SuperData released data for top digital game sales in August 2013.

Joost van Dreunen, CEO of SuperData, provides insight for the report.

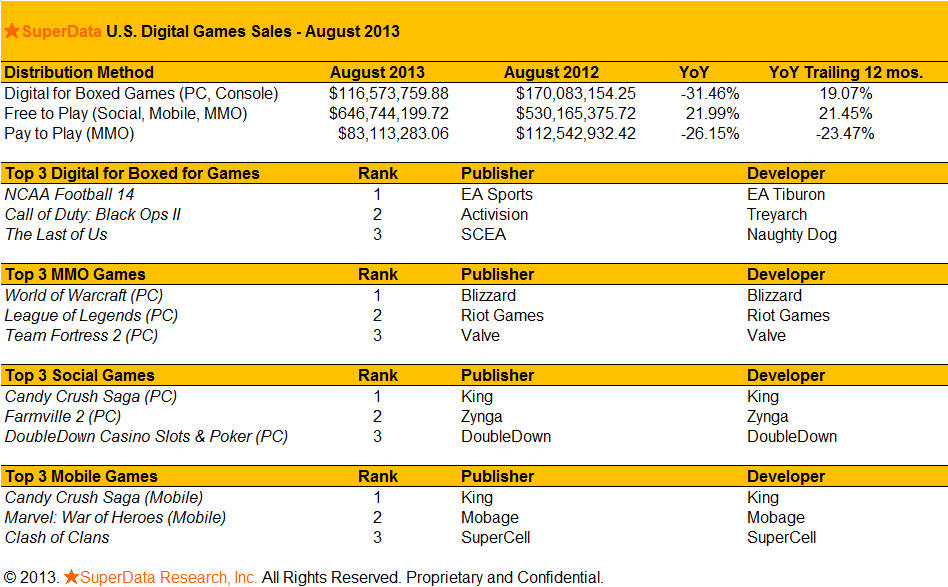

During their respective quarterly earnings review, the major publicly traded publishers all emphasized the importance of digital sales. Take-Two Interactive saw its digital revenues grow to $75 million, or 52 percent of total revenue. For Activision, that number was 63 percent. For EA, it was 76 percent. Ubisoft said that digital sales represented approximately 12 percent of their total sales. The overall digital games category was $846 million in the month of August, an increase of 4.1 percent year-over-year.

Social Games

Social game revenue increased slightly month-over-month, reaching $166 million. Despite an ongoing decline in the overall numbers of monthly active users in the segment, average spending continues to improve.

Several shutdowns by leading publishers characterize the month of August. Zynga closed its Slingo game after RealNetworks acquired the Slingo name for $15.6 million in late-July. Similarly, King is streamlining its focus by shuttering Bubble Saga, Hoop de Loop Saga, Miner Speed and Puzzle Saga in mid-September. We expect the shuffle in available title inventory by these publishers, and their accompanying marketing budgets, to positively affect the overall social game segment.

Free-to-Play MMO

The overall free-to-play MMO segment saw a slight contraction, with revenues from the total audience base settling around 46 million. Spending also proved sluggish with just over $36 per paying player.

In August, several of the major publishers declared their increasing focus on free-to-play as a revenue model, most notably with Sony Online Entertainment’s announcement of the much-anticipated EverQuest Next. Activision’s The Hearthstone: Heroes of Warcraft beta was officially launched, providing further evidence that the company is experimenting with free-to-play monetization.

Pay-to-Play MMO

The overall subscription-based category saw a 26 percent decline, year-over-year, dropping to $83 million in total sales in August. The overall audience base remained relatively steady, and conversion rates (for micro-transactions) climbed back up to 15 percent across the segment.

Continuing several months of dramatic decreases, World of Warcraft lost a combined total of roughly 200,000 subscribers in the Eastern and Western market. EVE Online, another long-term subscription-based MMO, fared better and broke 550,000 subscribers in August. Bucking the decline in the overall category, Bethesda announced that its Elder Scrolls Online will use a subscription model when it launches on PC, PS4 and Xbox One in 2014.

Mobile

The US mobile games market saw a month-over-month decline as a result of a drop in average spending to below $20. Compared to August 2012, the mobile category shows clear signs of maturing as its overall audience base declined by two percent.

A notable climber in the overall mobile category was Terraria (505 Games), an iOS optimized version of the title previously released on other platforms. Mobile publisher Funzio also had an excellent month, with its titles Crime City, Modern War and Kingdom Age all ranking just below the top grossing apps.

In early August, Apple adjusted the way it calculates its rankings by adjusting its algorithms to include user ratings, refunds and an alleged greater emphasis on non-gaming apps. While details remain foggy, we expect this to have no negative effect on the overall mobile gaming category.

Downloadable (PC and Console)

After last month’s summer sale, DLC revenues were down, reaching $116 million in August. As noted previously, we expect the release of blockbuster titles like the eagerly anticipated Grand Theft Auto V to rejuvenate overall digital sales.

The major publishers, Activision, EA and Take-Two, have done well on digital platforms. Especially Take-Two, which has managed to benefit in the lull leading up to GTA V, as mentioned claiming $75 million in digital revenues to make up more than half of what it made last quarter. For Activision, which saw 63 percent of total sales made up by digital, its draw from the category was up from 47 percent a year ago.

Note from SuperData on methodology: SuperData collects anonymized user data directly from publishers and developers, looking at spending by more than 2.8 million unique paying online gamers across 50 publishers and 450+ game titles.

For full reports, visit SuperData Market Data.

About the Author

Joost van Dreunen, Ph.D., is CEO SuperData Research, a market intelligence provider specialized in online games. He has written extensively on online audiences, monetization strategies, virtual goods, social games, free-to-play, online gaming and entertainment.