SuperData released data for top digital game sales in July 2013, which we run as part of a monthly column on [a]list daily.

For methodology, SuperData collects anonymized user data directly from publishers and developers, looking at spending by more than 2.8 million unique paying online gamers across 50 publishers and 450+ game titles.

Joost van Dreunen, co-founder and CEO of SuperData, provides insight for the report.

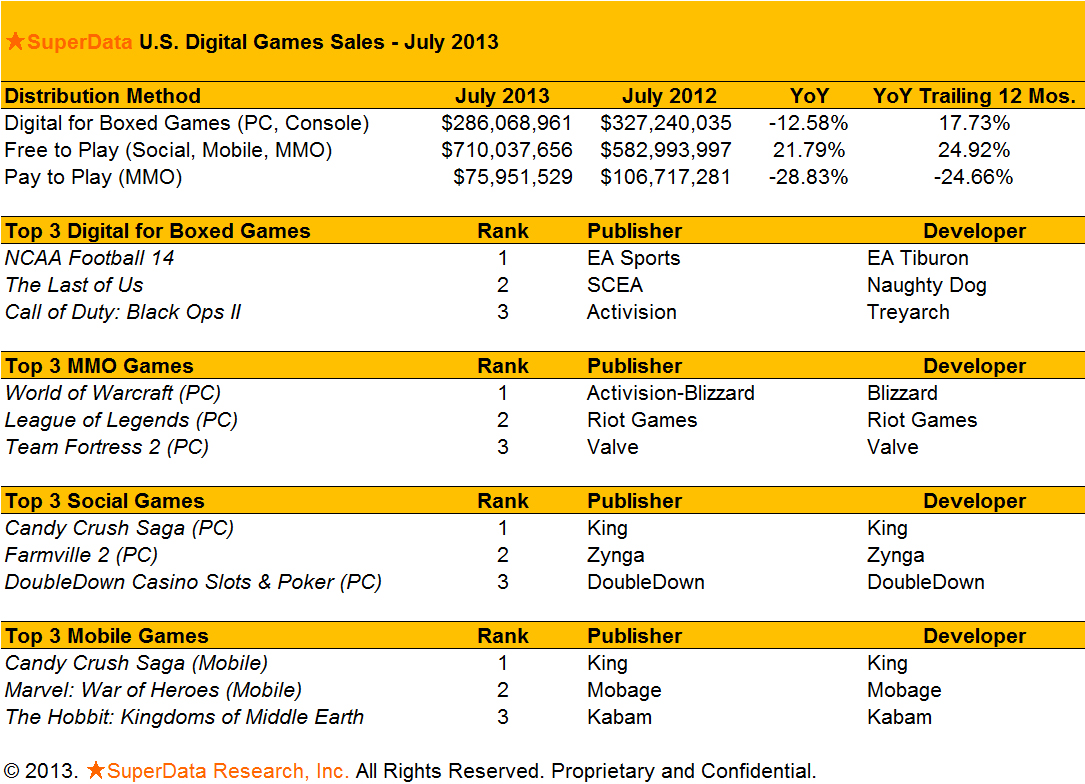

The overall digital games category totaled $1.1 billion in sales in the month of July, representing a year-over-year increase of 5.4 percent. Major growth drivers were social games and the summer sales in PC DLC, which offset declines in subscription-based MMOs and console DLC.

Social Games

Overall revenues for social games improved to reach $164 million compared to $133 million last month. The underlying metrics for social games are improving, with July’s conversion rate reaching 2.11 percent across all categories. Nevertheless, we foresee a decline for the category in August because of the summer season.

In early July, King dethroned Zynga as the leading social game developer on Facebook by number of monthly active users (MAUs) despite having a much smaller portfolio of titles. With social platforms maturing, game companies that offer more complex gameplay and make better use of social functionality will continue to do well. King’s Candy Crush Saga generated an estimated $438,000 per day in July.

Free-to-Play MMO

The overall audience base for the free-to-play category declined slightly in July, likely due to the month as a prime vacation period. The total number of free-to-play MMO gamers dropped to 45.8 million. Overall spending remained strong however, with an average revenue per paying user just south of $40.

Trion World announced that End of Nations, a real-time strategy game, is to become a multiplayer online battle arena (MOBA) game that features “heroes” with special abilities. With a growing number of MOBA titles announced for the coming year, it is clear that the saturation of the free-to-play MMO market is accelerating.

Pay-to-Play MMO

The total number of subscription-based MMO players continued its decline to 5.8 million in July. This is consistent with market leader World of Warcraft’s announcement that it lost 600,000 subscribers since its previous quarterly report. The overall segment contracted 9 percent month-over-month as revenues totaled $76 million.

After buying back $5.8 billion in shares from Vivendi, Activision has gained more autonomy in its decision-making and has indicated a departure from the traditional subscription model. The company’s Blizzard division is currently in the process of selecting a new direction for its unannounced project, code-named Titan, which it has stated is “unlikely to be a subscription-based MMO.”

Mobile

Mobile games continue to do well, totaling $271 million in revenues in July, up 32 percent from a year earlier. Overall conversion rates have been consistently above 5 percent, indicating that mobile gamers are becoming increasingly accustomed to spending on mobile games.

In July, it was again Candy Crush Saga from King and MARVEL War of Heroes from Mobage that featured as top grossing apps in the US. Kabam’s The Hobbit: Kingdoms of Middle Earth came in as the third top grosser across all app stores, taking the spot at the expense of Supercell’s Clash of Clans.

Facebook’s announcement to enter the mobile games market as a publisher may bring a wind of change to the top of the mobile games food chain, which has been dominated by a small group of titles. However, the effects may be a few months out as Facebook is selectively working with medium and small game developers.

Noteworthy mobile game launches in July were Magic 2014 from Wizards of the Coast, which hopes to repeat the success its predecessor by offering more varied and improved multiplayer game play. Indie darling LIMBO from Playdead was released on iOS after winning a slew of industry awards on PC.

Downloadable (PC and console)

The PC DLC summer sale across digital distributors such as Steam and GamersGate drove an estimated increase of 15 percent in downloadable PC sales in the U.S. for a total $158 million. This offset the decline in console DLC sales, which is currently at one of the low-points of its digital cycle with little expected change until the upcoming holiday season. We expect the eagerly anticipated GTA V to invigorate sales in September.

Despite losing licensing rights to the NCAA, EA’s NCAA Football 14 was a top-seller in July, proving the strength of the franchise. In all likelihood, EA will continue the series under a different name. Total sales for the DLC category were $286 million in July, 2013, up 5 percent from the month before, but down 13 percent year-over-year.

A note from the author: Over the summer SuperData secured several important data sets. With more transactional data available we’ve been able to adjust our models and improved our accuracy. As a result the observant reader may notice a change in some of our previously reported averages. For any questions regarding our methodology, don’t hesitate to contact us.

For full reports, visit SuperData Market Data.

About the Author

Joost van Dreunen, Ph.D., is CEO SuperData Research, a market intelligence provider specialized in online games. He has written extensively on online audiences, monetization strategies, virtual goods, social games, free-to-play, online gaming and entertainment.