By Meelad Sadat

More than two thirds of mobile users find in-app ads intrusive, and nearly half of them completely ignore what they see. But engagement can improve when ads offer incentives or let users choose which ones to watch. These are among top takeaways from a recent Forrester study commissioned by Tapjoy that surveyed 2,000 smartphone owners in the US.

Apps now dominate mobile device use. According to the study, “The Mobile In-App Marketing Opportunity,” people dedicate more than 81 percent of their time on smartphones to app usage versus less than 19 percent for browsing the internet. They own a lot of apps – 29 percent own 21 or more, and 20 percent say they download new ones every day. Three quarters use them on a daily basis, with social networking, playing games and music apps topping usage. Few are paying however. More than a third have stuck to strictly free apps, and another third said they’ve paid for less than 25 percent what they own. In a separate study, Forrester says it found a third of US adults who use mobile apps on a monthly basis prefer free ad-based apps over paying for them.

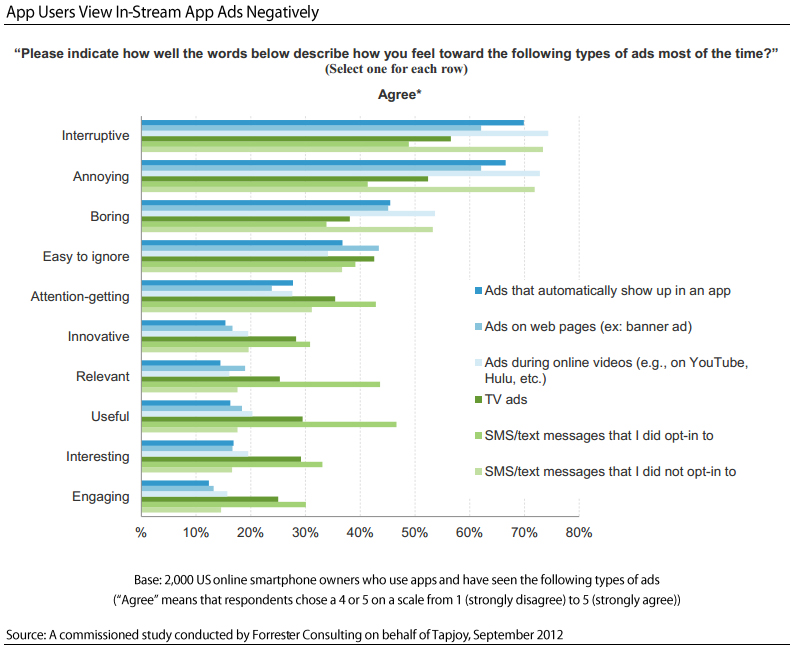

Not surprisingly, that fondness is for the ‘free’ and not so much the ‘ad-based’ part. This most recent study shows perception of these ads running the gamut from “interruptive” and annoying to just plain easy to ignore. Of those surveyed, an astounding 86 percent said they find what they see as irrelevant.

That’s where Tapjoy’s role in commissioning the research comes in. The company’s mobile app monetization and advertising platform is incorporated into more than 20,000 apps worldwide. Among its offerings is a new service that delivers ads where users can opt-in to which kind of product they want to be marketed, and also gives incentives for engaging with the ads they choose. Tapjoy’s Forrester study shows this is what users want – 68 percent agreed that marketers need to minimize how ads interrupt their experience, and 59 percent want some sort of reward or incentive for clicking on an ad.

Tapjoy says the study shows these methods can help leverage mobile’s audience captivity, using its intimacy and immediacy to deliver a better experience and prompt higher engagement. We talked with Tapjoy chief marketer Peter Dille on what the study’s findings mean for mobile marketers and app makers.

What prompted Tapjoy to commission this study?

There’s a lot of confusion about what works — and what doesn’t — in mobile advertising today. We’ve long believed that an opt-in, incentivized advertising model works. That said, incentivized advertising still has a stigma among some advertisers that it doesn’t attract the best users, and that it’s not a serious option for major brands. This came about mostly because of the first wave of “incentivized advertising” that took place on the Web nearly a decade ago, where people were being rewarded with offers of free iPods and the like. This new generation of opt-in, incentivized ads could not be further removed from that type of advertising, but that initial backlash still causes advertisers to pause before putting their feet in the water. We commissioned this study from Forrester to show that not only do consumers want this type of advertising model, but the tactics of Web advertising aren’t best for mobile, either.

Users are showing preference for free apps with ads over paid apps. Are the stakeholders — app creators and advertisers — seeing enough returns or even the potential for returns to believe that this is a sustainable economic model?

For developers, many of the top-grossing apps in both the Apple App Store and Google Play are free-to-play. We recently worked with Madfinger Games, creators of Dead Trigger (one of the most popular games on mobile at the moment) and, by using a free-to-play model and integrating with Tapjoy, helped them increase their revenue by 66 percent on Android and 48 percent on iOS. Smule, creators of Magic Piano (also free-to-play), was able to double their revenue thanks to a special currency promotion we hosted for them. These are just two of the thousands of examples of successful free-to-play apps across our network. We are major advocates of the free-to-play model for apps and strongly believe it’s the best way for developers to monetize their apps on mobile. For advertisers, we enlist more and more major brands every day, a clear sign to us that even the major players are seeing the need to shift their media mix to properly address mobile.

The study says people hate interruptive in-app ads, and at the same time half of people surveyed said they ignored the last one they saw. For those who noticed ads, sentiment and engagement metrics are low. Where are advertisers getting it wrong?

First, many advertisers are missing an opportunity with opt-in models. Consumers responded strongly about having more control over their advertising experience in their mobile apps. In the survey, almost 40 percent of the respondents said they would be interested in picking the most relevant option from a list of advertisements. Advertisers also need to improve their targeting on mobile, and make their advertisements more relevant to their target audience. Almost half of the respondents to the survey said they want ads relevant to their personal interest and their location. Only 14 percent of consumers are getting that type of experience on mobile right now, which means advertisers need to improve their targeting techniques.

Can you give us any examples of mobile ads, whether in-app or not, that proved highly effective?

We have many types of ads that have delivered superior results for our brand partners compared to both their Web campaigns and other types of mobile ad campaigns. In once recent campaign, for instance, our Cost-Per-Completed-View video ads drove higher ad awareness, brand favorability and purchase intent compared to mobile norms. In fact we will soon be publishing a case study demonstrating this difference, and we will be glad to share it with you once it’s available.

One big takeaway from the study seems to be pull marketing beats push on mobile. Besides delivery methods like giving people a choice of which ad to watch, what do you see here for marketers to take into consideration in the content they create?

According to the Forrester study, consumers want more control over their mobile advertising experience. With even a quick glance at the survey results, it’s clear that the current state of mobile advertising isn’t delivering an experience that customers want or enjoy. Just 17 percent of respondents found current in-app ads interesting, and 70 percent said they found automatically served in-app ads interruptive. However, when consumers have a chance to opt-in to an advertising experience and can earn a virtual reward for their engagement, consumers showed an increase in receptivity. It’s also apparent from the Forrester study that consumers understand the virtual economy, and are willing to engage with their favorite brands in exchange for the content they want, especially when they choose the brand to interact with.

It’s ancillary to the study, but I’d love to get your thoughts on this set of findings: Here is a study on mobile ads that finds online ads — video and banners — perceived to be the least effective, and TV ads still considered very effective. As a marketer talking to your colleagues, how would you couch this?

TV still provides excellent reach for an advertiser, to a scale that neither the web nor mobile can achieve at this point. That said, advertisers can never be certain how many of the potential eyeballs a TV ad truly reaches.

Any final thoughts?

While we commissioned the study, you can’t buy Forrester’s opinion, so we are obviously excited about the results. The results provide strong affirmation for the consumer dynamics that we’ve long observed through our model. Since mobile is still evolving, we always encourage advertisers to try different solutions to find what works best for them. Additionally, it’s also helpful to enlist a reputable team like Forrester to help sift through the new solutions that are routinely introduced to the space.