Given the massive population, opportunities arising after the Chinese Console Ban was lifted, and a reported $22.2 billion in revenue this year from video games (especially mobile), it’s no wonder Western publishers want to expand into China and other Asian countries. However, Asian companies have been executing their own plans for expansion.

Niccolo de Masi, President of Glu Mobile (Kim Kardashian: Hollywood;Â Katy Perry Pop)Â and others have predicted that a great consolidation will hit the mobile gaming industry. Afterwards, mobile gaming will be dominated by a handful of huge companies at the top, making it even more difficult for small companies to get ahead, save by being acquired by larger ones.

Additionally, de Masi tells [a]listdaily that Chinese and Korean companies with “big domestic markets and low cost bases” compared to Western companies will be “figuring out international markets… A lot of buyers, partnerships and ventures will be from Eastern companies looking to bring their titles and expertise to the West.”

Glu should be no stranger to this form of expansion, as its major investor is the Hong Kong-based Tencent Holdings. Tencent, which recently purchased full control of League of Legends developer Riot Games, in addition to investing $128 million in Glu, is looking to bring its biggest mobile shooter, We Fire, to a Western audience. However, de Masi explains that We Fire‘s gameplay and social mechanics will be combined with a Western IP, most likely Frontline Commando, to appeal to a global audience and become the shooter that sets a new bar for lifetime revenue.

Glu should be no stranger to this form of expansion, as its major investor is the Hong Kong-based Tencent Holdings. Tencent, which recently purchased full control of League of Legends developer Riot Games, in addition to investing $128 million in Glu, is looking to bring its biggest mobile shooter, We Fire, to a Western audience. However, de Masi explains that We Fire‘s gameplay and social mechanics will be combined with a Western IP, most likely Frontline Commando, to appeal to a global audience and become the shooter that sets a new bar for lifetime revenue.

In most instances, bringing an IP from one region to another doesn’t work out. A Western shooter brand won’t be very popular in China, and a Chinese brand has a low chance of success in the West. That’s why, in the case of We Fire, Glu won’t be bringing the brand over – just the game engine. In this partnership, both Tencent and Glu will be working together and playing on each others’ strengths. “A Western consumer will not know that this is We Fire. They will know it as Frontline Commando or Contract Killer.”

Simon Hade, Co-Founder and COO of Space Ape (Rival Kingdoms; Samurai Siege) , see Chinese companies falling into three categories “Publish – bring Western content to China; Partner – acquire or invest in a company that will win in the West; and Beach head – establish presence in the West,” noting how Tencent has been making big moves in the West with its numerous acquisitions and investments.

Hade also tells [a]listdaily, “Mobile game companies cannot just localize language and launch their game in the West successfully. While features like Gacha [collectible characters] are becoming more widely adopted in the West, games from Asia generally do not directly translate. In order to successfully bring a game to the West, you must invest resources, which takes time and money. The companies and games that invest well will have a better chance to create a top 20 game.”

“We’re seeing more and more Chinese game mechanics translating to the West,” adds Hade. “It’s still the case that China, Korea and Japan are each very different markets and a lot of the charts are dominated by local players addressing local tastes. However, it’s feeling more and more like the concepts that work in China are easier to adapt for the West (e.g. Game of War). One big difference is around the pace of content. Chinese players consume content very quickly, and your monetisation needs to reflect that behavior in order to make a game viable.”

While Hade’s thoughts closely matches with de Masi’s, their opinions differ in regards to the rate Asian games will break through into global markets. de Masi tells [a]listdaily that he expects global expansion from Asia to go “slowly,” since “you’re not going to see a lot of the partnerships be successful.”

Hade, on the other hand, states “Asian game companies have already begun to expand quickly, and it’s likely we’ll see at least one Chinese game and one Chinese developer break into the top 20 in the West in 2016. While Chinese investment in Western game companies will continue to rise quickly next year, it’s unlikely we’ll see much expansion from Japanese or Korean companies in that time.”

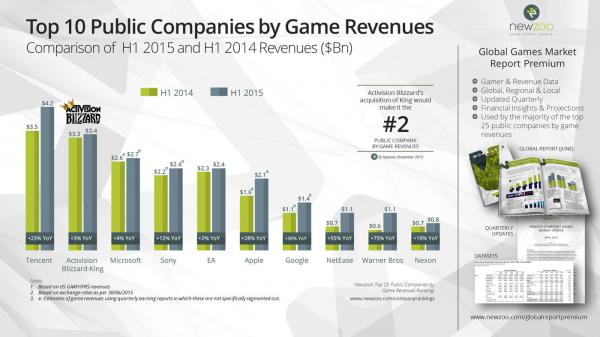

However, Tencent’s aggressive moves may lead to other impacts in the coming years. Newzoo‘s Peter Warman, in discussing Tencent’s buyout of Riot Games, notes that through various investments in companies like Activision Blizzard (which recently acquired Candy Crush Saga developer, King), the company “(partially) controls about a third of the revenues generated by the top 10 global companies by game revenues. The only other true publisher left in the top 5 is EA.”

This kind of reach could prompt, Netease, Tencent’s chief rival in China, to become more aggressive with its own investments, which this year has included a $2.5 million investment in Reforged Studios. Warman concludes by saying, “I would not be surprised if Netease makes an effort to acquire EA before the power of Tencent in the Western market is behind their horizon.”

This kind of reach could prompt, Netease, Tencent’s chief rival in China, to become more aggressive with its own investments, which this year has included a $2.5 million investment in Reforged Studios. Warman concludes by saying, “I would not be surprised if Netease makes an effort to acquire EA before the power of Tencent in the Western market is behind their horizon.”