Fresh August data on global mobile game revenues reveals several changes that illustrate the global battle that Apple, Google and other digital giants are fighting to gain mobile market share and accelerate growth. For the first time since the launch of the iPhone back in 2007, the US is no longer the top grossing country for iPhone’s most popular content: games. Japan, with a history of spending billions on mobile games before the arrival of smartphones and tablets, is taking the lead in the app stores of Google and Apple big time.

Considering the explosive growth over the last months, we anticipate iPhone game revenues in Japan to exceed $1 billion this year. In August, Google Play game revenues were slightly higher than those of iOS, securing Japans’ position as the world leader in Google Play game spending. Korea is the only other large country where Google Play beats iOS game revenues. In the US and most European countries (except for Germany and Spain) iOS enjoys a comfortable lead. That will probably see Google Play generate more revenues than iOS by the end of the year.

China is a key country for Apple, and not just because of its size. As alternative Android markets flourish, Google will struggle to get serious revenues from China. Already China takes second place behind the US on iPad game revenues. On the iPhone it only leaves Japan and the US in front. Still, overall iOS revenues are less than a quarter of that in the US.

To illustrate the fact that there is major money going around in Chinese mobile gaming outside the reach of Apple and Google, consider the following acquisition that occurred this August. Chinese search giant Baidu acquired mobile app marketplace 91 Wireless from Netdragon for $1.85 billion. The company operates two app store market places that combined have seen over 10 billion downloads since it launch in 2007.

Apple’s new 5c and 5s iPhones will not lead to a significant change in market share for iOS versus Android. These devices will ensure Apple returns to growth figures needed to keep ahead of Google Play and other Android stores, though. In spring this year Google Play game revenues were at a level of about 35 percent of that generated via iOS. Less than half a year later, that figure has surpassed the 50 percent mark.

There is no question that Google Play game revenues are currently growing faster compared to iOS. Apple’s uptake in China with their cheaper devices and the rumored China Mobile deal should get them back on pace. Still, iOS is facing a different challenge in maintaining its lead over Google Play and Amazon in the US and Western Europe. The launch of the 5s and 5c will help this in the short term, but not solve the bigger issue of maintaining Apple’s appeal to the early adopters.

One of Apple’s biggest assets is Supercell. Their Clash of Clans and Hayday are continuously in the top 5 grossing games but are not available in Google Play. If Supercell decides to launch on Google Play the effect will be significant to say the least. Reportedly Supercell is considering this move, but there is no official word as yet.

The numbers show that so-called mid-core games are improving in their market share, and casual games losing some of their grip on the top ten. The top 20 grossing rankings are now dominated by mid-core games and social casino style apps, Candy Crush being the obvious exception to the rule. It took a while, but game enthusiasts and even the majority of core gamers are playing on mobile devices, specifically tablets. And these consumers are used to spending good money on games.

While the gender divide for mobile gamers is equal, the majority of paying mobile gamers is male. Russia (which surpassed Germany in iPad game spending a couple months ago) has not one casual game in the top 10, only mid-core games. If you have a mid-core iPad game, localize in Russian first, then German!

Machine Zone’s Game of War has been tested over the last months in countries including France, Singapore, Australia and Mexico and launched globally end of July. It illustrates the eagerness of core gamers to try out new high quality games on their tablets and smartphones. Machine Zone has taken a close look at monetization of other mid-core games, because it is bringing in serious cash from the start. The coming three months will learn if their business model and game quality is so well balanced that they will stick around the highest rankings.

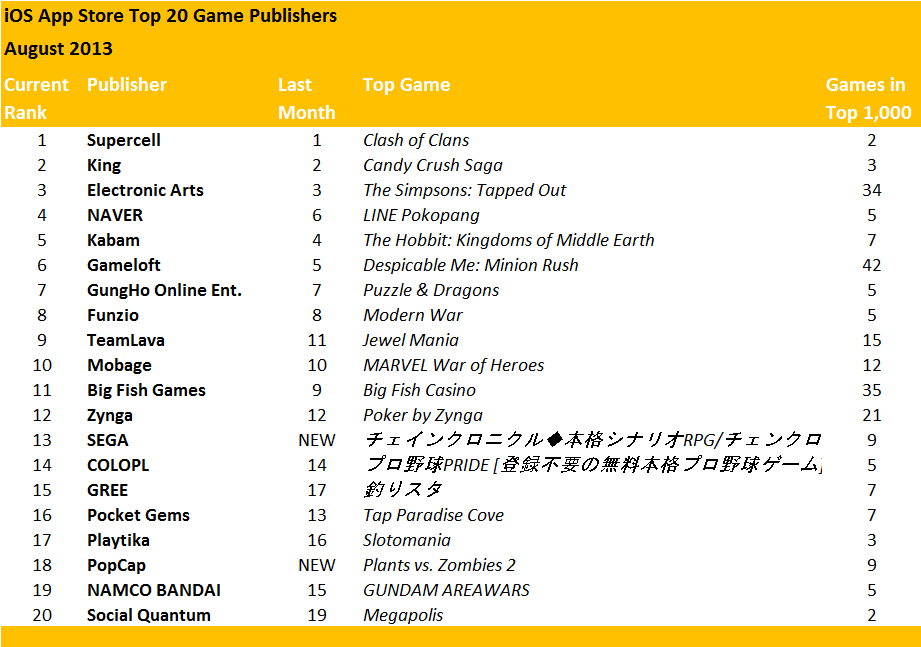

iOS Publishers

The top 3 iOS publishers remained unchanged in August, with Supercell still claiming the number one spot with just two games. The Finish publisher is followed by King.com and EA. Naver is now the top performing Asian publisher, climbing 2 places to number 4. SEGA Corporation has entered the charts at number 13, with Chain Chronicle as their best performing game. PopCap has re-entered the charts this month thanks to the huge success of the newly released Plants vs. Zombies 2. There are 6 Asian publishers in this month’s top 20, a relatively high amount for a usually Western dominated list.

Source: Newzoo and Distimo. Rankings based on gross sales.

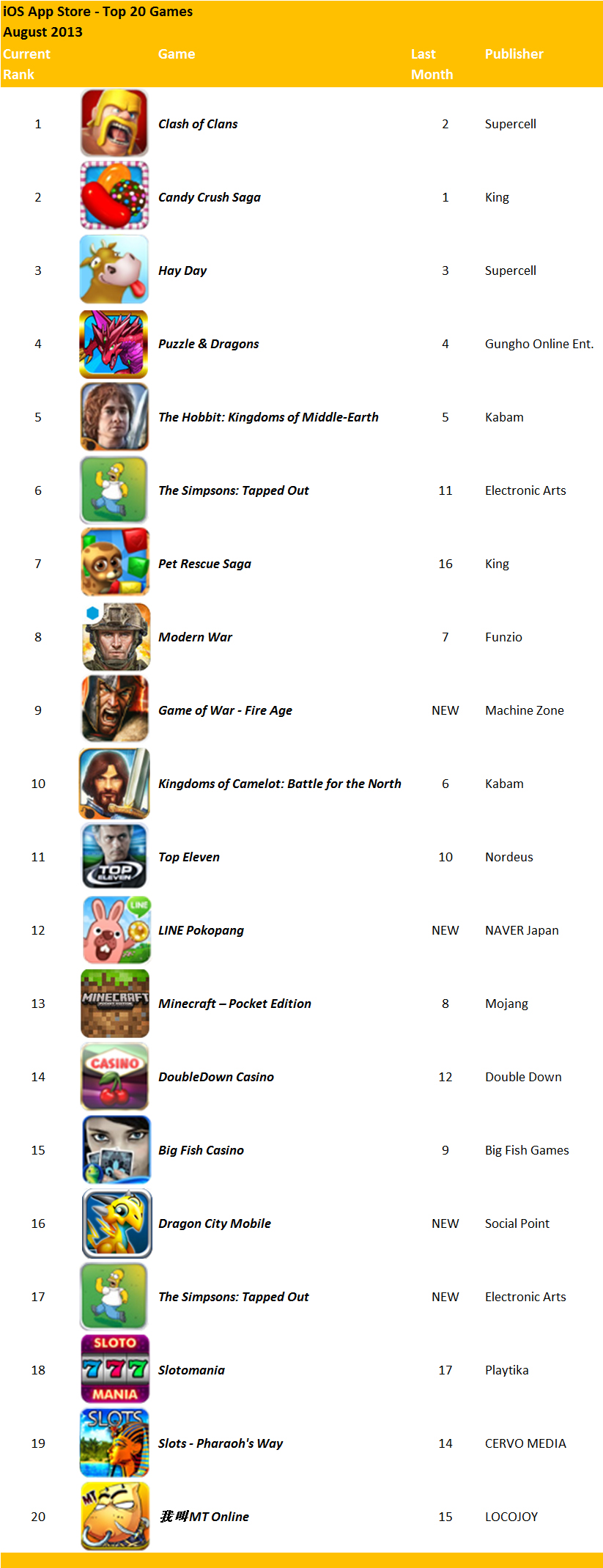

Source: Newzoo and Distimo. Rankings based on gross sales.iOS Games

Clash of Clans from Supercell has reclaimed the top spot from King.com’s Candy Crush Saga, while Hay Day, also from Supercell, remains at number 3. The Simpsons Tapped Out from EA has jumped 5 spots to number 6 in the charts, followed by Pet Rescue Saga which climbed an impressive 9 places. Big Fish Casino continues its descent down the charts now sitting at number 15. Game of War from Machine Zone Inc has debuted at number 9, with LINE Pokopang also entering high at number 12.

Source: Newzoo and Distimo. Rankings based on gross sales.

Source: Newzoo and Distimo. Rankings based on gross sales.

Google Play Store Publishers

LINE Corporation and CJ E&M Corp remain on top of the top 20 list. Mobage however has fallen from number 3 to 6, as GungHoOnline Entertainment climbs to take their position. The rest of the top 20 is almost unchanged, except for Namco Bandai’s ascent to number 9, which pushed GREE to 11. SEGA Corporation is debuting at position 11, having also entered the iOS charts at number 13. Gamevil has lost the most revenues this month, falling 5 places to number 19. Social Quantum re-entered the charts at number 20 with their hit game Megapolis.

Source: Newzoo and Distimo. Rankings based on gross sales.

Source: Newzoo and Distimo. Rankings based on gross sales.

Google Play Store Games

Candy Crush is still the number one game followed by Puzzle & Dragons. LINE Pokopang is now number three, having climbed 4 places. This leaves Everybody’s Marble for Kakao and LINE Wind Runner at positions 4 and 5 respectively. Wind Runner for Kakao , LINE POP and Marvel: War of Heroes all fell down the charts and now sit at positions 12, 13 and 17. Pet Rescue Saga from the number 5 publisher, King.com, debuted at number 16 while Keri-Hime Sweets from Gungho Entertainment entered at bottom place. Of the top Playstore games, 16 of them are from Asian publishers, compared to just 3 in the top 20 iOS games.

Source: Newzoo and Distimo. Rankings based on gross sales.

Source: Newzoo and Distimo. Rankings based on gross sales.For full reports, visit Newzoo Global Game Markets Reports.