According to data collected by Parrot Analytics, which tracks global “demand expressions”—the number of people discussing shows across multiple channels and platforms—Star Trek: Discovery crosses trend lines and makes a strong case for how weekly shows can be used to grow fledgling services such as CBS All Access.

According to Parrot’s The Global Television Demand Report, Discovery drove the platform’s biggest month for signups when it premiered in September. The report also indicates that the show generated over 44.8 million demand expressions in the US and over 3.8 million in Canada, making it the third most popular SVOD show in both countries behind Netflix’s Stranger Things and 13 Reasons Why, respectively. Discovery ranked in the top 10 for the UK, Germany and Japan, but Stranger Things tops almost all the charts in the countries covered by the report.

Netflix set the standard for binge watching when it first decided to release entire seasons of its original shows all at once instead of at a weekly pace, proving that simultaneous releases have a tremendous payoff, with social activity hitting huge spikes during these launches before quickly dropping down to baseline levels within a month or so. Linear shows see lower, but more sustained activity throughout the season and often end up surpassing the baseline of binge-watch shows.

Star Trek: Discovery may constitute a third category, as it has shown that programs can have the best of both worlds: high social activity for the premiere that is sustained or grown over time.

Simultaneous launches mainly benefit subscription video on demand (SVOD) services such as Netflix, whose only goal is to acquire and keep subscribers, with the trade-off being that the platform needs to produce much more content to keep audiences entertained and space out the spikes of activity.

Conversely, weekly shows are ideal for broadcast channels because they rely on advertising and want viewers to return, but premium cable networks such as HBO also rely on linear content to maintain subscribers. Some digital subscription platforms do feature weekly programs, with one of the most notable being Hulu’s The Handmaid’s Tale, but they haven’t seen the same level of global success due to a host of factors including limited distribution due to the fact Hulu is only available in the US and Japan.

In addition to being well-received by critics, Discovery has a great deal going for it, starting with how it’s part of the globally recognizable Star Trek franchise, which has a 50-year legacy that was bolstered by three blockbuster movies in recent years. Additionally, CBS aired the two-part premiere on its regular broadcast network with the third episode immediately available on All Access, where all subsequent episodes were shown exclusively.

Parrot also confirmed that the show hit a major stride in January, when CBS All Access became available as a subscription channel on Amazon Prime Video, noting that boosting demand expressions through increased accessibility isn’t something that’s unique to Discovery.

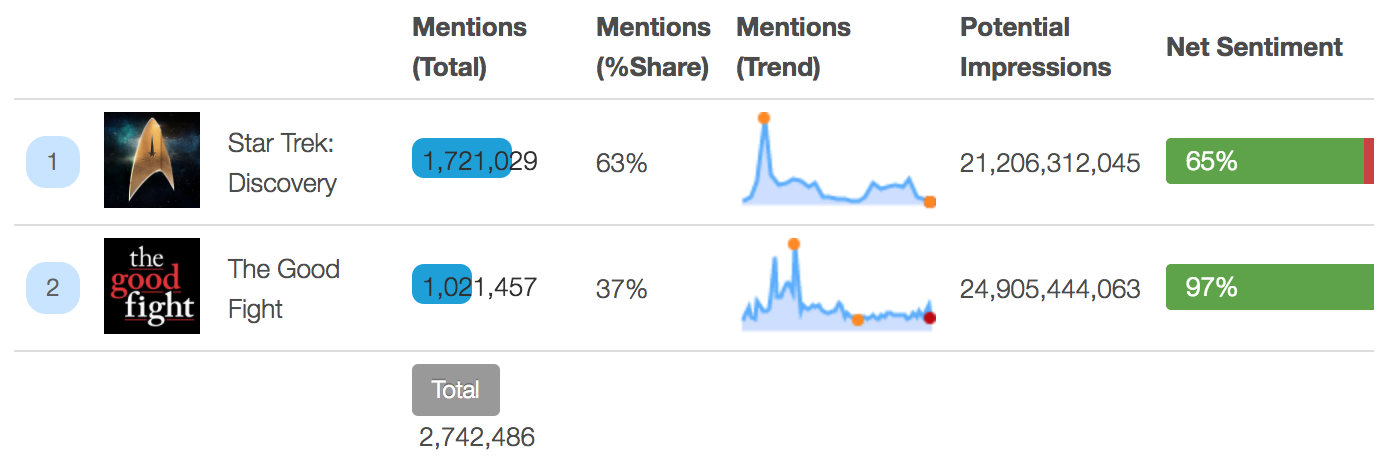

However, it might be a sign that accessibility could be a significant factor when launching a linear SVOD show, as demonstrated by another All Access exclusive, The Good Fight. The legal and political drama spun off from The Good Wife is CBS’s first scripted show for All Access, and it premiered in February 2017 in much the same way Discovery did. Data provided to AListDaily from social media analytics firm NetBase shows there were almost 50,000 mentions of the show when the first episode aired on both broadcast channels and All Access. That activity saw a major drop when season 2 premiered in March exclusively on digital platforms, generating 7,610 mentions. On the other hand, that doesn’t mean Discovery will see a similar drop when its second season airs since it is based on a considerably larger franchise.

Even without the precedent set by Discovery, there is a growing case to be made for offering linear television programs on SVOD platforms. The binge-watching model still appears to be the strongest at generating high global demand, as demonstrated by Netflix’s February launch of Altered Carbon and other high-profile streaming shows, but it should be noted that the extraordinarily high demand expressions for Stranger Things is specific to that program.

Although season 2 saw a significant drop off in the weeks following its premiere, it still managed to generate high demand months after, which may be related to fans continuing to demonstrate enthusiasm and support on social media. According to Parrot’s findings, other recent Netflix releases, including Altered Carbon, Dark, Sense8 and The Crown, didn’t come close to matching the global peak demand expressions the second season of Stranger Things saw.

But don’t discount linear programming because they might see delayed spikes in demand as The Handmaid’s Tale did. Hulu launched the first three episodes of the dystopian drama on the same day, with subsequent ones releasing weekly, but peak demand for the show occurred months after the season finale aired when it won multiple Emmy Awards. Parrot explained this kind of delayed demand might speak more to a show’s global popularity than immediate spikes do, as some shows need time to be discovered and develop long-running appeal—a comment that also happens to describe the Star Trek franchise’s rise to popularity.

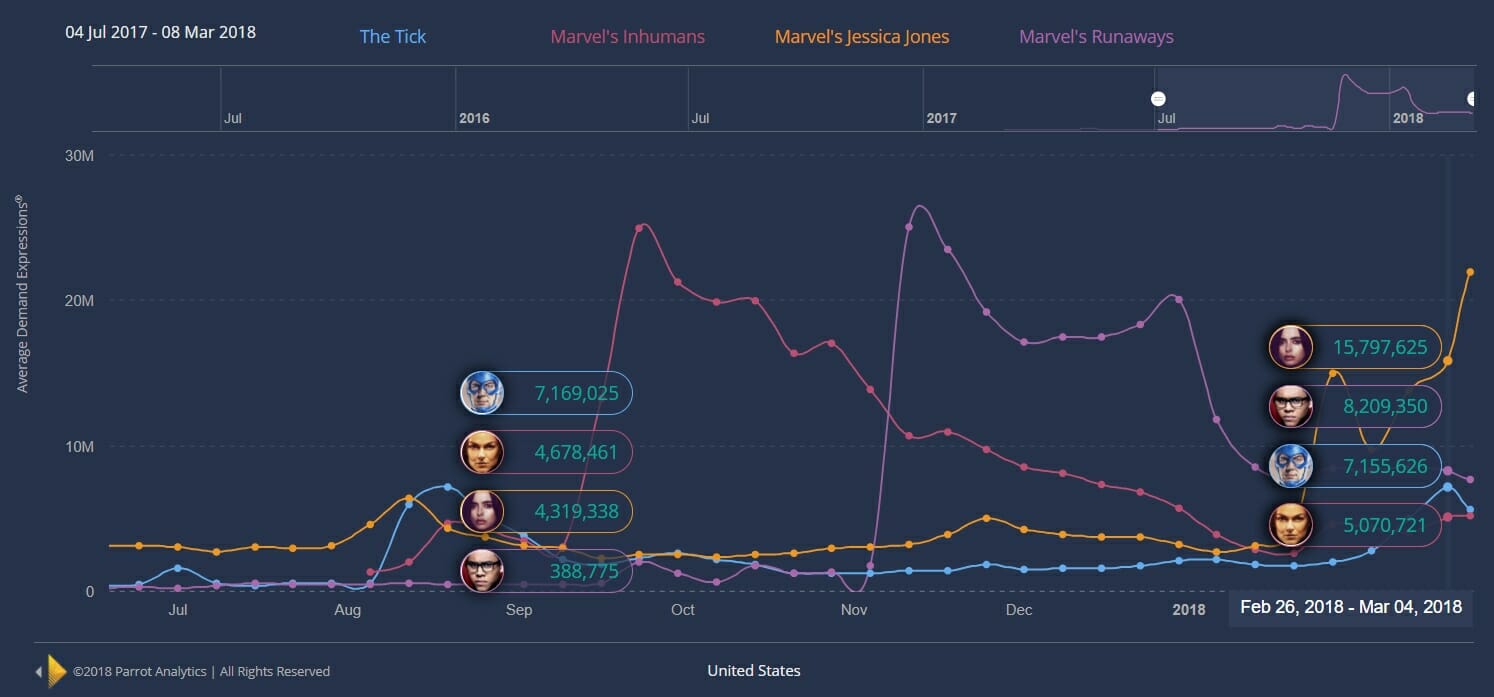

SVOD platforms are also experimenting with different release models to maximize their potential. For example, Amazon Prime Video split the first season of The Tick into two parts, with six episodes releasing simultaneously in August and the final six coming out in February, in an effort to bring back a sense of episodic anticipation. The strategy seems to have worked, as confirmed by Parrot Analytics. The company told AListDaily that the split release resulted in a near-identical peak demand between the initial launch and the mid-season premiere, averaging around 7 million daily demand expressions. However, audience anticipation leading up the mid-season premiere is shallower than the initial launch, and it is spread out over more weeks before hitting peak demand, meaning there was strong buildup on social media leading up to the second half of the season.

In January, Amazon revealed The Tick was one of its top five most popular shows, with The Grand Tour remaining at #1, and the series was renewed for a second season. Even so, it faces stiff competition from Marvel superhero-themed shows across multiple platforms. Parrot added that Marvel’s Inhumans, which began airing on ABC in September, generated three times the peak demand expressions of The Tick. That was beaten slightly by Hulu’s original weekly show Marvel’s Runaways when it debuted in November. But Netflix’s Jessica Jones is poised to surpass them all, having matched the peak demand expressions for both shows during the lead up to its second season premiere on March 8. Its demand is likely to shoot up much further over the subsequent week.

Still, it’s a close race between the benefits of binge-watch shows and linear ones. In 2017, one of the most talked-about shows on social media was Game of Thrones, according to Brandwatch. The fantasy-themed show was in its seventh season, and weekly episodes aired simultaneously across HBO’s broadcast cable channel, website and apps. A later report published by data science and media technology company 4C Insights showed that activity for season 2 of Stranger Things quickly rose to become a close second before tapering off almost as fast. Game of Thrones won’t be returning until 2019, giving shows such as Stranger Things ample time to pull ahead and perhaps claim the social media throne.