Mid-January China Mobile, China’s largest mobile operator, started selling Apple’s iPhone. The effect can clearly be seen on iPhone game spending in its first full running month of February: an increase of 20 percent representing around $10 million. In one month, the network added an astounding 14 million 3G subscribers.

Remarkably, revenues generated on the iPad in China fell by 27 percent compared to January, pushing them down into fourth place in the country rankings, behind Australia. iPhone revenues are now almost five times bigger than iPad revenues in China. This trend can also be seen in Japan, where iPhone games generate more than ten times the revenue of the iPad.

The jump in China revenues did not prevent iOS game revenues from slipping on a global scale, as expected in the post-holiday period. Moreover, iPad revenues witnessed a greater drop than iPhone. Playstore revenues were up several percent points, led by growth in Japan and the US. Supercell and King are still dominating the publisher charts, a trend that is likely to continue as King’s latest saga titles race through the charts and Supercell’s third game, Beach Boom, is released.

The key rank changes for iOS and GooglePlay games as well as publishers are described below.

iOS

The top five games have remained unchanged with Clash of Clans retaining the top spot, followed by King’s Candy Crush Saga. Hay Day, Puzzle & Dragons and Game of War: Fire Age are claiming the next three positions.

King’s latest release, Farm Heroes Saga, has climbed to position six, following its debut at eleven last month. This is the fifth title in King’s Saga series for mobile. Big Fish Casino: Free Slots, Blackjack, Poker, Cards & Bonus Chips! has climbed four spots to number 13.

There is one new entry, Dragon Quest Monster, which debuted at number 14. King.com has the most games of any publisher in the top 20, with three of their titles featuring.

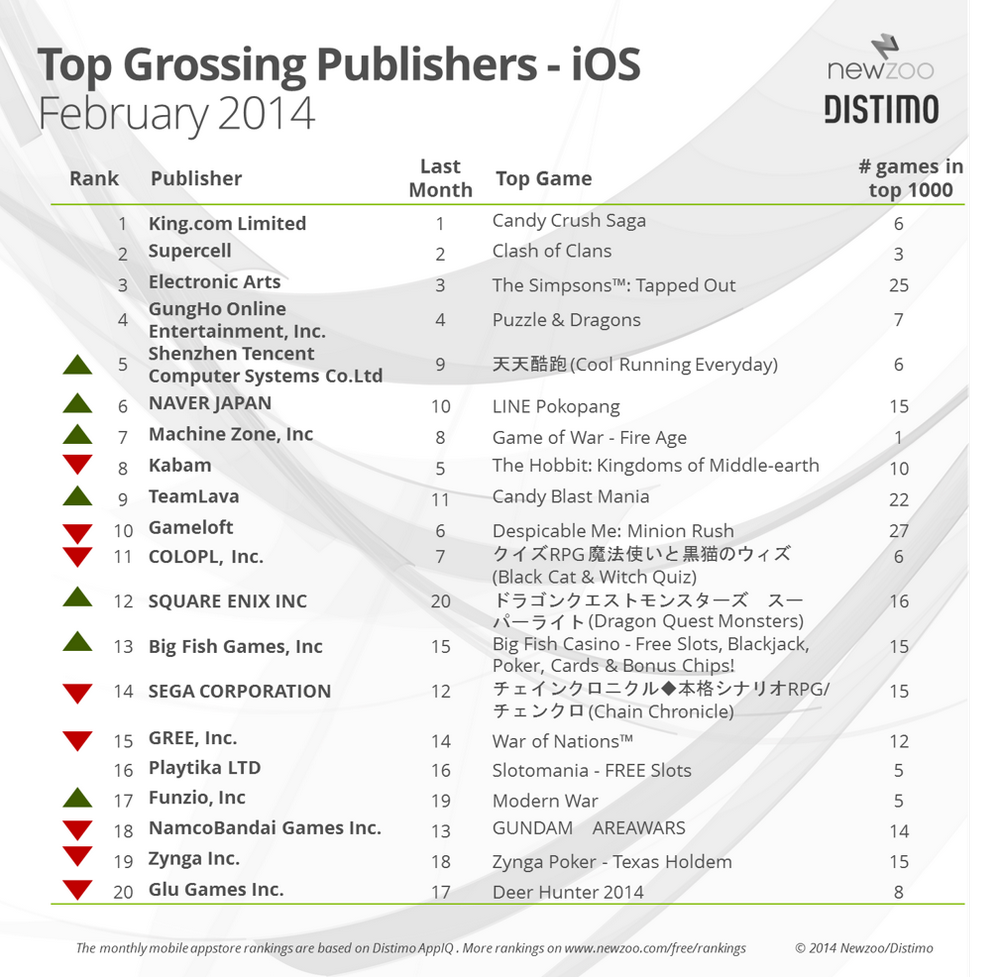

On the publisher side, the top three remained unchanged this month with King.com holding the top spot and Supercell taking second place followed by EA. King now has three games in the top ten following the successful release of Farm Heroes Saga to mobile.

Shenzhen Tencent Computer Systems Co.Ltd has jumped a further four places to number five thanks to the continued success of Cool Running Everyday. Kabam have dropped three spots to number five, while Gameloft dropped four spots to number six. Square Enix, who re-entered the charts at number 20 last month, has climbed to number twelve.

Playstore

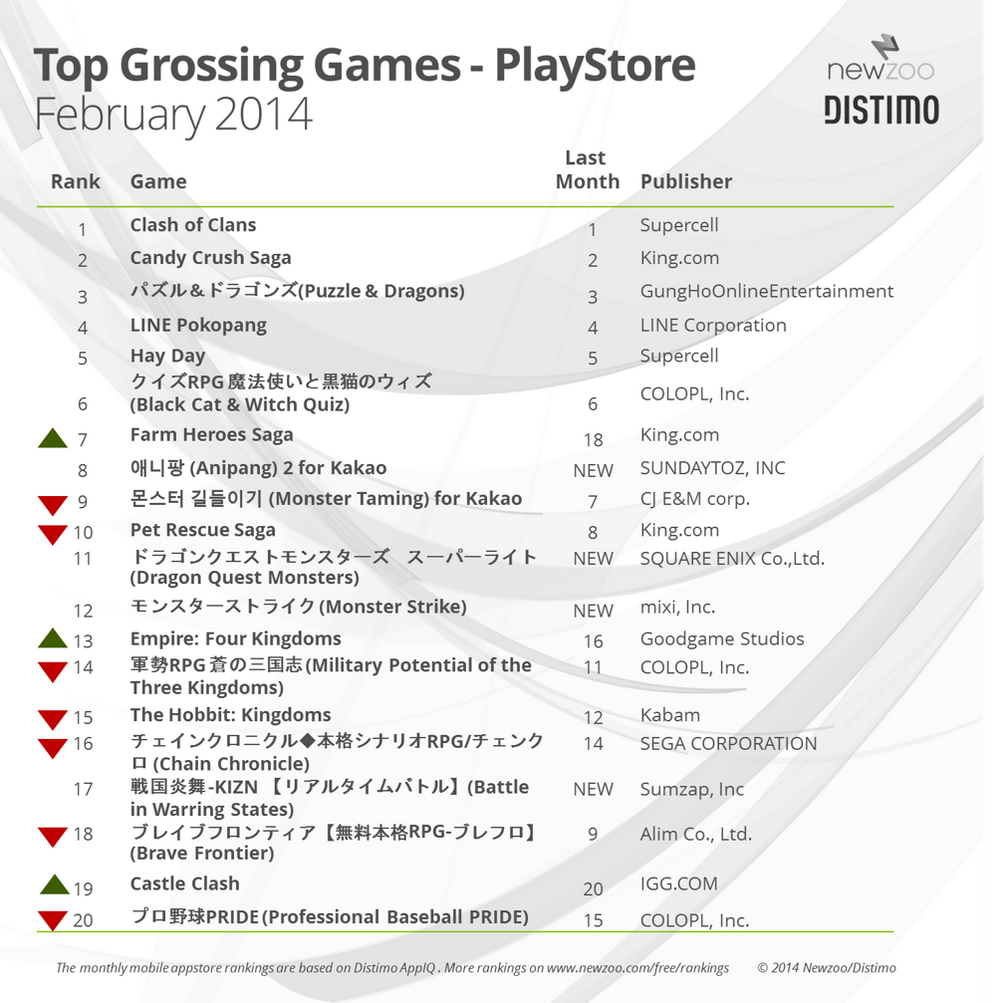

Just as in the iOS charts, the top five games remained unchanged this month. Clash of Clans is holding on to the top spot followed by Candy Crush Saga and Puzzle & Dragons. Supercell’s second hit title, Hay Day, is still sitting at number five having made its debut in the December charts.

King’s latest release, Farm Heroes Saga, has climbed eleven places to number seven. Candy Crush Saga for Kakao is notably missing from the charts having peaked at number nine in December.

Anipang 2 for Kakao has made an impressive debut at number eight in the charts. Dragon Quest Monster is new at number eleven with Monster Strike and Battle in Warring States also entering the charts this month.

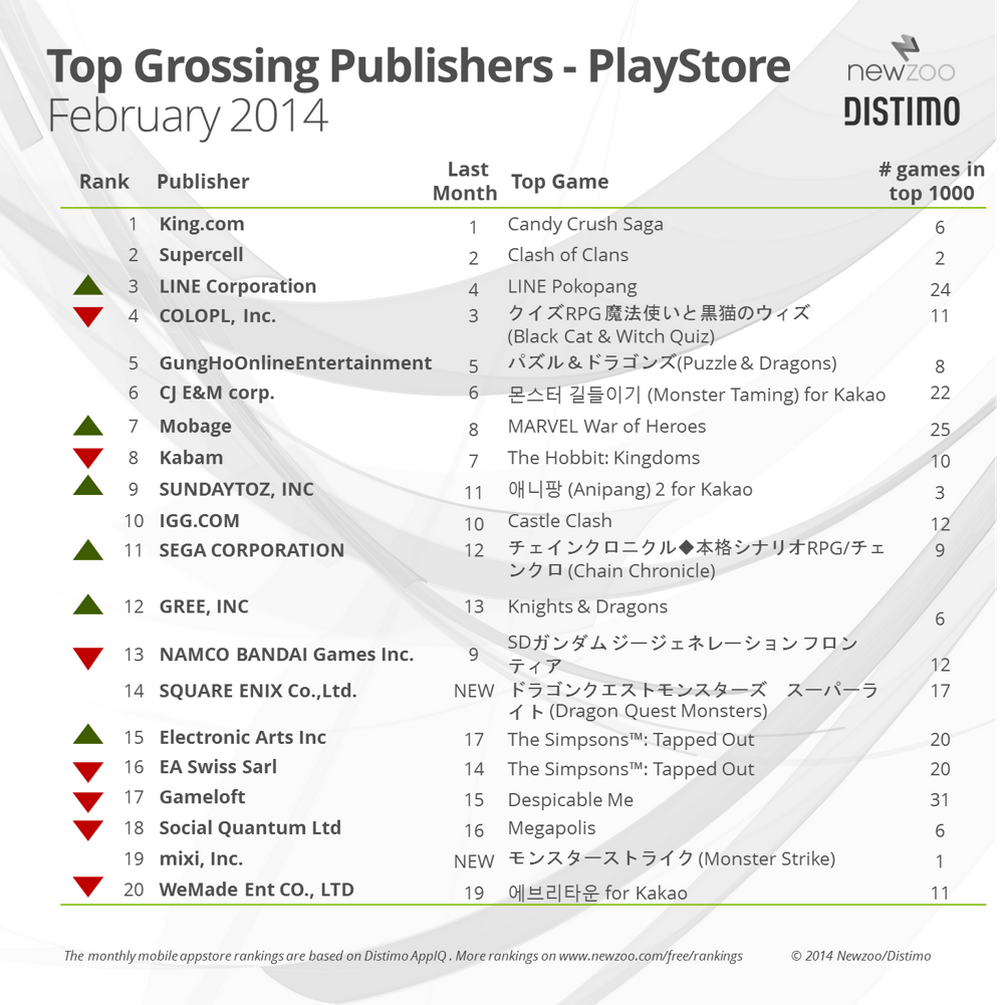

Looking at the publishers, King.com is holding on to the top spot this month with rival Supercell right at its heels. Last month’s number three, ColoPL, Inc, has fallen to number four replaced by Line Corporation.

Namco Bandai Games Inc. has made the biggest drop, falling four places to number thirteen. Square Enix has re-entered the charts at number 14 and Mixi Inc., is the other new entry with their title Monster Strike at number twelve in the games chart.