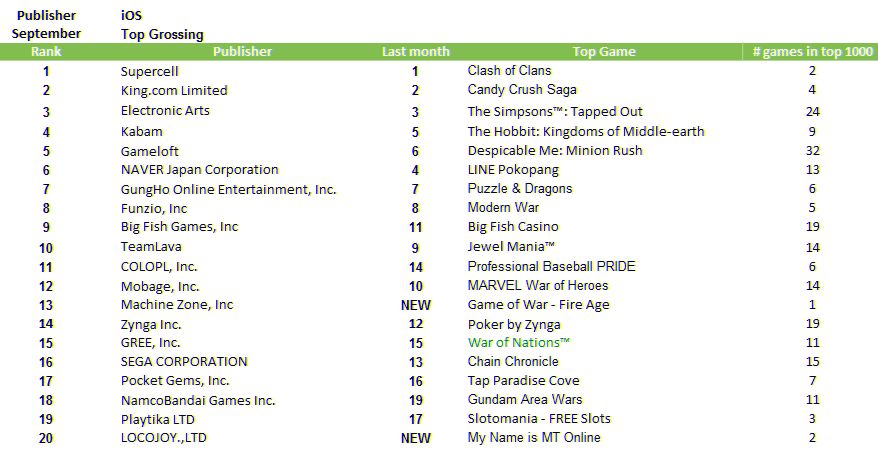

The September report from Newzoo on mobile gaming shows an interesting set of trends, with the biggest being the consolidation of top-earning games between GungHo and Supercell. Newzoo CEO and co-founder Peter Warman analyzes the numbers.

Finally, Supercell’s blockbuster mobile game Clash of Clans hit the Google Play store, launching on the 30th of September. Most likely the launch was postponed until the $1.5 billion investment of GungHo in Supercell was finalized. Since the launch, revenues of the Google Play version have ramped up to around $250,000 a day in the space of three weeks. Japanese and U.S. consumers generate an equal share of 20 percent of this total.

The launch is helping Supercell to reach two big milestones. Firstly, Clash of Clans joins a select number of games worldwide that generate revenues of more than $1 million a day. Secondly, since GungHo’s investment in Supercell, the top three games of both companies are taking close to 10 percent of game revenues in the iPhone, iPad and GooglePlay stores. On a global scale only Candy Crush sits in between Puzzle & Dragons, Hay Day and Clash of Clans to form the top four grossing mobile games on the planet. The three franchises of Supercell and GungHo combined will be running at a $1 billion yearly turnover rate soon.

GungHo, with the support of Softbank, is taking a different strategy than their Japanese colleagues GREE and DeNA in building a global mobile entertainment empire. GREE’s effort to set up local offices around the world and source games from local developers has proven not to work. At least not at the pace that they wanted and needed considering the investments they were making.

The acquisition of OpenFeint back in 2011 for $100 million showed GREE’s ambition to be a mobile destination for multiple games, a strategy that turns out not to be so effective. Only Kakao in Korea has succeeded in becoming the destination of choice to select games from a huge portfolio. Until today, GREEs best grossing app is their “game portal app” called GREE.

DeNA and its mobile game publishing brand Mobage also relies on Japan for most of its revenues and uses Western IP, such as Marvel to create success outside their home market. Their Marvel War of Heroes game is doing very well actually, ranked on position 20 in Google Play.

GungHo, with its enormous hit Puzzle & Dragons is taking a completely different approach than GREE and DeNA by focusing on a limited number of big franchises. They are buying two of the four best-grossing mobile games on the planet and a studio that has experience in developing free-to-play games with a very good conversion to revenues. The top four games are Clash of Clans, Candy Crush, Hay Day and GungHo’s own Puzzle & Dragons. Following the move by GungHo, the GungHo-Supercell alliance owns three of the four top grossing games in the world. The only one not owned is Candy Crush of King, who has filed IPO and is expected to be valued at about $5 billion. In that sense, the $1.5 billion for 51 percent of Supercell could be seen as a pretty good deal.

In other news, tomorrow Apple will introduce new devices, and it’s widely expected that new iPads will be featured. A new iPad launch will no doubt have a positive influence on hardware sales and app revenues. The bigger issue, that we all know about, is if Apple can regain its lead in device innovation. New functionalities and device properties including curved screens (LG, Samsung), 15+ MP cameras (Samsung, Nokia), underwater use (Sony) are nibbling away at the preference of the gadget geek for Apple. There are some signs that youngsters aged 16 to 25 are developing a preference for non-Apple smartphones in the US and Europe, stating that iPhones are for older people. That could have a significant and sudden impact, if they all move together. A phenomenon that brought BlackBerry to the top in Europe — temporarily that is. Because of Apple’s focus on growth in Asia this might not appear in the global sales figures until late….