Big Fish CEO Paul Thelen spoke at the Digital Game Monetization Summit in San Francisco and noted that his company is making money on a variety of casual games, ranging from free-to-play to $19.99 collector’s editions. He said that one of the keys to stay solvent is to reinvent your business constantly.

“Just because we made money doing this last year doesn’t mean we will make money doing this again next year,” he noted. “You need to match the game mechanic to the business model, and the monetization needs to match the business model of the game. If you have a game that has 6 to 8 hours of linear gameplay and when you finish it, you’re done, there are very limited ways you can monetize that game. What we’ve done is a simple transaction; you buy it, just like you would buy a book. It’s very hard to monetize a book with free-to-play.”

Big Fish will launch dozens of games over the next year, and notes that a big title for them only costs $500,000 to produce, can be ported to the iPad for about $20,000. “Now you have a half-million dollar game on a hyper growth platform, and that game has already returned a profit to the developer,” Thelen said.

“Supercell came from nowhere after a lot of mistakes, and they are now making $300 million on two games on iOS alone.” added Thelen, who noted that free-to-play games reach 1.2 billion PC users, an that 14 million gamers are visiting Big Fish each month.

While there’s success to be had in the mobile and F2P realms, Rumble Entertainment CEO Greg Richardson asserts the importance of core games. “If you look at what people successfully did on Facebook or the early days of mobile, a lot of it was about cheap user acquisition through the spammy virality that Facebook allowed for a while, or manipulations of the terms of service from Apple or Google on the mobile side. That’s gone away,” said Richardson. “Of the $50 billion that was spent worldwide last year on games, less than 10 percent was spent on casual content. These companies were really smart around analytics and monetization and very light in terms of product and content creation. I’m not sure any of those things are particularly sustainable. The future lies in going into the larger part of the market which is people that self-identify as gamers, and where the user acquisition and long-term value creation comes from making great games.”

In talking about stickiness, Hawken creator Mark Long, CEO of Meteor Entertainment, detailed how they changed the beginning of their game. “In our closed beta exit survey, we saw a lot of players play one session and leave, and this concerned us,” said Long. “We came up with the idea of what we call Newbie Island; your first five sessions you’re only playing new players, so there’s a safe place for them to not get their asses handed to them and hopefully get the them to come back after that first session.”

On the subject of real-money gambling for online games, companies like Zynga will find themselves fighting with casino operators over reaching the next generation of gamblers. “They have to. The typical Vegas operator is concerned about their traditional customer base, which ranges between the ages of 50 and 75,” said George Zaloom, CEO of GoPlay. “They see the traditional social gamer as this young mom who’s sophisticated, who’s technology savvy, and likes to play games. If they can migrate that customer from being a free-to-play player and bring them into their real-money space, that’s a new way to save their business.”

Nick Bhardwaj, the VP of monetization for Natural Motion, described his work for CSR Racing and how they helped make in the number one racing app in 75 countries, bringing in $12 million in revenue during its first month. “I was in mobile advertising, I understood user acquisition, I understand all the price points, and the truth is, it’s a shitty industry,” Bhardwaj said. “It really is. The first harsh reality is: CPIs [Cost Per Install] are only going to go up. You think they’re high now? It’s going to be just like gas prices. Right now, average CPIs in the industry on the weekends are over $2, $3. There have been previous weekends where I’ve seen major players bid upwards of $10 per install. This will only go up for two reasons: new entrants, and cash influx from Asia. There are a lot of great companies in Asia who’ve been doing great games in Japan, China, and Korea, who now want entry into the U.S. Next you’re going to see the influx of real-money gambling apps. The LTVs [Life Time Value} of those customers are hundreds and hundreds of dollars, 10x, 20x higher than anything you see in even the greatest mobile games. I would assume by the end of Q2 next year you’re going to see average CPIs above $5.”

In the subject of ads in games, it’s accepted now that it doesn’t work in all titles, but it’s noted that Zynga and King.com will work to generate more revenue from the huge numbers of players. “I do think Zynga will soon start doing pre-roll ads for users who virally don’t invite a lot of new people,” said Greg Mills, VP of marketing for Goko. “If you look at the number of impressions that would generate, it would be huge. It’s going to start with the large companies that have a massive audience, then it will trickle down.”

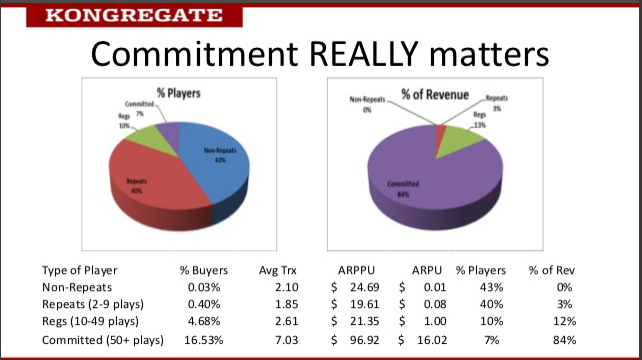

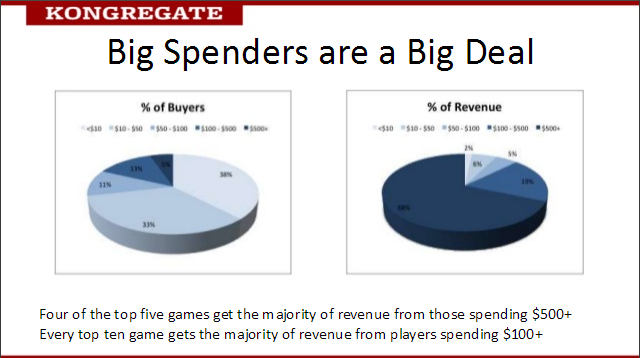

Emily Greer, COO and co-founder of Kongregate, noted that with micro-transactions, permanent items generate more money than consumables. “The other thing that’s really important, besides big spenders, is commitment really matters,” Greer said. “We divide our player base on a game into four categories: Non-repeats, players who come into a game once and bail; repeats who play a game between 2 and 9 times; regulars who play between 10 and 49 times, and the committed players who play 50 or more times. For the top ten games, the 7 percent who are committed are 87 percent of the revenue.”

“When games have problems, they are either not getting players deep enough into the game or they don’t maximize what they can get from players,” said Greer.

Source: GamesIndustry International