Ten years ago if you had said China would be home to the world’s largest game company, you would have been dismissed as a lunatic. Today, that crazy vision has become reality, with analyst firm Newzoo’s latest report showing that China’s Tencent earns more money from games than any other company in the world.

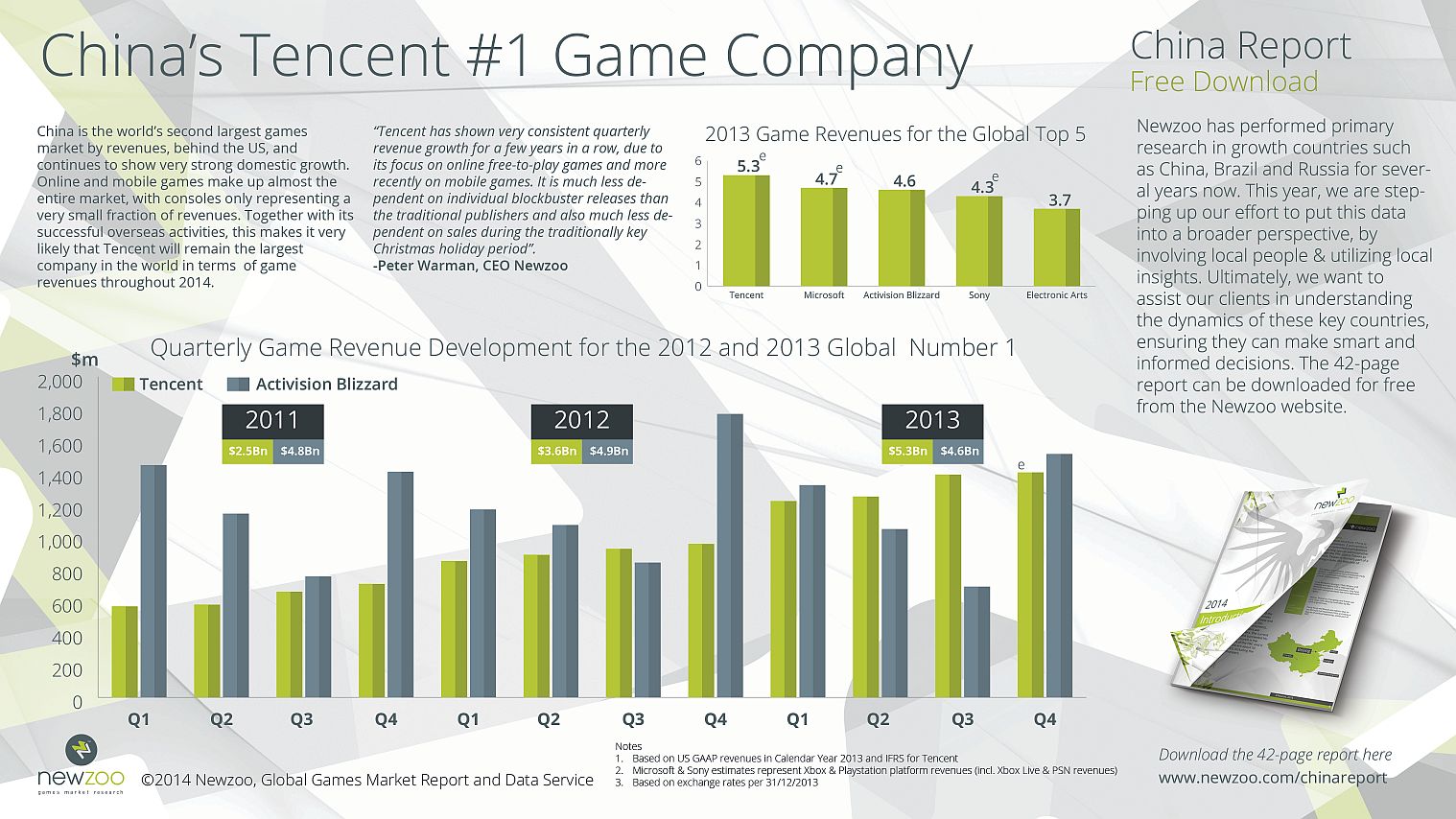

Tencent is a diversified Internet company offering information services, messaging, social networking, and games, but games are by far its biggest revenue producer. According to Newzoo, Tencent, which reports its results for the last quarter of 2013 on March 19, is expected to have generated approximately US$5.3 billion in games revenues last year. The company enjoyed an annual growth rate of 45 percent in 2013, taking almost 8 percent of the $70.4 billion global games market.

Tencent has also invested heavily in other game companies, including a majority stake in Riot Games (publishers of smash hit MOBA League of Legends), a 40 percent share in Epic Games (developers of the Unreal engine), and substantial financing for Activision’s buyout from Vivendi (which means Tencent now owns a chunk of Activision Blizzard).

2013 marks the first time that a Chinese company reached the top spot. “In 2012, Tencent ranked number 5 behind more traditional contenders Activision Blizzard, Microsoft, Electronic Arts and Sony. Tencents’ growth is fueled by increasingly successful overseas operations as well as continued growth in China itself,” said Newzoo in a press release.

Newzoo’s free 42 page report on China, ‘Introduction to the Chinese Games Market,’ contains other interesting facts about the game market in this fast-growing market. The report provides a high level overview of the country’s demographics, economy, media, internet, mobile telecom and app store landscape. The section on games summarizes revenues and players per segment, and discusses the prospects for consoles and Western PC games.

Some of the key findings include:

- The Chinese games market reached $13.8 billion in 2013, slightly higher than several estimates from Western research companies;

- In China, Apple’s iPhone and iPad take a quarter of Chinese mobile games revenues. The total 2013 mobile games revenues are stated to be $1.9 billion, exceeding estimates published earlier by Niko partners in September 2013 ($1.2 billion) and Newzoo in June ($1.5 billion);

- Three quarters of spending by Chinese mobile gamers takes place in a wide variety of local Android stores, none of which are counted under Google Play revenues;

- One of the most popular PC game download destinations in China, Ali213.net, offers over 7,000 free PC game downloads including almost all major Western PC games. The Western games are unofficially localized versions with add-on software developed by the website staff themselves. For example, GTA V has been downloaded for free over 10 million times from Ali213.net, illustrating that Western game IP is very popular in China. At the same time, GTA V has sold around 35 million legitimate copies of its game to date worldwide.

Newzoo notes that China is the world’s second largest games market by revenues behind the US, and continues to grow strongly, and this shows no sign of slowing as yet. Of course, in contrast to the US and European markets, console games are almost non-existent, though this may change as China experiments with lifting its ban on consoles. For now, though, online and mobile games make up almost the entire Chinese market.

Newzoo’s expectation is that Tencent will continue to grow and is likely to remain the largest company in the world in terms of game revenues. “Sony, Microsoft and EA will hope for a boost in games sales in 2014 if the PS4 and Xbox One continue to sell well,” notes Newzoo’s release. “However, forecasts that next-gen consoles will significantly grow the overall console market are likely to prove too optimistic.” Newzoo expects next-gen to help the console segment maintain its share-of-wallet of the Western and Japanese gamers, but not spark significant new growth. The company cites GameStop’s 2013 holiday sales report which notes “strong sales of next generation software were offset by a greater than expected decline in Xbox 360 and PS3 software sales resulting in a 22.5 percent decline in the new software category.”

“One company to watch is Softbank of Japan, which owns majority stakes in GungHo Entertainment and Supercell, has a 37 percent shareholding in China’s ecommerce giant Alibaba and recently invested $120 million in Wandoujia, one of the premier app stores in China,” said Thijs Hagoort, co-founder and CFO of Newzoo. “And of course there are non-public companies such as Mojang, Wargaming and King that would all be contenders for the top 25 if they were public. In fact, with $1.9 billion in revenues in 2013, King, which filed for an IPO in February 2014, would have been in the global top 10 of public companies in 2013 if it had listed earlier.”