SuperData released data for top digital game sales in May 2013, which we’re running as part of a monthly column on [a]list daily.

Joost van Dreunen, co-founder and CEO of SuperData, provides insight for the report.

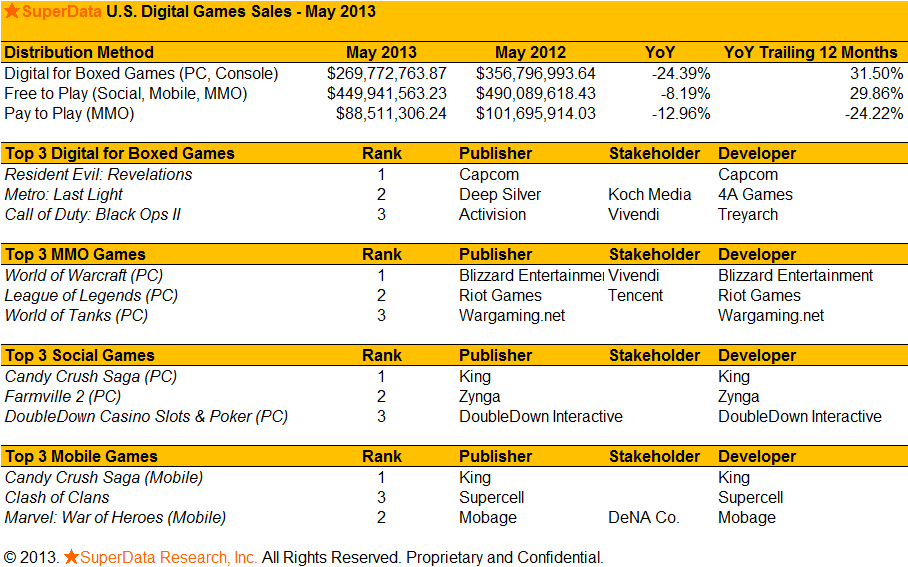

Consistent with seasonal spending on interactive entertainment, gross revenues for digital games bottomed out in May and totaled $808 million across all categories. Consumer spending continued its overall downward trend as the industry readies itself for major announcements on both the hardware and software side of the business.

The two segments that performed best in May were social games, which gained four percent [month over month] and totaled $124 million, and subscription-based MMOs, which increased seven percent [month over month] and totaled $88 million. Both categories are least affected by seasonal changes, unlike the DLC segment which saw a drop of eight percent to $270 million.

Social Games

After several months of decline the social games category experienced a slight increase as revenues reached $124 million in May. While the addressable audience, expressed in monthly unique users, continued its decline, both the overall conversion rate and spending were up month-over-month.

King’s Candy Crush Saga maintained its lead with an estimated 36.7 million monthly actives throughout the month of May. The average revenue per paying user for social games (across all categories) was $34 in May.

Free-to-Play MMO

With conversion rates now consistently above 15 percent across all categories (browser- and client-based), the free-to-play MMO segment is showing its resilience and strength as a growing market. Overall F2P MMO revenues totalled $181 million in May.

The decision by Trion Worlds to have RIFT make the switch to free-to-play suggests growing faith among key publishers in this monetization scheme, and offers a wider audience of gamers access to top quality content.

Pay-to-Play MMO

After last month’s widely published decline of the subscription-based MMO market, May showed welcome signs of recovery. Overall player numbers stabilized at 6.6 million and gross revenues climbed back to $88 million for the month.

Whether this uptick means a reversal of the pay-to-play segment remains to be seen. Especially titles using a hybrid monetization method, offering a combination of subscription and micro-transactions, increasingly carry the overall segment.

Mobile

The mobile games segment showed a slight contraction after last month’s record-breaking ARPPU of $12. Fortunately, conversion rates were up and reached 5.36 percent across all game categories in May. Overall, the mobile games segment is starting to show signs of becoming a saturated market as overall audience growth levels out.

There were no new surprises at the top of the market, as Candy Crush Saga (King), Clash of Clans (Supercell) and Marvel: War of Heroes (Mobage) continue to dominate. Title-level revenues, however, have clearly declined since their initial heyday. We expect that the ongoing dominance of only a handful of titles may, especially on the long term, reduce publishers’ willingness to invest in innovative game design.

Downloadable (PC + console)

Consumer spending on DLC content contracted by more than eight percent. This is unsurprising as the market generally slows right before major announcements. More so than any other console cycle, publishers are entering a year in which the release of expansion packs is closely tied to the launch of major titles and platforms.

Overall DLC generated $270 million in monthly sales with Metro: Last Light (Deep Silver) and Resident Evil: Revelations (Capcom) leading the charge in May.

About the Author

Joost van Dreunen, Ph.D., is CEO SuperData Research, a market intelligence provider specialized in online games. He has written extensively on online audiences, monetization strategies, virtual goods, social games, free-to-play, online gaming and entertainment.