The earnings reports are in for the three traditional console giants, and they provide an interesting status report as we enter the great marketing battleground that is the holiday quarter. This is the biggest revenue opportunity of the year for console games, and not coincidentally we see marketing efforts and spending peak during the holiday season. This year, the battle has taken an interesting shape one year in to the new console releases from Sony and Microsoft. All three console makers are in a different position, and it’s not entirely clear how things will stand as we start 2015.

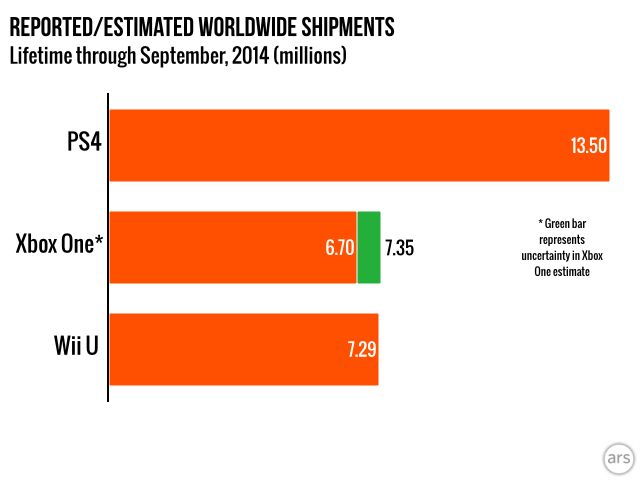

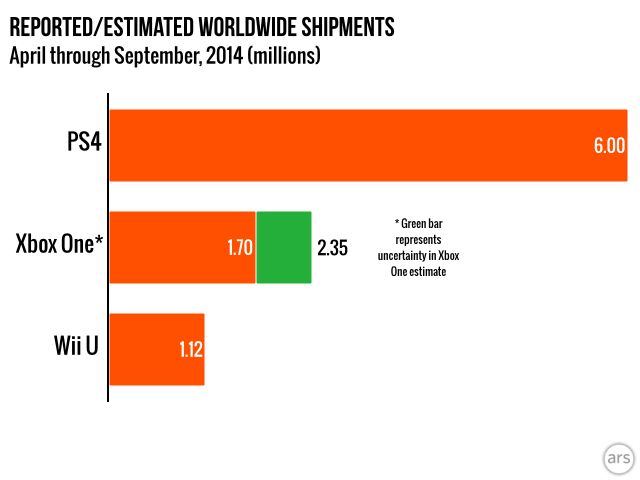

First, let’s take a look at the current situation. Ars Technica has crunched the numbers to provide the most accurate look we can get at the current installed base of the three major consoles. Through the end of September, Sony is far in the lead with 13.5 million PS4 consoles sold, while Microsoft and Nintendo are essentially tied with about 7 million sold for the Xbox One and 7.29 million sold for the Wii U. It’s important to note here that the Wii U has been in the market for more than a year before either the Xbox One or the PS4, and it’s had a substantial price advantage as well. Ars Technica also notes that over the last six months, the Wii U is selling at about half the rate of the Xbox One — and that was before the Xbox One’s recent $50 price cut.

With that in mind, let’s take a look at the situations for the Sony, Microsoft, and Nintendo, as revealed by their latest statements.

Sony

Sony’s Game Division looks like a duck. Sony’s position in the console market is gliding smoothly ahead in first place, seemingly unconcerned with all the maneuvers and travails of its competition. Underneath, Sony is paddling furiously to stay in first place. The company is comfortably ahead of its competitors and performing very well indeed with its internal competition (other Sony divisions). The challenge is to keep this going at a time when Sony continues to suffer financially because of other divisions.

One of the temptations Kaz Hirai faces is to cut back on Sony Computer Entertainment’s budget in order to help the other areas of the company. No doubt SCE execs are saying something like “no, give us the resources so we can stay ahead!” However that plays out, it likely means that Sony won’t be making major new investments in the games division, and massive marketing infusions or big price cuts are unlikely unless the competition gets very much sharper.

Sony’s not taking its lead for granted, though. The company has a huge slate of games in progress, investments in new areas like Project Morpheus, original programing for PlayStation Netowrk (the new Powers series), and PlayStation Now, and its PlayStation Plus audience is at 7.9 million members and continuing to grow. Sure, PS Vita continues to languish, and the PlayStation TV doesn’t appear to be taking off yet, but overall Sony seems to be making the right moves strategically.

Yes, there have been some stumbles (the DriveClub debacle continues, and the latest PS4 firmware release had serious problems), but Sony’s position in the lead seems firm. Nothing portends explosive growth, but another year of great performance looks like a very good bet.

Microsoft

For Microsoft, the company is confirming the old wisdom that a stern chase is a long chase. This coming quarter looks like a real chance for Microsoft to gain some ground on Sony, with two winning exclusive games and a $50 price cut on the Xbox One to try and get some momentum. Still, there’s a tremendous amount of ground to make up. Microsoft is rumored to pressing ahead on the die shrink for the Xbox One’s SOC (system-on-a-chip) to a 20 nm process, which means that the Xbox One could get cheaper to manufacture. Will the price cut continue beyond January, or possibly even get larger. That evaluation will certainly be made after looking at some of the sales numbers from the holidays.

Microsoft isn’t leaving all the R&D to Sony, either. There’s that interesting Illumiroom project, and the unified development environment of Windows 10 (along with DirectX 12) has some interesting potential. Even Kinect might find some new uses in the future. Microsoft is continuing to invest in its Halo original programing despite the shutdown of Xbox Studios, no doubt hoping the Halo effect (ahem) will help Xbox One sales. It looks like Microsoft will do very well this holiday season, especially with the $50 price cut bringing the Xbox One well below the PS4, and only slightly more than the Wii U.

Nintendo

Meanwhile, Nintendo is off on a search for blue ocean, sailing away from the mainstream in search of new markets and new audiences. The company’s latest initiative, though, looks more like seeking blue ocean by pulling your ship out of the water and carrying it across a desert in the hopes of finding an ocean on the other side.

Usually when you seek to expand your large business by opening up a new product area, you look for an opportunity that takes advantage of where your company’s strengths lie, or something that your current audience might buy, or both. For instance, Apple decides to create a smartwatch, drawing on its expertise in hardware and software, creating something that it hopes to sell to its existing iPhone customers. Or Sony buying Gaikai and rolling out its service as PlayStation Now, giving its device customers a new source of games to play.

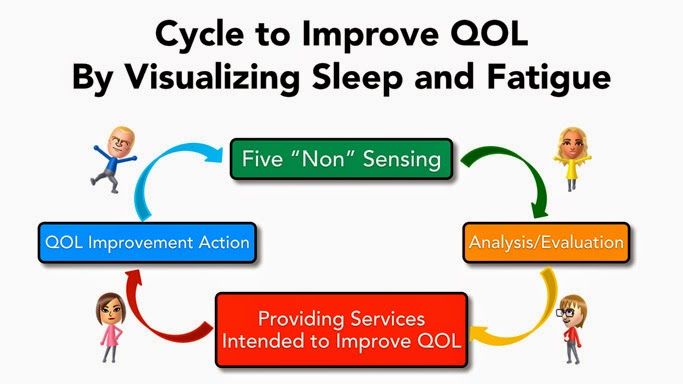

Nintendo’s Quality of Life initiative is starting off with a technology it hasn’t developed, in an industry it knows nothing about, trying to create a product that none of its existing customers will be interested in and where its brand identity is worse than no help at all — it’s actually harmful to the sale of the product. So the company is expanding in a direction where its expertise in game design is barely applicable, its massive brand is worse than useless, and where it has to develop a completely new audience for its products. How does this make sense

It doesn’t.

A more sensible initiative that built on Nintendo’s strengths would be getting into the toy business, perhaps with toys that could connect directly to Nintendo games. That’s the Amiibo product line, and it has some nice potential. Product extensions could be very interesting — what about remote-controlled toys that connected to Nintendo games and devices. This is an area where Nintendo’s brand is of enormous value, its expertise in game design and hardware design comes into play, and the products can both appeal to the existing customer base and help attract new customers to Nintendo.

Or, if the company really wants to enter into a growth market, how about mobile games Yes, others have suggested that before. But here’s a Nintendo style twist to the idea: Enter mobile games with uniquely Nintendo hardware as well as software. Imagine a Mario Kart for smartphones that came with an adjustable grip for smartphones that added joysticks and buttons; bundled together for $24.99. Or imagine Smash Bros. with the same sort of bundle. Nintendo is the one company that could get away with premium prices for its games. The company has a long history of being able to drive hardware adoption by offering must-have games with the hardware — remember Star Fox 64 and the memory expansion for the N64 The company was able to reach an astounding penetration of its installed base (on the order of two-thirds) with add-on hardware for a consoles, something that never happens to any other manufacturer.

Meanwhile, the Wii U continues to be the worst-selling console in Nintendo’s history, and the 3DS has been on a decline this year compared to last year. Yes, Nintendo is now profitable, but the long-term prospects have yet to show signs of a return to the massive profits of the Wii heyday.

While Super Smash Bros. will undoubtedly lead to a boost in Wii U sales, that will probably be short-lived, just as the Mario Kart 8 sales boost was. The basic fact is that the Wii U now lives in a different universe than the PS4 and the Xbox One, with almost none of the leading titles for PS4/Xbox One appearing on the Wii U. If you’re interested in playing the games coming out from Activision, EA, TakeTwo, and Ubisoft, you’re buying a PS4 or an Xbox One. The Wii U is your device for playing Nintendo games . . . and that’s a hard sell when there’s just not that much new content coming out compared to all the titles you can see on PS4 and Xbox One.

Nintendo will likely have a good and profitable holiday quarter, but heading into next year the Wii U installed base will be behind the Xbox One, never to catch up. Third party publishers will be unlikely to revisit their decisions to withhold support from the Wii U, so going forward the console will be dependent upon major new Nintendo releases for sales boosts. The Amiibo line will be nice, but it seems unlikely that many people will buy a Wii U just to be able to buy Amiibo toys.

It would seem that Nintendo will need a new console, or a bold new strategy of some kind, to return to the heady days of the Wii’s market dominance. A sleep sensor doesn’t look like the technology that will awaken sleeping profits. Nintendo needs to find a new Triforce to invigorate its sales.