The social casino game business is an interesting yet different game business that is a major market segment. The rise of social gaming via Facebook and later mobile games has led to the social casino game market. The distinction between social casino games and the gambling games they resemble is still the subject of much discussion and scholarly studies, being eyed carefully by regulators in different countries. However they are defined, social casino games have become a major, fast-growing segment of the gaming market in the last few years.

SuperData estimates the global social casino market for 2015 to be $3.4 billion, growing 13 percent year over year. “A series of mergers of acquisition has consolidated the market creating barriers to entry for late-comers,” SuperData noted in their recent post. “Caesars Interactive acquired Pacific Interactive in February of this year, its fourth major acquisition in recent years. More recently, Scientific Games acquired Ballys for $5.1 billion in November and Churchill Downs announced their purchase of Big Fish Games for almost $900 million. As social casino companies consolidate, the majority of revenues will go to just a handful of large publishers.” As well, IGT acquired Double Down for $500 million last year.

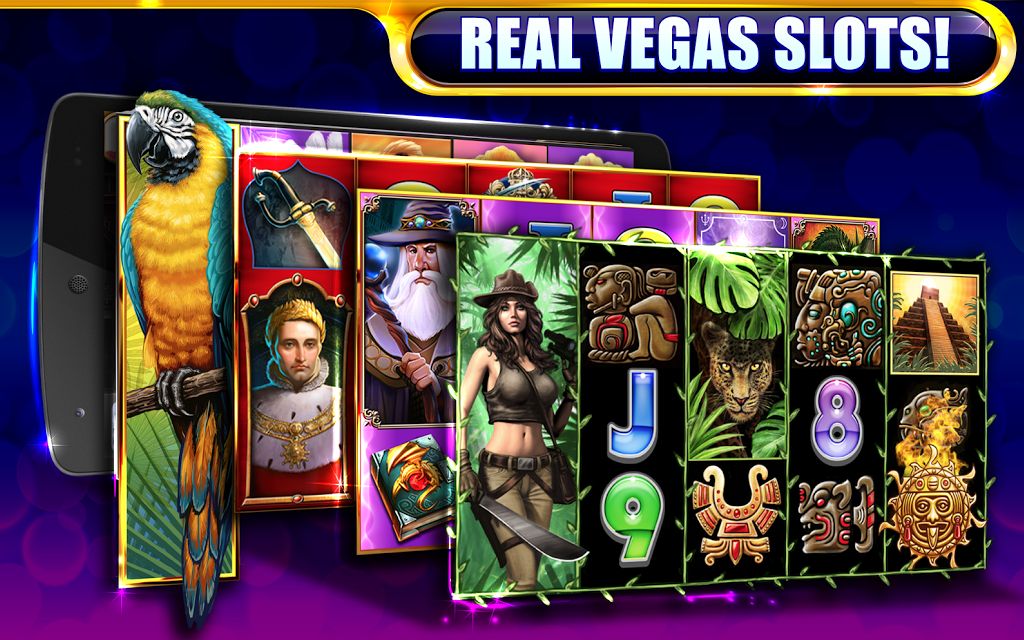

Looking at the top-grossing games on iOS, five out of the top 25 games are social casino games. “A month after its re-launch, Zynga Poker on mobile earned almost a quarter more than its desktop counterpart,” noted SuperData. It’s clearly a lucrative place to be, but how does a startup carve a place for itself amongst well-established giants

Monarc Gaming Labs is aiming to become one of the big players in mobile social casino gaming. That’s a tall order for a startup company, but one which co-founder, president and chief creative officer Al Thomas believes is very possible, starting with their first game Golden Sand Slots on Android (and soon on iOS). The company is funded by Korean company NHN, the ISP and gaming company whose Japanese subsidiary runs the messaging app Line, and whose annual revenues top $2 billion. Add to that Thomas’s vast experience with casino games and the top-notch team he’s been putting together, and what seem like long odds begin to shift in his favor.

Al Thomas

Thomas laid the groundwork for his game company at the arcade game giant WMS. “I was recruited to start their gaming division, around ’93,” Thomas recalled, “and I started designing slot machines for them back then and eventually became the executive director of advanced R&D for them.” His role was to predict where new sources of revenue would come for them, and Thomas saw one opportunity very clearly.

“I noticed a huge demographic overlap between people who played in casinos and people who were playing casual games like Bejeweled and Tetris,” Thomas recalled. “It skewed older female, which is very much how the casino gaming industry skewed. I looked into it and said there’s so much demographic overlap here there’s got to be a connection.” Thomas discovered that when the casino player went home, this is the kind of game they played — very relaxing, self-explanatory, play it any time you want. He told WMS they should develop games in this space, but no one could understand how you’d make money over something that doesn’t pay out. Eventually WMS got tired of Thomas telling them this was the way to go, and Thomas recalls they said “If this is such a great opportunity, why aren’t you pursuing it ” So he left to form his own company.

Thomas spent years learning about the mobile industry, and eventually, along with some other people, connected with the Korean company NHN. “They asked us to work as consultants to put together a plan for creating a social mobile app in a fairly mature market,” Thomas said. “Because NHN has that huge marketing muscle, they have tens of millions of dollars they could easily put into user acquisition, that made me say this is something I’m not going to be able to do in my own startup. I can create great games, but great games alone just doesn’t cut it. It’s an essential part of what you do, but you just can’t get the scale you need without having outstanding business intelligence and user acquisition people.”

After getting started with NHN and working on a variety of games, the team finally settled on slots as the starting point. “What NHN thought was going to be the most lucrative part of the business, peer to peer poker, was actually nowhere near as lucrative as slots,” Thomas said. “We started as NHN Entertainment Labs , but we realized we needed to focus around a core product — in this case, the Golden Sand Casino slot app.”

NHN asked Thomas to head up the effort and then re-brand it, because NHN does not have a brand presence in the U.S. “We chose Monarc for two reasons,” Thomas said. “It was going from the caterpillar to the butterfly stage, and it was also that sense of royalty. We thought it was a good strong brand.” Monarc’s team has some world-class slot designers, with people who have done multiple hit games. Thomas himself has dozens of issued patents and hundreds pending. “We knew we were going to be world-class,” Thomas said. But it takes more than just great design to succeed, and Monarc is building the business intelligence and user acquisition team it needs to succeed.

Casino games have some key differences from other games that Thomas points out. “We’re not the same as a normal mobile social game,” Thomas said. “When you’re playing a mobile social game, typically as you play the game it becomes fundamentally different — you see new levels that are very different, or there’s a clear objective you’ve achieved. With a slot machine, all you’re getting content-wise is more of the exact same experience. There are some thematic changes, but it’s basically still a slot machine. It becomes a never-ending game — it’s more of the same, but it’s what our players want. So there’s a different type of retention we see, there’s a different conversion and a different LTV than other things.”

Why do people play slot machines to begin with, much less ones that can never pay out “The thrill is in risking something of value, that’s the thrill of gambling,” Thomas explains. “It’s not in winning, and it’s not in losing — it’s in risking. The sense of risk becomes greater when you’ve actually injected some money into the game. The game becomes measurably better without changing the game at all when the player has injected money into it. With other games, when the player puts money in it alters that game.”

“We look at it like we’re running a live casino,” Thomas said. “How do we manage the customers that are at different levels The big difference between us and other companies that are out there is we look at that part of our business as the most important part of it, the live services and the player experience. The guy who’s running it, Matt, came from my design team. I wanted a game designer involved in customer service, as opposed to just a customer service person. For us, that customer experience that is typically viewed as part of the marketing, is still part of the play experience.”

Thomas is optimistic about Monarc’s prospects for the future. “The interesting challenge for us is to be one of the last few large players that could break into a maturing market. In theory, there’s not a lot of room,” Thomas noted. But Monarc has created a game engine that lets them get new slots up quickly, Thomas notes, something that other companies don’t have. And with NHN’s financial backing, Monarc can compete in user acquisition as much as it needs to.

“NHN is used to being a large successful company and being number 1 in the markets they enter. So they got into this to be one of the biggest and most successful in this business,” said Thomas. NHN’s long-term view gives Monarc the ability to weather ups and downs and build a casino that can take on the big players.