SuperData released data for top digital game sales in September 2013.

Joost van Dreunen, CEO of SuperData, provides insight for the report.

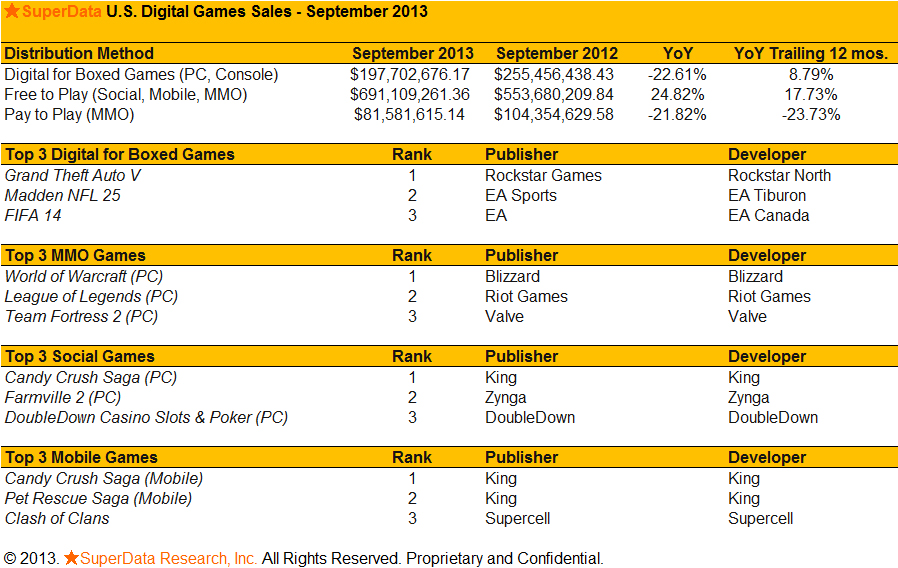

September saw the release of the biggest entertainment franchise to-date, the filing of King’s public offering, and a shuffling of the deck among several major free-to-play publishers. Across all categories, digital games accounted for a total of $970 million in sales, up six percent from a year ago. We expect GTA V’s foray into micro-transactions to be closely watched by its competitors, as it serves as an important barometer for the future of the revenue model for triple A titles.

Social Games

The social game segment showed signs of recovery, as monthly revenues reached $176 million in September, up 16 percent from a year ago. This is largely the result of an increase in average spending, as the average revenue per paying user reached almost $48, up from $45 last month. However, the overall conversion rate dipped below two percent for the first time in four months, reiterating the strong dependence this segment has on a narrow group of high-spending users.

After several shutdowns in August, September saw the launch of several new casino-style games such as CasinoRPG (Goldfire Studios), Stardust Casino (Win) and Akamon Slots (Akamon Entertainment). As the available inventory for social casino continues to grow, users have started to migrate to mobile platforms instead, allowing for a reshuffling of the top publishers in several of the major game categories.

Free-to-Play MMO

The free-to-play MMO segment stabilized around $249 million in September, as overall spending softened for a second month in a row. This offset a slight gain in the overall audience base, which grew by just under 700,000 monthly actives.

EA announced the release dates of the next expansion pack for Star Wars: The Old Republic. Scheduled for early release in 2014, Galactic Starfighter features 12-on-12 dogfighting in addition to the current PvP combat in the three “Warzones.” The new end-game content announced for Rift (Trion Worlds), called Beyond Infinity, offers several new 20-player raids, and is one of the largest updates for the title so far. At PAX Prime, Sony Online Entertainment released more details on EverQuest Next: Landmark, which allows players to build structures and in-game items. And finally, Lord of the Rings Online (Turbine) announced the release date of the next expansion pack, Helm’s Deep, for November 18, which will raise the level cap to 95 and offers pre-order packs.

Several disappointments also characterized the category this month. After four years of existence, EA announced the closure of card-based RTS BattleForge after it failed the transition to free-to-play. Firefall (Red 5 Studios) only managed to get 3 percent of its players to regularly play in PvP mode, thereby shattering its ambitions to become an eSports favorite. As a result, Red 5 Studios has taken PvP offline, hoping to “regroup, rethink and deliver the best PvP system possible.” Hi-Rez Studios CEO Erez Goren gave a candid account on why they shuttered Global Agenda and Tribes Ascend, stating that “overall we spend [sic] about $40 million running the company vs. $10 million in revenue.”

Pay-to-Play MMO

Despite losing over 300,000 subscribers in September, the subscription-based MMO category earnings reached $82 million, roughly the same as the month before. In the past 12-month period, the overall segment has lost 1.7 million subscribing gamers, but managed to offset its losses by growing the average revenue per paying user to about $25 a month with micro-transactions.

EVE Online (CCP Games) continues to perform well, especially on its Eastern servers, as the game encroaches upon 600,000 monthly subscribers. SW:TOR’s release of Rise of the Hutt Cartel failed to positively affecte its subscriber base, losing an estimated 20,000 players, but did manage to keep its monthly active user base above one million.

Mobile

The mobile games segment grew an estimated 14 percent month-over-month to $266 million in September, and 52 percent year-over-year, up from $175 million in September, 2012. This was largely the result of the increase in monthly active users across the various platforms, which reached 246 million.

Chinese MMO giant Perfect World announced its intention to launch several free-to-play style mobile games, which potentially adds a worthwhile contender in the ecosystem. Meanwhile, app store leader King managed to file for an initial public offering and add a second title, Pet Rescue Saga, to the top grossing list on iOS. This second contender generated an estimated $360,000 per day in September, compared to its big brother Candy Crush Saga, which had an estimated daily yield of $850,000, or roughly 2.4x.

Downloadable (PC + Console)

The combined U.S. market for downloadable content on consoles and PC reached $198 million in September, down 23 percent from a year earlier. This was mostly due to an increase in spending on consoles, which grew 24 percent month-over-month. Nonetheless, we expect the total sales of DLC on console to remain limited throughout the rest of the year, as storage space on the hardware devices continues to be limited.

Because of enormous demand, Take-Two Interactive struggled to keep the multiplayer component of GTA V online. The company did confirm that it is offering micro-transactions as an additional revenue stream, but this has yet to fully materialize. As this additional monetization scheme currently only appears to offer in-game currency, and no unique items or vehicles, we forecast $206 million in additional revenues in the next twelve months.

Note from SuperData on methodology: SuperData collects anonymized user data directly from publishers and developers, looking at spending by more than 2.8 million unique paying online gamers across 50 publishers and 450+ game titles.

For full reports, visit SuperData Market Data.

About the Author

Joost van Dreunen, Ph.D., is CEO SuperData Research, a market intelligence provider specialized in online games. He has written extensively on online audiences, monetization strategies, virtual goods, social games, free-to-play, online gaming and entertainment.