Analysis from SuperData CEO, Joost van Dreunen, follows:

- With $979 million in May sales, US digital games revenue is up 11 percent year-over-year.

- Can E3 handle the industry’s switch to digital

- Heroes of the Storm enters right as US MOBA market plateaus at 28 million.

- Google and Oculus place VR bets as install base reaches 11 million (2016E).

- Konami sees its future in the $24.6 billion mobile market.

With $979 million in May sales, US digital games revenue is up 11 percent year-over-year.

Overall, US digital games revenues grew 11 percent compared to the same month last year, with all segments experiencing year-over-year revenue growth. Historically, May tends to be a slower month in the year as the summer season begins and the industry prepares its major releases for the holiday season. Across the market we observed an improvement in conversion rates, indicating a greater willingness among consumers to spend on digital games. Notably, despite stable player numbers, both digital console and digital PC market saw impressive year-over-year growth in revenues: 17 percent and 12 percent, respectively. May digital PC revenue was $203 million, and as more console players transitioned to newer systems with more storage and greater focus on digital content, May digital console revenue reached $67 million.

Ongoing high revenues from Call of Duty: Advanced Warfare (NASDAQ: ATVI) and Grand Theft Auto V (NASDAQ: TTWO) contributed to the year-over-year increases in the digital console and PC markets. CD Projekt RED’s (WSE: CDR) The Witcher 3: Wild Hunt saw strong digital sales as well, becoming the third highest-grossing digital console and PC game of May, despite only being available for purchase during the later part of the month.

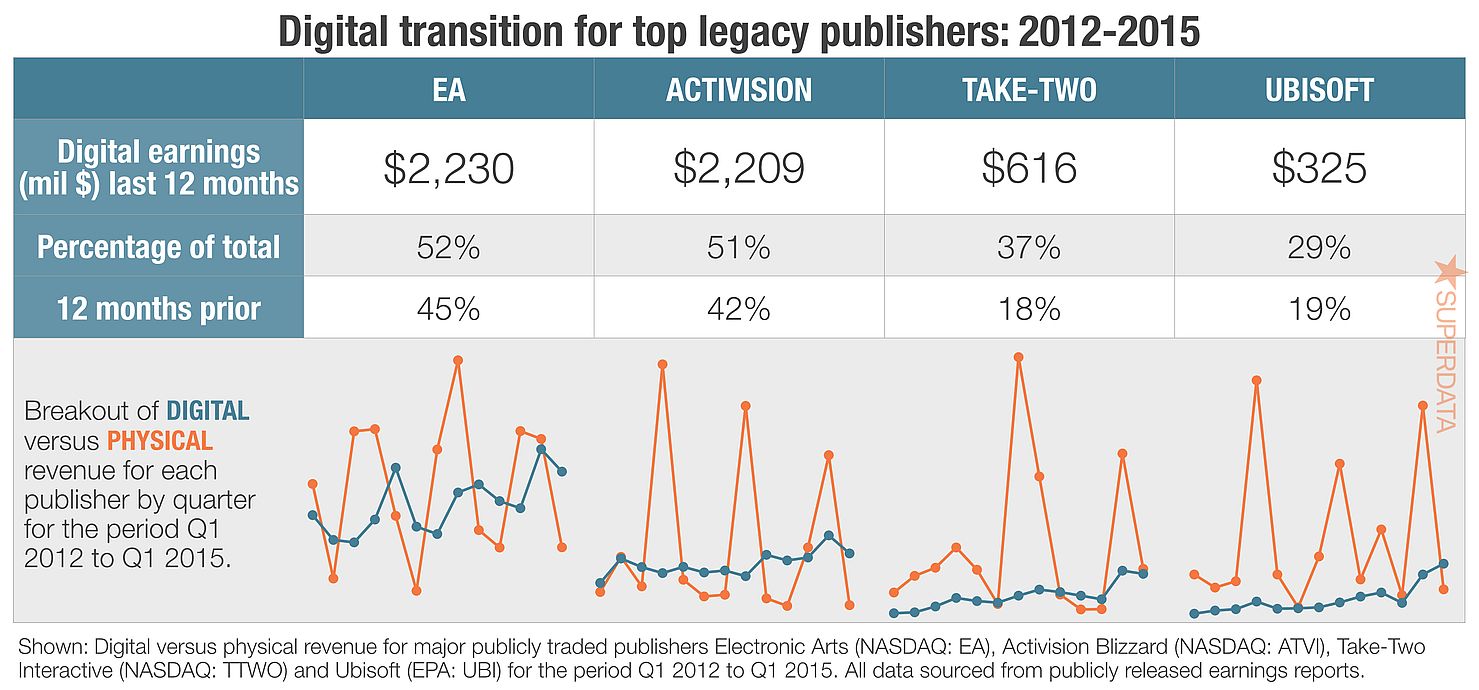

Can E3 handle the industry’s switch to digital

As the usual frenzy toward E3 accelerates, we expect this year to offer an emphasis on sequels and existing game franchises. Despite next gen consoles sales still going strong and continuing to outperform the last console cycle, Microsoft has already announced its price drop for the Xbox One to $350 for the base model. However, we expect the discussion around hardware this year to revolve around virtual reality. Following a slew of hardware announcements during GDC earlier this year, both Oculus and Sony’s Project Morpheus are likely to announce part of its initial lineup and pricing. As pre-orders for the Oculus go live during the upcoming holiday season, consumers will be looking for convincing killer apps to justify the initial expense.

In terms of software, we anticipate an emphasis on sequels rather than new IP. Considering the current install base of around 30 million units, it is an influx of risk-averse consumers rather than early adopters that will continue to grow the market. Consequently, this wave of consumers is generally less willing to take a chance on new content and chooses familiar titles and franchises instead. The real question on the table this year, however, is how the traditionally retail-focused event is going to adapt to an increasingly digital market. Simply put: since digital distribution is much less seasonal in terms of consumer spending, how will E3 maintain its position as a platform for publishers to announce their upcoming titles for the holiday season

Heroes of the Storm enters right as US MOBA market plateaus at 28 million.

In a single week we saw both the retirement date for Infinite Crisis by Turbine/Warner Bros. Interactive Ent. (NYSE: TWX) and the official release of Heroes of the Storm by Activision Blizzard (NASDAQ: TTWO). Activision Blizzard’s pedigree and marketing muscle is enough to convince millions to try the game out in the short term. But the company still faces an uphill battle to grab market share from League of Legends (Riot games/Tencent, SEHK: 700) and Valve’s DoTA2. Most MOBAs are exceedingly complex games; players who have invested substantial time to master one game are unlikely to jump ship. Because of this, Heroes of the Storm’s long-term success depends on Blizzard’s ability to draw in and retain players who have not already committed themselves to one of the genre’s existing entries. The MOBA market in the United States continues to perform well in terms of spending, but following its peak of 29 million MAUs in August 2014 has started to stabilize.

Google and Oculus place VR bets as install base reaches 11 million (2016E).

In anticipation of the holiday season, Oculus VR (NASDAQ: FB) began rolling out the first major details of its consumer headset, including a Q1 2016 launch window. Oculus is aiming for a premium experience and will target VR enthusiasts and hardcore gamers at first, with an estimated cost of $1,500 USD for the necessary PC rig and headset. Google (NASDAQ: GOOG), on the other hand, wants its VR offerings to be highly accessible out of the gate and is making a push to put its affordable Cardboard VR headset in classrooms and now supports both Android and iOS. Google’s initial strategy of appealing to a mainstream audience has allowed the company to ship 1 million Cardboard headsets, making it currently the most-used platform in the market. Finally, Sony’s Project Morpheus, which has not nearly received the same amount of attention, holds the promise of seamlessly combining VR with its massive PS4 install base. To do so, however, the Japanese giant will have to also offer compelling content. We expect to see some initial applications showcased during this year’s E3.

Konagi’s switch to mobile heralds end of Japanese console heyday.

After a highly-publicised executive reshuffling and the unfortunate cancellation of Silent Hills, Konami (TYO: 9766) CEO Hideki Hayakawa revealed in May that the company’s games division will be focusing on mobile games. Leaving behind a long history as a console-first publisher, the move makes sense for Konami given the state of the Japanese games market. Japan has a smaller mobile player base than North America and Europe, but thanks to high average spending, the country’s mobile revenue is on track to reach $6.2 billion (2015E), compared to $4.7 billion in North America and $3.7 billion in Europe. Different from North America and Europe, the release of a new generation of digital-focused consoles has not rejuvenated console sales in Japan. And with the exception of Square Enix (TYO: 9684), which has a substantial western operations, Japanese legacy publishers have not been able to take advantage the popularity of digital consoles elsewhere in the world. Going forward, other historically console-focused Japanese publishers like Sega (OTCMKTS: SGAMY) will continue to slim down their console development operations in favor of a mobile-first business model.