The army of tents outside your local Best Buy should have been the dead giveaway, but Black Friday is coming. As soon as Thanksgiving dessert is over, retailers across the U.S. will put various items on sale, ranging from video games to movies to high-end electronics. With that, customers will flock to it like crazy, buying up bargains just in time for the holidays.

Adobe is already forecasting that sales for this year’s event will go through the roof, reaching even bigger heights than ever before.

They also noted that 51 percent of online shopping visits on Thanksgiving/Black Friday will come from mobile devices, with 29 percent of total sales coming from said devices a 12 percent increase from the previous year.

With that, it’s time to take a closer look at where Black Friday actually came from, and how its managed to grow so much over the years.

The Origin of Black Friday

The term actually got its start in 1961, as part of a way to describe the heavy pedestrian and foot traffic that emerged from shopping around the holiday season, which officially kicked off the day after Thanksgiving (due to the three-day weekend, enabling extra time to shop). The term actually comes from retailers being “in the black”, as they see a sales boost around that time compared to slower times in the year, when they’re stated to being more “in the red.”

How Marketing Around Black Friday Evolved

For many years, Black Friday worked more along the lines of a three-day period, starting on Friday (of course) and going into the weekend. However, as the late 2000’s emerged, more retailers began to open their stores earlier to give shoppers a jump on potential sales, going as early as 5 or 4 a.m., allowing people to line up for bargains. In 2011, this was pushed even further ahead, with some retailers opening as soon as midnight the day after Thanksgiving. Deep promotions have now become commonplace among brands and retailers.

Black Friday has become so ingrained in our culture, Buy Nothing Day now exists in contrast to it. REI this year has decided this year to create a marketing effort that is decidedly anti-Black Friday with their Opt Outside campaign.

Black Friday Now and In The Future

Something that has become especially tangible in the past few years is that attitudes and spending habits around Black Friday has been changing.

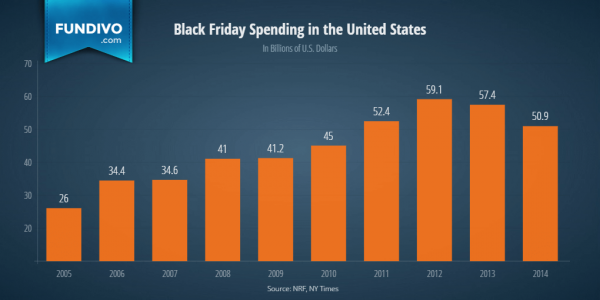

According to Fundivo, Black Friday spending has gained a critical amount of traction over the years, rising from $26 billion in 2005 to a peak of $59.1 billion in 2012. That same year also saw a peak in average spending.

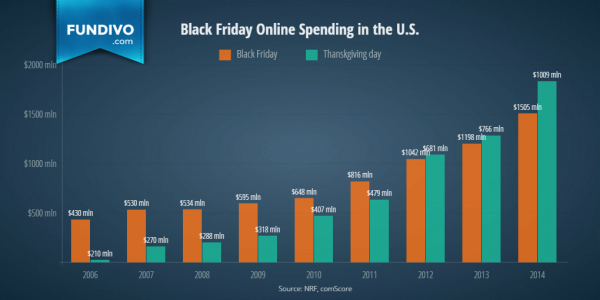

Of course, online spending has become a huge factor in Black Friday’s shopping scene. It may surprise you, however, that while many Americans are occupied with preparing turkey, a large number of them are shopping online. Online spending on Thanksgiving superseded Black Friday online spending in 2012 and only continues to grow.

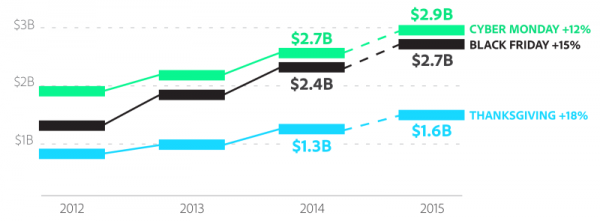

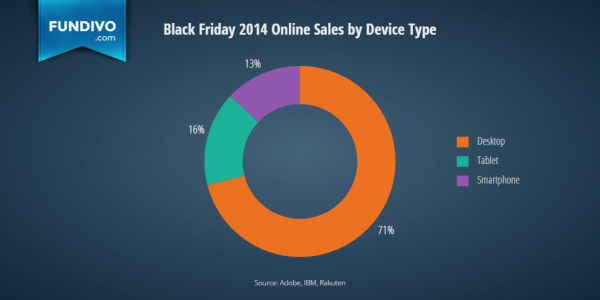

As online shopping gains steam, so does mobile, with 13 percent of overall consumers using smartphones and 16 percent using tablets. This year, Adobe expects an estimated 11 percent year-over-year growth is expected over 2014’s numbers, reaching a high of $83 billion. That’s also not taking into account the sales numbers that will come from the following Cyber Monday event, which is expected to reach a record $3 billion, a 12 percent year-over-year increase in its own right.

By spreading word about their sales through the likes of Facebook, Twitter and Pinterest, retailers can gain better interest from consumers over particular deals, as well as the spread word-of-mouth to bring in even more of them. Two particular social channels seem to be converting more purchases than others Facebook and Pinterest. The numbers show that referrals from Facebook lead to an average of $109.94 spent per order, compared to just over $100 for Pinterest. Facebook showed twice the rate of converted online sales compared to Pinterest.

Email continues to be a big factor in marketing these deals, but marketers have eschewed frequency of these blasts in favor of increased targeting. Last year, brands and retailers averaged 5.3 emails during Black Friday a drop of more than 11 percent from 2014 to 2013.