eSports has been on the rise for several years now, building up speed not only with big tournaments, but also with streaming on Twitch and even broadcasts on channels like ESPN and forthcoming coverage from TBS. But just how much money is it primed to make over the next few years

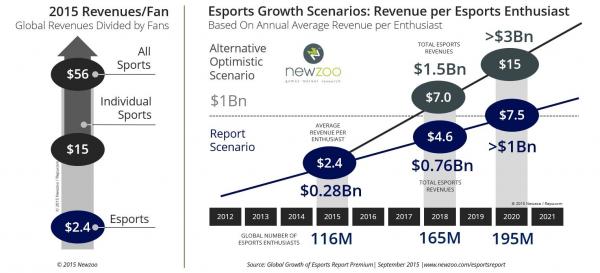

According to estimates from Newzoo, it has the potential to reach the billion-dollar mark by 2020 — yep, eSports are likely to become that popular.

Revenues have gained with tournaments, partnerships, players and other degrees of eSports, and have also reached mainstream audiences through its various broadcasts and other products. But it’s all about how eSports keeps this momentum going in the long run, if Newzoo’s numbers are correct.

The company broke down the success of eSports into five different factors, which can be found below, taken straight from the article:

Diversity of Game Genres?

The vast majority of eSports titles are PC games that fall into a few major genres, with MOBAs like League of Legends, Smite, Heroes of the Storm and DotA2 being some of the most popular in terms of participation. However, with their complex game play, MOBA games can be difficult for viewers who don’t play them to understand and for gamers to master. Would more accessible game genres and segments gain a wider audience and player base

Riding the wave of ESL One, Counter Strike: Global Offensive, Valve’s multiplayer first-person shooter, took over Twitch with the most hours watched for a game in one day, beating out even League of Legends. In August and September of this year, Philippines mobile operator Smart Communications held the Philippine Clash 2015, a Clash of Clans tournament that has set records as the largest prize pool for a mobile gaming competition in the country. US-based Super Evil Megacorp held its first World Invitational tournament in Korea last summer based on its mobile MOBA Vainglory. Last week, Blizzard announced the creation of a new worldwide eSports league for the popular console first-person shooter series Call of Duty. A wide variety of game publishers are boosting eSports activities for franchises around which competitive gaming already exists in some shape or form, organized by game enthusiasts themselves.

Geographic Expansion of Leagues?

For eSports leagues to tap into bigger advertising budgets, they need to exist on national, regional and global levels as traditional sports does. Few advertisers have a significant global advertising or sponsoring budget, as most marketing money is spent on a local level. Currently, only League of Legends has a structure that resembles this hierarchy, with regional league structures in North America, Europe, South-East Asia, Oceania and Latin America, and country-based league structures in China, South Korea and Turkey.

The chart above breaks down just what kind of revenues are divided by fans, as well as eSports growth scenarios per eSports enthusiast. It’s easy to see just what kind of growth is expected, and how far eSports have come.

Regulation of Competitions?

eSports has grown beyond the small grass roots venues where small groups of gamers were competing. More and more companies are seeing the potential to make money in eSports. Most recently, FanDuel purchased the daily-fantasy startup AlphaDraft, a day after competitor Draft Kings announced it was expanding into eSports with daily fantasy games for League of Legends. With multi-million dollar prize pools now at stake, and increasing amounts of money being bet on the outcome of these games, new rules and regulations are needed to combat cheating and match fixing.

In an attempt to prevent match fixing, software manipulation and use of performance-enhancing drugs, ESL and some betting companies such as Unikrn have become strong advocates of rules and regulations to prevent and/or detect fixing by tracking all in-game data and betting data and using software to detect any irregularities that indicate dubious activities. Other eSports organizations have implemented supportive measures for players themselves.

Wouter Sleijffers, CEO at FNatic, comments from an eSports team perspective: “A player’s career can involve the pressure of matches and fan expectations, frequent international travel, and in some cases living away from home in another country for long periods of time. An environment like that can place a strain on any person. At Fnatic, our goal is to offer our players the most secure and friendly environment in the industry, with the best supporting organization behind them to help them succeed as teams, grow as individuals, and to develop skills and experience they can use during and after their gaming careers.”

Ownership of Media Rights?

One of the larger regulation voids in eSports is the current structure around content rights. As of now, it is uncertain who owns the rights to eSports content. Games played during events are owned by publishers or the event organizers, while videos made by fans and streams that contain game content are owned by the fans and streamers themselves. Thus far, content rights have not really been a focus for publishers, as fan-generated content has served as free advertising for their games. As direct eSports revenues grow, this may change.

Alignment of Digital & Traditional Media?

While competitive gaming would surely benefit from broadcaster advertising and its budgets, eSports and traditional media have not yet aligned. Will the all-digital eSports world adapt to the traditional media ecosystem or vice versa Turner Broadcasting and WME/IMG just announced that they will form a Counter Strike: Global Offensive league that will be aired on TBS on Friday nights for 20 weeks in 2016. TBS isn’t the first cable network to show interest in eSports. ESPN has been increasingly recognizing the legitimacy of competitive gaming as a sport, covering more and more eSports events, including a collegiate-level Heroes of the Storm competition (“Heroes of the Dorm”), and Valve’s multimillion-dollar DotA2 tournament “The International.” Earlier this month, ESPN began its search for an eSports editor.

Hollywood media and entertainment veteran Rich Melcombe, CEO at Richmel Media & Entertainment, adds: “I’d argue that brands do not understand the value of games, most game companies do not know how to sell advertising, and game ad tech needs to be re-imagined. Where most ad tech companies fail is that they do not try to make an emotional connection with the players or create an environment conducive to advertisers or brands. Advertising has to work for both games and brands — each has a very different agenda. Games also need to take a more integrated media approach and own and connect the media surrounding their games to increase value.”

More information on these findings, including the particular challenges that lie within each of these categories, can be found here.