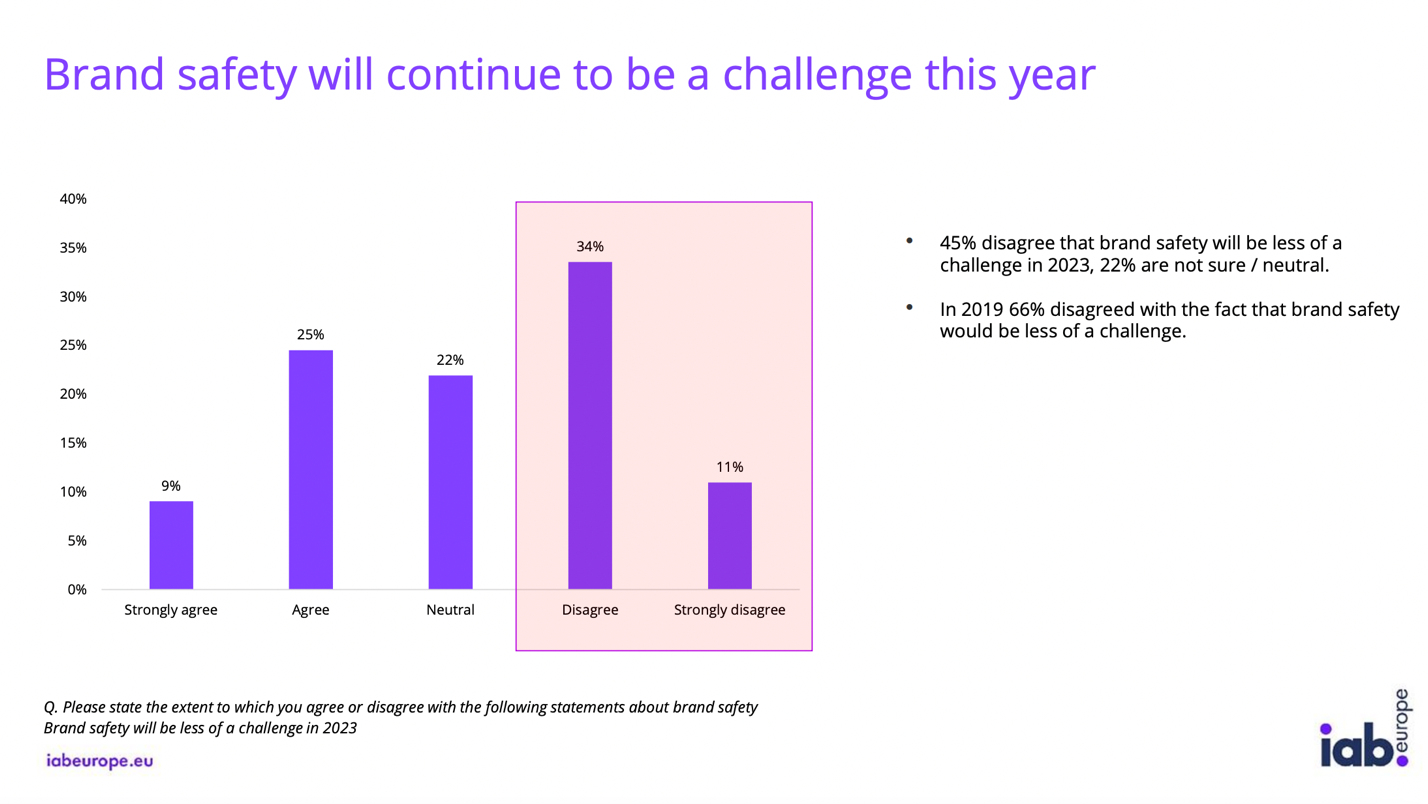

According to the report, only 45 percent of brands surveyed believe brand safety will be less of a challenge in 2023. That may be because, despite technical advances in how brands can track and analyze brand risk, solutions may vary in quality and offer inconsistent results across platforms. Case in point: the numerous brand safety concerns that upended Twitter advertising in late 2022, causing many brands to reduce or halt ad spend temporarily.

Brand Safety Is Changing Because Of New Technologies

New platforms and technologies also mean new categories of risk for brands. For one of the world’s largest advertisers Procter & Gamble, managing risk has meant cutting as much as $140 million in digital ad spend due to concerns about brand safety in 2017 and again in 2022, in removing ads from parts of Eastern Europe. That’s because, for brands, brand equity matters much more than the reach supplied by ads. According to Andre Schulten, P&G’s CFO, in a January 19 earnings call, the company is focused on “sufficiency” in their advertising spend to grow the brand.

“I would characterize our current media spending and support spending for our brands as sufficient, which we are paying a lot of attention with each of the businesses,” Schulten stated. “And sufficiency is defined as sufficient reach, sufficient frequency. It’s not defined as dollars spent.” Schulten noted that the company’s goal was to “continue growing our brands, their top-of-mind awareness, and their equity.” Schulten stated that future reinvestment with respect to media would occur when “there is a positive return in the short term, and we can further strengthen our brands or specific innovation that is out there.”

According to Claire Atkin of Check My Ads Institute, a brand safety consultancy, the value and complexity of brand equity are becoming more apparent to brands because of consumers’ new awareness of how ads work and their role in supporting content and, by extension, ideas.

“The first thing to know is that brand equity matters. I mean, the entire idea of brand safety acknowledges that brand equity is very important,” said Atkin. “And it’s not just ‘Don’t sponsor hate.” Instead, Atkin says that brands want to be associated with “good, trusted publishers” and “good, trusted brands” – not promoting harm or misinformation is not enough to win the trust of today’s more informed consumer.

Atkin stated that “brand safety tech companies complicated the idea of brand equity” because their tech tends to focus on an article-by-article metric rather than a larger context of relevance and messaging for the brand and its audience.

“Ad tech companies have co-opted the idea of what a key performance indicator is for a campaign,” Atkin believes. “They’ve said, we’ll get you reach, we’ll get you click-throughs, there’ll be no waste, and will keep your brand safe; they’ve made all these huge promises.”

According to Atkin, when brands go for higher view rates at lower CPMs, they can end up in some dodgy areas of the digital ecosystem, risking brand equity amid content that does not reflect or even opposes their core brand message.

As new data predicts only a mild rise of 2.6 percent in ad spend in 2023 due to inflation concerns, CMOs will likely be more judicious about where they are directing their budgets and the potential risk to their investments from content or platforms with lax or non-existent brand safety controls.