SuperData released data for top digital game sales in June 2013, which we’re running as part of a monthly column on [a]list daily.

For methodology, SuperData collects anonymized data directly from publishers and developers, looking at spending by more than 1 million unique paying online gamers across 50 publishers and 350+ game titles.

Joost van Dreunen, co-founder and CEO of SuperData, provides insight for the report.

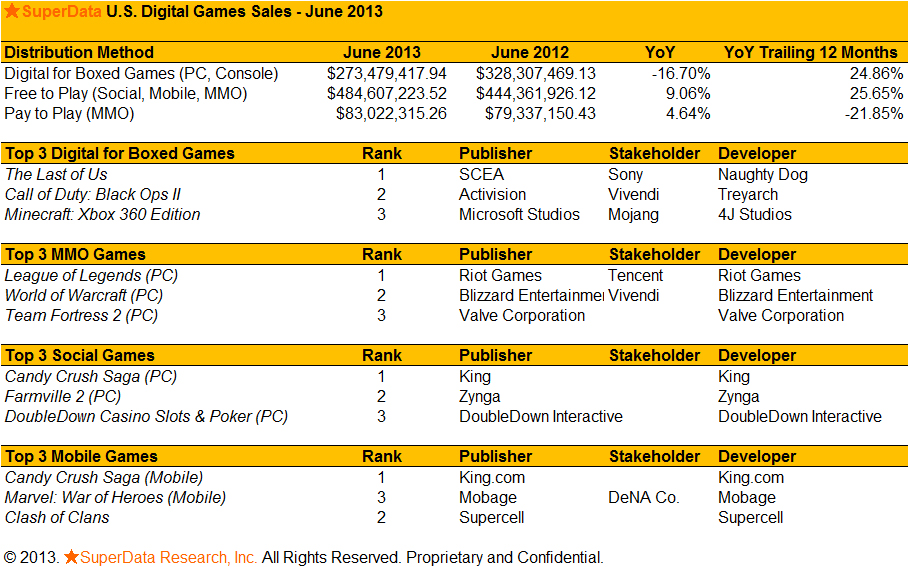

With the announcements of next generation hardware behind us, the overall digital games market recovered from last month and totaled $841 million across all categories in June 2013. The free-to-play category consisting of social, mobile and MMO grew 9 percent year-over-year to $489 million for the month.

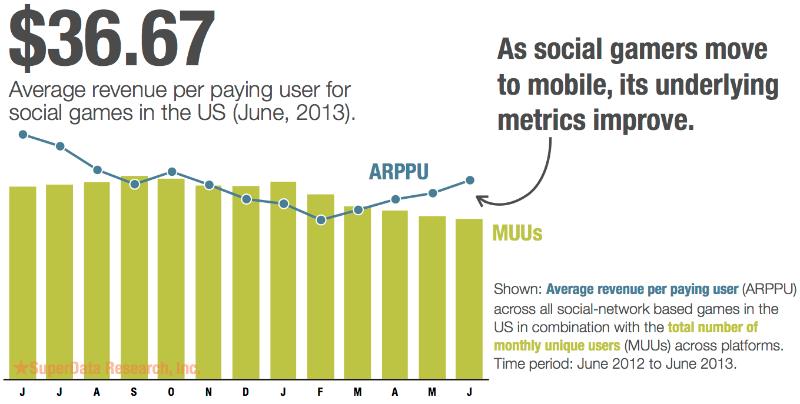

For social games in particular, even as the total number of monthly unique users (MUU) dipped during the period, the average revenue per paying user (ARPPU) rose to nearly $37. It’s apparent that as social gamers move to mobile, the underlying metrics of social games improve. The social game sector totaled $133 million for the month.

Free-to-Play MMO

Revenues for free-to-play MMOs broke an important symbolic barrier by reaching $205 million in June and more than doubled year-over-year. Key drivers for the success of this category have been the sustained growth of the overall audience, estimated at 46 million players in June, and the increasing level of spending per user. The category’s June ARPPU was $27.Popular titles such as League of Legends and Team Fortress 2 are proof that the gameplay mechanics and monetization methods of free-to-play provide a sustainable business model in Western markets. Compared to social games where the conversion rate tends to hover around two percent, free-to-play MMOs are monetizing at a rate of eight times better.

Pay-to-Play MMO

Earlier this month, Blizzard confirmed it is testing an in-game store in World of Warcraft. Although the test will initially focus on the Asian markets, where the micro-transaction revenue model is more common, the US market also shows great promise. Among American MMO subscribers, monthly spending on in-game items totaled $24 per user in June, up from $17 in December. This suggests that Blizzard’s decision to expand its monetization strategy might fit well with the preferences of their customer base.Month-over-month, the overall pay-to-play MMO market was slightly down in June at $83 million in total revenues, compared to $89 million the month prior. After the loss of well over one million users earlier this year, the overall user base has stabilized at 6.3 million MMO subscribers.

Downloadable (PC + console)

Spending on downloadable content on PC offset the usual decline in digital console sales during the summer months, which is likely compounded by consumers preparing for the next hardware generation. Overall revenues for the DLC category reached $273 million. Summer gaming is starting to heat up however as the market is flooded with discounted titles that released earlier this year and during the last holiday season.

The most notable release in June was Naughty Dog and Sony’s The Last of US for PlayStation 3, which did well at both retail and on digital platforms. The game totaled 3.4 million in combined sales.

Because of the announced delay of the Vengeance expansion pack for Call of Duty: Black Ops 2 (Activision) on both PC and PS3 we expect an uplift in overall digital sales in August.

Mobile

The mobile games segment continues to be concentrated at the top with the same titles claiming dominance month-over-month. However, looking at the various sub-categories on a more granular level shows movement. Case-in-point, in June Fast & Furious 6 from Kabam became the fastest growing mobile game of all time, reaching 17 million downloads across both iPhone and iPad. Incumbent titles such as NaturalMotion’s CSR Racing and EA’s Real Racing both took a backseat. Fast & Furious 6 grossed an estimated $2.1 million in the US in June.

Revenues in the overall mobile games segment were up 1.7 percent at $147 million, despite a further cooling of overall monthly spending per user. With top earners generating 25 percent of revenues on Google Play, Apple has found a clear competitor in Google. We expect other major platforms to follow suit, including Facebook which announced it is experimenting with mobile game publishing.

Social Games

While the number of monthly uniques who play social games further declined in June, dipping to 89 million users, the underlying metrics have started to improve. Average revenue per paying user (ARPPU) reached nearly $37 for the month, helping overall sector revenues to recover to $133 million. A central driver of the platform’s shrinking user base is the migration of gamers to iOS, Android and the various tablets. We expect Facebook’s announcement to become a mobile game publisher to further push web-based social gamers to mobile.

The popularity of social casino games on Facebook has been an important part of the overall sector’s revenues growth this month, as the ARPPU user among social casino players can be two to three times that of average social gamers. Leaders in this category such as IGT’s DoubleDown Casino (IGT) and Caesars’ Slotomania generate around $500,000 in daily earnings.

For full reports, visit SuperData Market Data.

About the Author

Joost van Dreunen, Ph.D., is CEO SuperData Research, a market intelligence provider specialized in online games. He has written extensively on online audiences, monetization strategies, virtual goods, social games, free-to-play, online gaming and entertainment.

Source: