Core gamers are back in favor as publishers roll out next-gen titles for $936 million digital games market. This analysis comes from SuperData CEO, Joost van Dreunen:

Core gamers are once again becoming the industry focus as social and mobile game platforms soften and saturate.

Several key releases on digital console and in the free-to-play category suggests a re-engagement of publishers with traditional core gamers. After a period in which casual gamers on social and mobile platforms were all that mattered, the traditional gaming experience returns with publishers seeking to stake their claim at the beginning of the new console cycle.

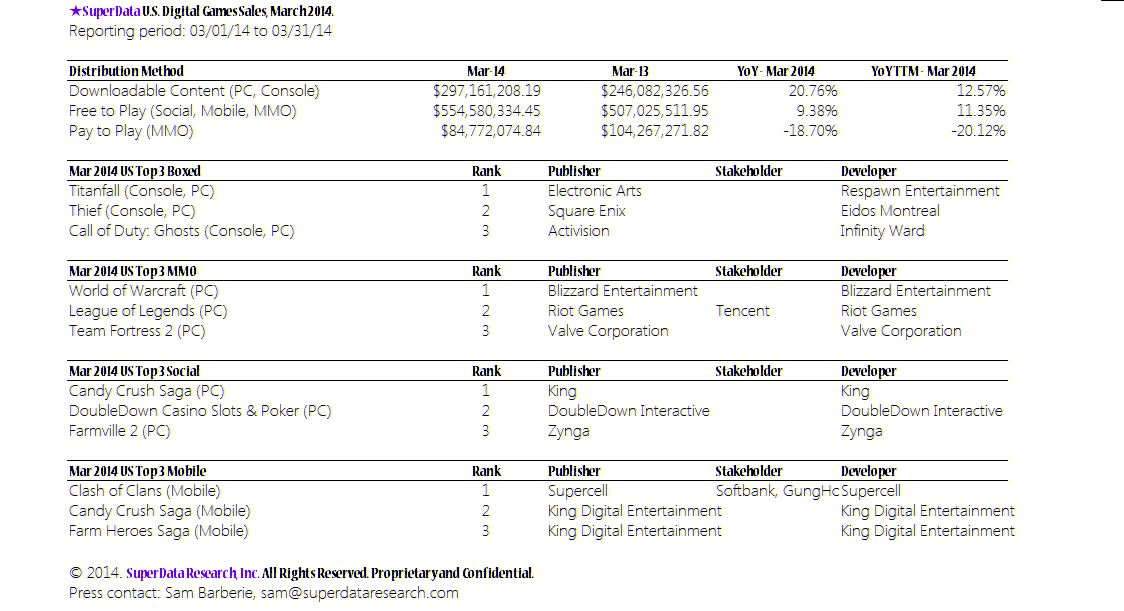

The digital games market continues to grow, reaching $936 million in total sales in March, up 9 percent year-over-year. Saturation and increasing marketing expense on mobile and social platforms level the digital playing field for incumbent publishers. Titles like Titanfall, Hearthstone and Heroes of the Storm target traditional gamer audiences, as Zynga and King struggle to repeat their initial success with casual audiences.

Activision/Blizzard readies a new volley of branded blockbusters.

After a successful launch on PC and Mac, Activision released Hearthstone in select markets on iPad. In Australia, Canada and New Zealand, all three key test markets before its release in the U.S., the game quickly managed to break into the top fifteen of grossing titles. Overall, the digital collectible card market shows both strong adoption and retention among gamers, with a 12 percent conversion to spending and an average revenue per paying player around $27 in the United States. As its second card game spin-off of its World of Warcraft franchise, Hearthstone is in a much better position to both appeal to existing and new players on digital platforms.

At the same time, Blizzard Entertainment is building the buzz around Heroes of the Storm, its much-anticipated MOBA title featuring characters from across its various franchises. The game is not out yet (and is, in fact, becoming notorious for its tardiness), but the announcement of its Tech Alpha to test out the game’s infrastructure suggests it is getting ready for showtime. Provided its release date falls within 2014 or even early 2015, Heroes of the Storm might prove a capable contender, competing with incumbents DotA2 (Valve) and League of Legends (Riot), and claim a piece of the global $2 billion dollar worldwide market for MOBA games.

Zynga is starting to fall behind, struggling to monetize on par with the big boys.

Earlier we observed an improvement in user spending as a result of the user shake out on social gaming platforms. Consistent with this, we recorded another month-over-month increase in conversion, reaching 2.3 percent in March, up from 1.9 percent just six months ago. Despite this market improvement category leader Zynga has yet to show comparable results, and reported a conversion rate of 1.7 percent in its most recent earnings reports. Efforts to stem the tide by focusing more aggressively on the highly-monetizing social casino category has so far failed to deliver. Across its social casino titles Zynga currently earns about $0.13 per daily active user, compared to the $0.17 minimum of its closest competitors in the space.

King’s second act is under close scrutiny, as their key franchise tops out.

After a souring IPO, King continues to be under close watch by shareholders and publishers alike. Despite heavy scrutiny, the company’s core franchise Candy Crush Saga showed a 1.2 percent improvement in overall spending month-over-month. In terms of monthly active users the game shows signs of saturation: after a period of continued growth, its mobile audience held steady in March with marginal growth (+0.3 percent) and a 2.1 percent decline among social players. Likely, the firm is preparing a takeover bid to maintain its momentum and reduce imminent churn. Meanwhile, King’s rival Supercell released Boom Beach late-March and managed to shoot up in the rankings, driven largely by the company’s strong cross-promotion among its Clash of Clans player base.

Titanfall refreshes digital PC and console offerings.

After several months of Call of Duty (Activision), Assassin’s Creed: Black Flag (Ubisoft) and Grand Theft Auto V (TakeTwo Interactive) dominating the charts, EA’s innovative first-person shooter breaks the chain. Launching on both PC and Xbox One, Titanfall (Respawn Entertainment/Electronic Arts) offers a fast-paced sci-fi shooter experience where players alternate between agile game play as soldiers or powerful titans pilots. Seated precisely between the traditional first person shooter genre and the recently emerged “mech” genre, Titanfall is exclusive to Microsoft platforms (the Xbox One, Xbox 360 and Windows PC). In the U.S., one in four gamers who also regularly purchase additional digital content prefer first person shooters, making it the top ranked genre on digital console. Overall, the digital console and PC category increased two percent, month-over-month.