While there was major attention focused on virtual reality at this year’s Game Developers Conference, the continuing evolution of eSports was another important trend, and it’s one that’s raking in millions of dollars right now. An entire day of sessions was devoted to eSports, and there was plenty of news, data and opinions to ponder. ESports continues to be an ever-more-important force in the games industry, and changes are under way that should help encourage that growth.

This March is an exceptional one for eSports fans, with a number of big tournaments under way from the Halo World Championships to Heroes of the Dorm to the World of Tanks Grand Finals. That’s showing the popular appeal of eSports, while GDC offered a look at what the insiders think about the current and future state of eSports.

Rocket League is one game that has really taken off in popularity, both as a game and as an eSport. Twitch has partnered with Psyonix to launch the Rocket League World Championships, and the announcement of cross-platform play has created quite a stir. The prospect of widespread cross-platform play could have an impact on other eSports that have console and PC clients, expanding the potential audience by tens of millions.

Rocket League announced that Basketball mode is coming for April, showing the potential to continue the game’s growth, and Psyonix design director Cory Davis promises that it will be difficult. “That’s a concern for us,” Davis said when Techradar questioned him. “It’s a lot harder than hockey to pick up and score, and it’s kind of a test in terms of, like, is a more hardcore mode going to be received well or not?”

Davis gave a well-received talk at GDC about the factors that made Rocket League into a success, which provided some important insights for publishers and marketers looking to turn their game into an eSport. First off, it’s important to note that Rocket League was based on a 2008 PlayStation Network game (for the PS3), which never achieved great success due to a number of factors. The current Rocket League is a result of realizing that the initial game had some dedicated fans, and polishing the game to make the experience more broadly embraced.

Some of the important changes to Rocket League include product-focused changes like creating dedicated servers, achieving a steady 60 frames-per-second and polishing the matchmaking and physics. However, it’s important to note some of the key features were marketing or business-oriented, such as going premium (abandoning the idea of free-to-play), “creating a highly GIF-able experience” that made it more shareable on social media, and making the game part of the PlayStation Plus program so it was free for the PlayStation 4 launch. As a result, Davis said, “We spent zero dollars on traditional marketing.”

Wargaming CEO Victor Kislyi, in an interview with GamesBeat at GDC, spoke about the state of eSports for World of Tanks and the market in general. “It’s good. It’s an inevitably upward trajectory now. Twitch and Kamcord and ESPN–these are all good signs. It’s been a bit like the wild west. Not every move companies are making is the right one. We might not be making all the right moves. But the eSports avalanche is coming no matter what. We’re not yet perfect, but every year we’ll learn more and more.”

The hugely popular League of Legends was the subject of a talk by Riot Games vice president of eSports Dustin Beck, who noted that the 2015 World Championships averaged 4.2 million concurrent viewers throughout the four weeks of the tournament, and the Grand Final had over 36 million concurrent viewers—figures that compare favorably with traditional sports. Still, Beck believes that League of Legends is still growing as an eSport, and nowhere near its peak.

While these talks were important, nothing beats a heaping helping of useful statistics for marketers, and Newzoo’s latest report on the state of the eSports market delivered, showing the growing value that eSports has for marketers. “Brands will spend $325 million on direct eSports advertising and sponsoring this year, 49 percent more than in 2015,” the report noted. Newzoo estimates that the audience will grow over 13 percent this year to 256 million worldwide, with more than half (131 million) being enthusiasts, and 44 percent of that total from Asia-Pacific.

The revenue growth of eSports is even more impressive. This figure that Newzoo calculates includes media rights, merchandise and tickets, online advertising, brand partnerships, and additional game publisher investment. That total will reach $463 million in 2016, a year-over-year growth of over 42 percent. As noted above, $325 million of that comes from brand advertising and marketing. That’s really an excellent deal for marketers, considering the broad reach of the audience.

The upward potential for eSports remains large, as Newzoo’s report points out. For one thing, the average revenue per eSports fan is $3.50, while the average revenue per NBA basketball fan is $20, and the average revenue per NFL fan is $60.

Meanwhile, event numbers and revenues are rising, with North America hosting 42 major events in 2015 (there were 112 globally), and a worldwide total of $21 million in ticket revenues. Prizes for tournaments skyrocketed by 70 percent, reaching a combined $61 million in 2015. The biggest was Dota 2′s The International, with a prize pool of $18 million (of which only $1.6 million came from game publisher, Valve).

Marketers are finding this a very attractive market, and the demographics explain why. Enthusiasts aged 21-35 account for 54 percent of the eSports audience, a group that’s more difficult to reach than ever through traditional advertising. These enthusiasts are more likely to have a full-time, high-paying job than the general population. Brands like Coca-Cola, Sk Telecom, MasterCard and Samsung are already sponsoring eSports, and more are expected as the industry continues its growth.

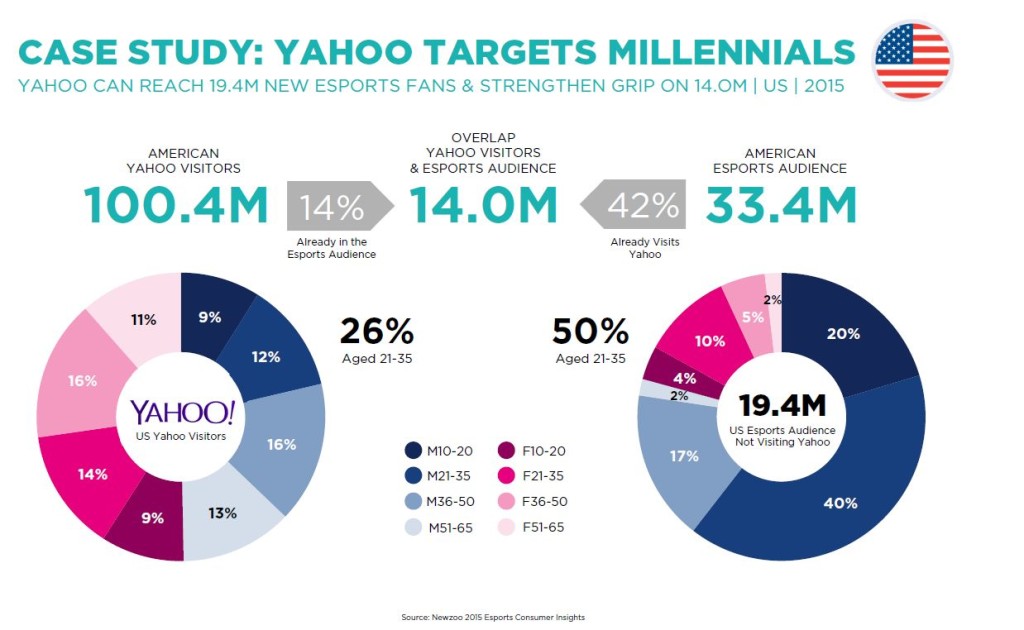

Newzoo’s report highlighted a case study of Yahoo, showing how the site is using eSports to reach 19.4 million new eSports fans and strengthen its grip on 14 million fans that already visit Yahoo. This clearly shows how non-gaming brands are finding great value in eSports, and that this is continuing to make inroads into a much wider audience of brand marketers.

The impact of eSports on the games industry, and the broader brand marketing business, is undeniable. While existing eSports already reach a very large audience, there’s no signs growth will be slowing down in the near future. New games will undoubtedly establish themselves in the eSports landscape, while current games seek to expand the existing audience. Right now, eSports is almost entirely about PC games, but efforts by Activision and Electronic Arts in setting up new eSports divisions make it easy to believe that console games will be getting a much bigger eSports audience. Meanwhile, mobile is already demonstrating the possibilities for eSports with an avid and growing audience for Vainglory and Hearthstone.

VR may have gotten the lion’s share of the attention at GDC, but eSports is already grabbing a considerable share of the hearts, minds, and wallets from gaming enthusiasts.