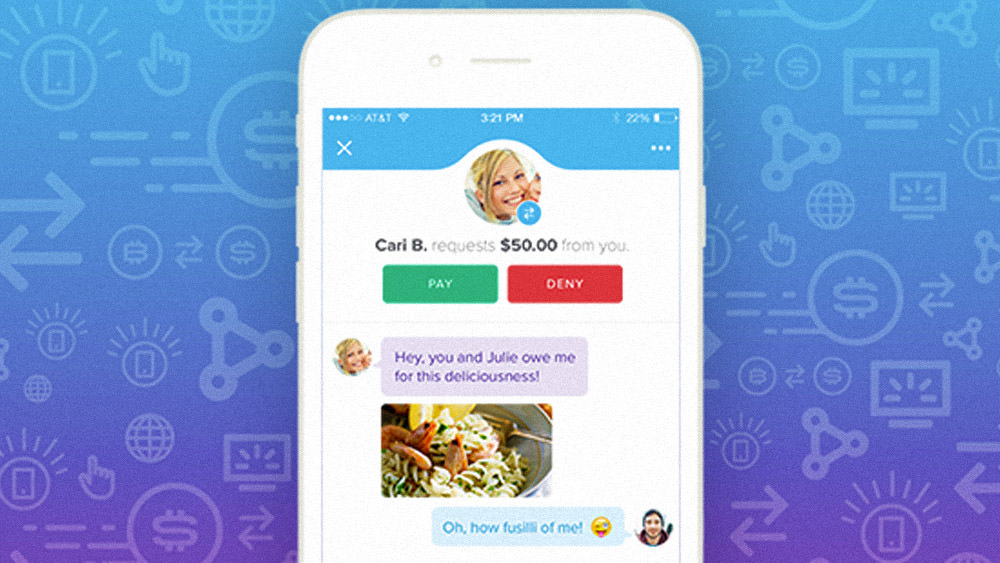

Circle Pay is a free social payment app that allows users to send money like a text message. The Boston startup got its start as a bitcoin wallet, but it now focuses on US dollars, UK pound sterling and euros, and it recently founded a separate company called Circle China.

Hoping to connect with young, digital native consumers, Circle was an official sponsor of DreamHack Denver—the company’s first major commercial partnership in the space.

Josh Hawkins, vice president of marketing for Circle, joined AListDaily at DreamHack to discuss the company’s esports marketing strategy.

“The esports sector has really blown up over the few years and it has achieved a very attractive scale for marketers,” said Hawkins. “Surrounding gaming gatherings, pop-up tournaments, and community events, there is an enormous volume of peer-to-peer payments. Use cases span collecting entry fees for tournaments, to groups making payments for venues, to tipping on livestreams. It’s a natural fit for a social payment app like Circle Pay.”

Those attending DreamHack Denver could win $100 by downloading the app and sending $25. Four winners were selected each day of the event. The Circle logo was also prominently displayed on the DreamHack Denver website and around the expo floor.

“We have a number of esports enthusiasts at Circle and have employees that come from the game publishing industry,” said Hawkins. “We’ve been fortunate to have connections in the community, and early on we spent time with grassroots organizers of regional tournaments and events across New England. Since then, we’ve been branching out, sponsoring organizations on college campuses like Harvard University’s Esports Club, and even newer venues for esports like Wizard World.”

Hawkins explained that gaming isn’t the only way Circle hopes to attract new users.

“A significant part of our go-to-market strategy has been focused on activating digital natives, millennials and Gen Z consumers,” he said. “These segments have a very basic expectation that sending and receiving money should be the same as texting, sharing photos and posting videos—instant, free and global. Apps like Venmo and Square Cash don’t provide this—you have to wait days to get your money out or pay fees to cash out instantly. They also don’t work internationally or across currencies. These are key demands among millennials and points of differentiation for Circle.

“We’ve engaged influencers in the past including domain experts on millennial money issues and trends, various artists on Instagram, [as well as] some work with Vine producers. We’re only just beginning to explore influencer marketing within the esports community and have active conversations going with pro teams and agencies in the space.”

Circle has raised $136 million in funding, backed by some of the earliest investors behind Facebook and Snapchat and financial institutions like Goldman Sachs. The app does not charge any fees for its services and doesn’t plan on charging them in the future.

“We don’t believe that consumers should be charged a toll to move money across the internet,” said Hawkins. “Blockchain tech, digital currencies, machine learning and AI are helping to rapidly commoditize services offered by banks and remittance providers. In our view, charging fees to use money isn’t a viable long-term business model.

“Circle is focused on providing a free public utility for the exchange of value. To offer consumers free instant global payments requires us to maintain liquidity in fiat currencies and crypto assets, where we have an active trading desk. This generates revenue for the company. In the future, we also plan to provide value-added services related to retail investing, which will bring monetization opportunities.”