(Editor’s note: [a]listdaily is the publishing arm of the Ayzenberg Group. To read the updated Q4 EMVI report reflecting the rapid changes in social, click here.)

Written by: Robin Boytos

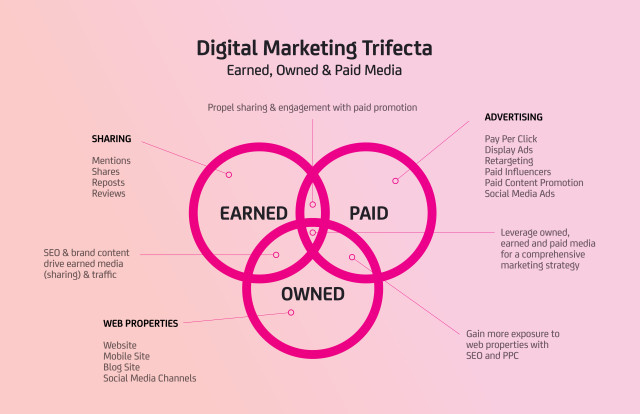

Earlier this year, at Ayzenberg, we created our first iteration of the Ayzenberg Earned Media Value Index (AEMVI) to help marketers better justify the value of content marketing. Since then, we’ve been regularly watching and evaluating market trends and decided enough fluctuation in earned media values warranted a formal Q4 update. (For a refresher on EMV, read our original article here. We’re committed to regularly monitoring these trends to ensure values are up to date.)

Part of the reason we created our own EMVI is because the social landscape changes so quickly that all publications we’ve found with EMVs were quickly outdated. Often, we also found that their methodologies are not thoroughly defined, or they were making use of indexes that were difficult to present as justification for value with executives at Fortune 1000 companies.

Since our last update, we’ve seen Snapchat soar in popularity, Instagram continuing to see exponential growth and making up for Facebook algorithm changes that throttle brand reach. We also witnessed the launch of Facebook reactions, the shutdown of Vine, and so much more.

To truly understand the effects of these changes, we take a holistic comparison-based approach that involves reviews of auction-based pricing on social networks, paid social and media campaign data, organic social data, and third-party publications across several key verticals—auto, beauty/fashion, consumer electronics, gaming, entertainment, and our newly added verticals, finance and healthcare. For more thorough details on our methodology, you can watch our video here.

What’s New?

As mentioned above, we added in finance and healthcare as verticals to our comparisons due to popular demand and customer feedback from the first AEMVI report. Financial industry pricing tends to skew much higher, and therefore we recommend applying a 2x multiplier to our baseline values if using these values for financial content marketing.

We added LinkedIn as a platform. LinkedIn is a valuable network especially for consumer electronics and healthcare. AEMVI inquiries helped encourage more research and numbers of actions on this popular social business platform.

We added a value per post for some networks. If engagement metrics are absent from data provided to you as a marketer or provider, then cost-per-post can be applied to help prove the value of marketing initiatives. Our goal is to aggregate as much information as possible to help show the value of earned media.

Most importantly, we switched our labels to “value per” as opposed to “cost per.” This was done to be clearer about what the Index communicates. Both actual prices and other research about the value of social endorsements and actions are included so the term “Value” is more appropriate. Some cost-based prices are included for reference with the values.

Biggest Shifts In Values

The largest and most surprising shift in value is Facebook’s value per click. Facebook recently launched major changes to their programmatic buying platform, allowing marketers to reach more people with better targeting, and making clicks much more competitive. These trends make sense to us at Ayzenberg, since we know from eMarketer that 74 percent of sales from social channels come from Facebook. Additionally, the launch of the Buy Now button has helped click-through conversions across all verticals. Simply put, clicks are valuable on Facebook.

Another big shift in value is Facebook’s value per page like. Since network pricing is more competitive in January and June, there was an increase in value during those months. There is a lot more content published by brands during these months, making it harder to stand out from the crowd. If you are evaluating a campaign for January or June, we recommend bumping up a multiplier from our baseline value in these months.

Instagram is the fastest growing social network, which makes obtaining a new fan a bit easier; this drove down the value per page like. However, engagement is strong. Instagram is where millennials and Gen Z are actively spending their time, making these engagement metrics that much more important.

LinkedIn has a very deliberate audience, driving rich value per click. Click throughs on this platform mean the person wants to learn more with a solid expectation of what they’ll be consuming beyond the gate of the social platform.

On Snapchat, not only did we add value per engagement (screenshots), we also adjusted down the value per view on this platform after learning this platform uses a less precise page load view methodology.

What’s To Come?

As mentioned above, social media platforms change quickly. We’re excited to see the effects of Facebook Live and 360-degree video on engagement metrics. On Instagram, we can look out for the addition of Instagram Stories. The network also recently announced they’re rolling out Facebook’s programmatic buying platform, which will surely cause rifts in values. As for our favorite update, Snapchat is coming out with a reporting API which will give us a wealth of knowledge and insight into the value of our engagement on this platform.

With the holidays around the corner, marketing behavior and consumption habits change dramatically, and it will be interesting to see how this activity drives values both up, and down.

As always, we’ll be monitoring and be excited to share a post-holiday release. Stay tuned to hear more about these updates by subscribing to alistdaily.com and be sure to download our most recent Q4 report here. To contribute rate cards to our study, or to provide feedback, please email emv@ayzenberg.com.