The latest video game consoles have been selling very well indeed, but as the latest NPD numbers show, software sales have been lagging far behind. Software for last generation consoles like the PlayStation 3 and Xbox 360 have been below expectations, while the PlayStation 4 and Xbox One titles have not reached the same blazing numnbers that the hardware has set. Based on the latest data about game sales on consoles and other game industry sectors, DFC Intelligence has revised its forecast for game industry software revenues through 2019.

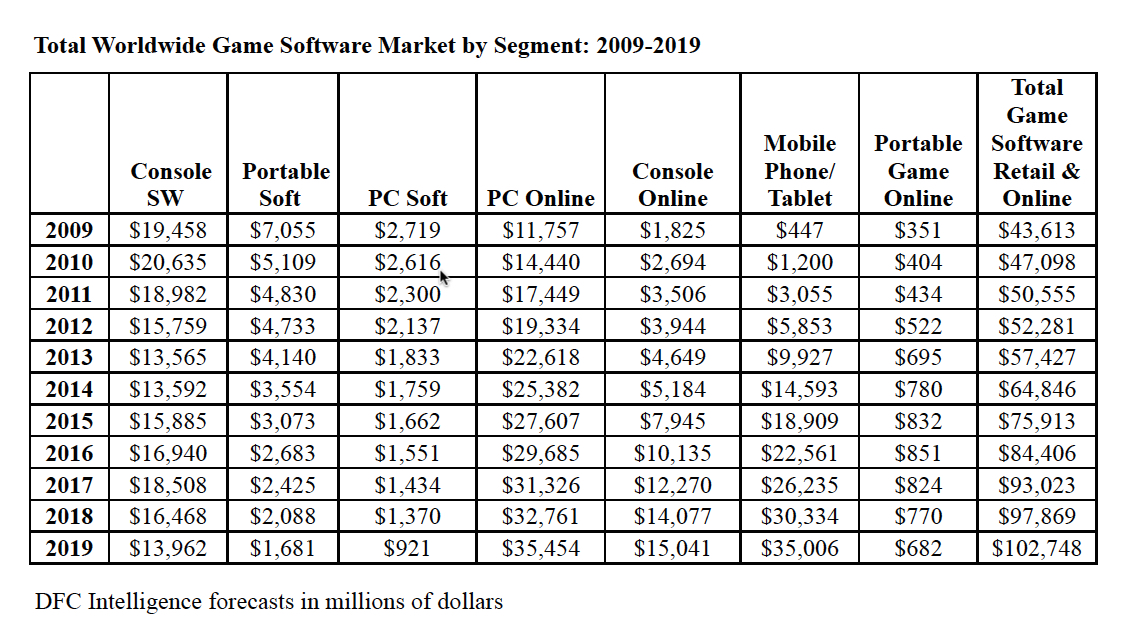

A new report, posted via GamesIndustry International, shows the revised numbers for the report that DFC posted earlier this year, when it said that the worldwide video game software market would reach $100 billion by 2018. The new numbers show even greater strength in mobile games, but substantially lower the numnbers for console games. Total software numbers are still likely to come close to that number, but not quite pass over it until 2019, with an estimated $102.9 billion in sales.

DFC believes console game sales will rise over the next few years, only to drop back down to the same levels as we’re seeing reported for 2014. That’s a rather depressing long-term trend for those companies whose revenue depends on selling games in retail stores. Meanwhile, smartphone and tablet game software will rise in to $35 billion by 2019.

“The console market is still very robust for AAA products. The concern is losing that second tier audience that made products like Wii, PS2, Guitar Hero, Kinect, Singstar, etc. so successful,” noted DFC’s David Cole. “Basically the more casual audience now has so many low cost options.”

Portable console software will continue its steady decline, with an estimated drop down to $1.68 billion in 2019 from the current $3.55 billion.

When it comes to PC online games, however, numbers will continue to increase, with online consoles tripling to $15 billion in 2019, and PC’s lapping that with an estimated $35.45 billion by that time. Thus the two leading sectors of the game industry in 2019 will be PC online and mobile, and given the way mobile numbers have been revised upward repeatedly in the last few years, it seems like a good bet mobile games will be the single largest segment of the game industry in the future.

“Digital only console game sales are continuing to grow, as are digital sales of retail games, however in terms of overall units the former is still larger than the latter but big AAA retail games are steadily increasing their digital percentage of total sales,” observed DFC analyst Jeremy Miller. “Day 1 digital releases on Xbox One and PS4 are helping the digital shift, but we can’t overlook the value of strong catalog management on both XBL and PSN. Digital catalog game prices have to compete with greatest hits, used games and the bargain bin at retail. It takes smart curation of these digital stores not unlike on the PC with Steam, which has gone through many evolutions in its history and not always smoothly as catalog sales become mostly dependent on discounts. That said, Microsoft and Sony, as well as Nintendo despite the Wii U trailing in next gen hardware sales, recognize the importance of digital sales of AAA retail games though will still have to simultaneously make it convenient and competitive for consumers while keeping retailers happy.”

Brands also play a big part in the numbers, something that developers can learn from. “The biggest leverage area is strong cross platform plays. Think games like Angry Birds and Minecraft,” said Cole.

The DFC study provides plenty to think about for game company executives as they plan development budgets for the next few years.