SuperData CEO, Joost van Dreunen, analyses the June numbers in this special [a]list daily report:

- Digital games market totals $774 million in June, as Watch_Dogs drives digital console.

- Subscription MMO market declines, as spending per player reaches $170 per year.

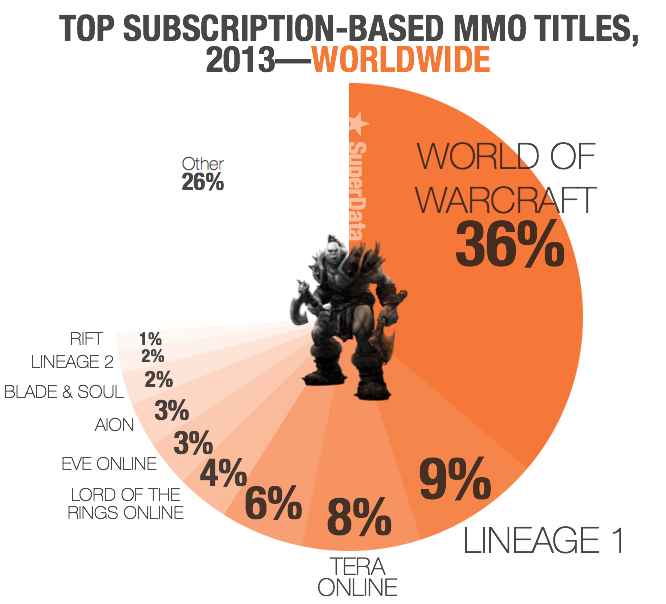

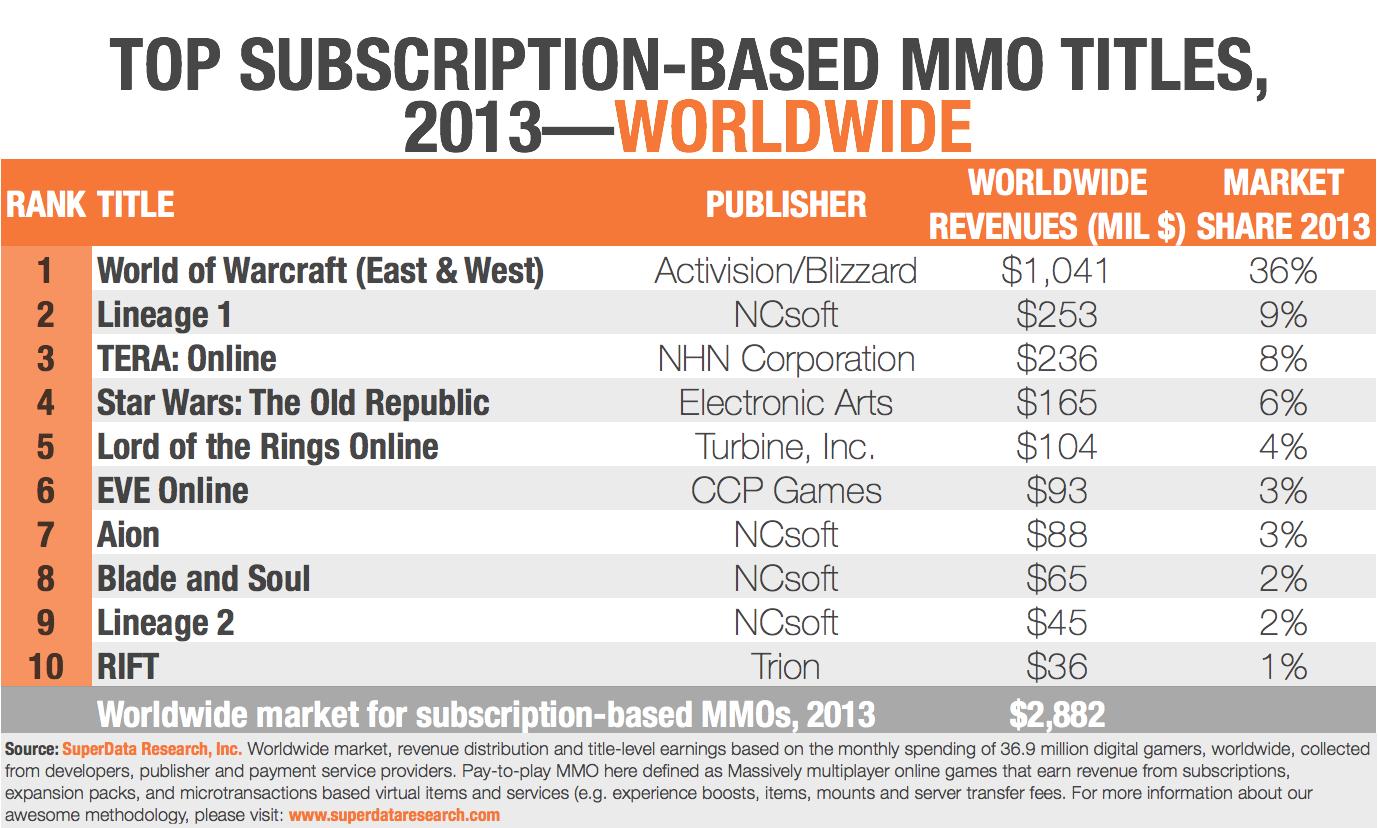

- New entrants WildStar and Elder Scrolls Online challenge status quo in $2.9B MMO market.

- King rolls out more happy fun time; silences critics. Glu rolls out Kardashian bombshell.

In this month’s digital games report, we take a closer look at the subscription-based MMO (pay-to-play) market, following the release of Bethesda’s Elder Scrolls Online and NCsoft’s Wildstar. Despite an ongoing decline in both players and total revenues, the average revenue per user continues to rise. The subscription-based MMO market, now a mature market, is expected to stabilize in the next few years, as free-to-play alternatives reach saturation. With the value of an average pay-to-play player going up, we expect more ferocious competition among Western and Eastern publishers, offering higher quality gameplay and new narrative settings.

June proved a sluggish month for the digital games market, despite the success of Watch Dogs (Ubisoft) and Kim Kardashian: Hollywood (Glu Mobile). Overall spending totaled $774 million, up 4.6 percent compared to June last year. Both the digital console and PC downloadable categories were down 11 percent from the high in April, led by Ubisoft’s Watch Dogs, and totaled $240 million in June. As the new console cycle gains momentum, following the announcements of key titles at last month’s E3, we observe a slight year-over-year dip among social, mobile and free-to-play in favor of digital console and PC.

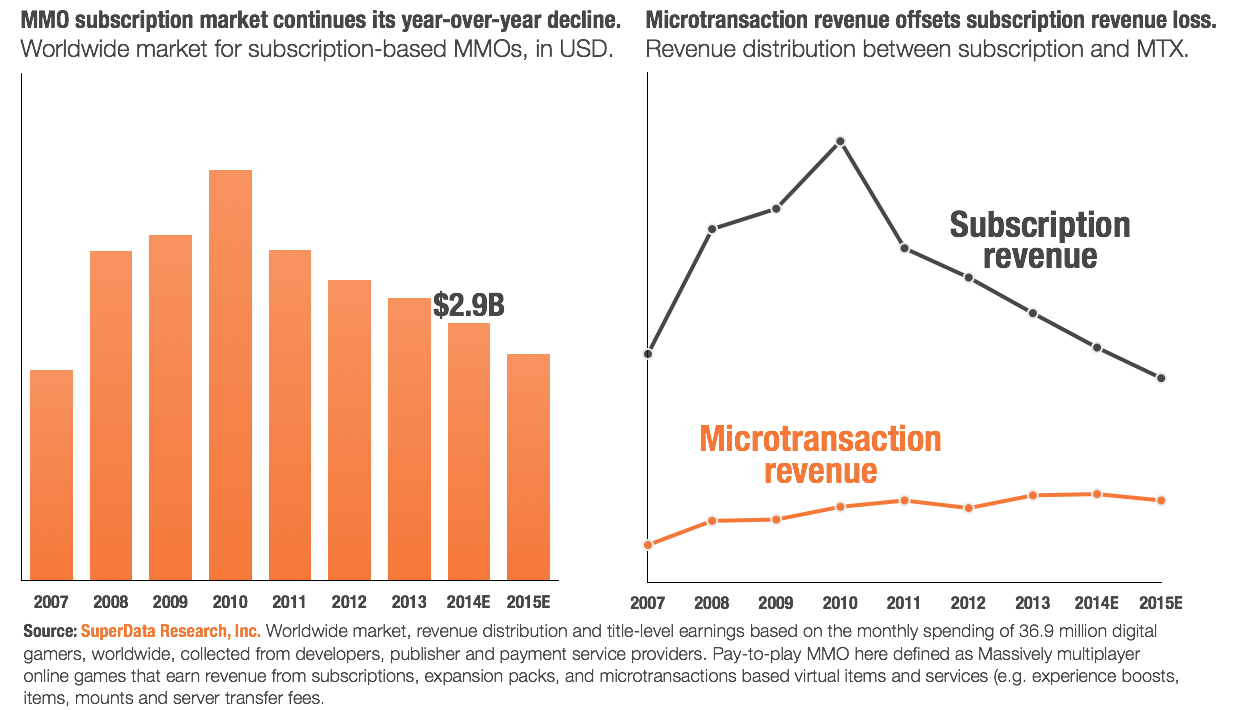

Microtransaction revenue offsets losses in subscription revenue

The pay-to-play MMO market has been shrinking since 2010, dropping from 30.6 million monthly active subscribers worldwide to 23.4 million this year. To offset the loss of revenue, several key titles have incorporated or switched entirely to a microtransaction-based revenue model. In the past five years, the percentage of revenue for subscription-based MMO generated via additional in-game microtransactions has roughly doubled from 14 percent for 27 percent. Furthermore, the average digital spend, in addition to the monthly fee, has tripled from $16 to $46 worldwide. Despite the overall decline, this category has so far managed to maximize their ability to monetize a shrinking yet loyal player base.

Wildstar (NCsoft) and Elder Scrolls Online (Bethesda) challenge status quo

When Bethesda Softworks released Elder Scrolls Online, the industry took notice as the publisher fearlessly announced a subscription model, rather than going free-to-play like its direct competitor Guild Wars 2 (NCsoft). So far, a subscriber base of 772,374 (June) indicates that its strategy is working. And perhaps its because of this that NCsoft released its own subscription-based title, Wildstar, over one month ago. As the initial purchase included a free first month, NCsoft is about to find out how strong the demand for sci-fi action really is. Traditionally, sci-fi styled MMOs tend to generate three times as much in monthly revenue compared to fantasy-based titles. And the early signs are good. According to Carbine, the game has so far seen “four to five times” as many concurrent users than during its open beta stage. Combined with NCsoft’s expertise, having four titles in the worldwide top 10 for subscription-based MMOs last year, Wildstar is a strong contender in the current market.

King silences critics

Despite heavy criticism during the time of its IPO, King has doubled down on developing a stable of fun yet increasingly challenging games for both mobile and social platforms. In June, it released Bubble Witch 2 on Facebook and mobile, which builds on the mechanics of several of its other titles, offering a clever mixture of bubble shooting, puzzling and animal rescue. On the business end, King is also making moves. It announced having entered into an agreement with Tencent to handle its distribution in Asia, and shifting marketing budget away from mobile (due to a lack of inventory) in favor of traditional TV advertising to expand its audience reach.

Glu rolls out Kardashian bombshell

As the mobile games market grows more crowded, the anticipated value of brands is starting to become evident as we observed the explosive success of Kim Kardashian: Hollywood (Glu Mobile). The game managed to become the top grossing mobile title in just a few weeks, due to a combination of the high visibility of Kim Kardashian, experienced game design from Glu Mobile and a clear targeting of female mobile gamers. Provided its success persists, the title is currently on track to generate $200 million this year.

Source: SuperData