Analysis from SuperData CEO, Joost van Dreunen, follows:

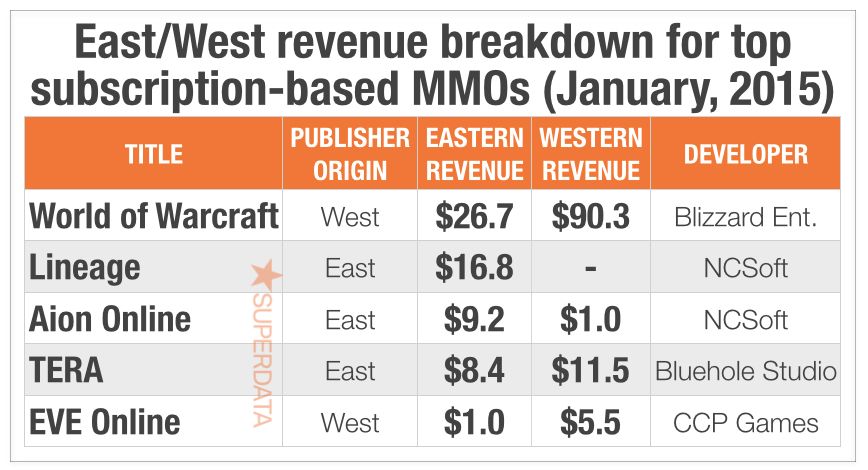

- Wildstar fails to deliver market share, as NCSoft earns 12 percent from Western territories.

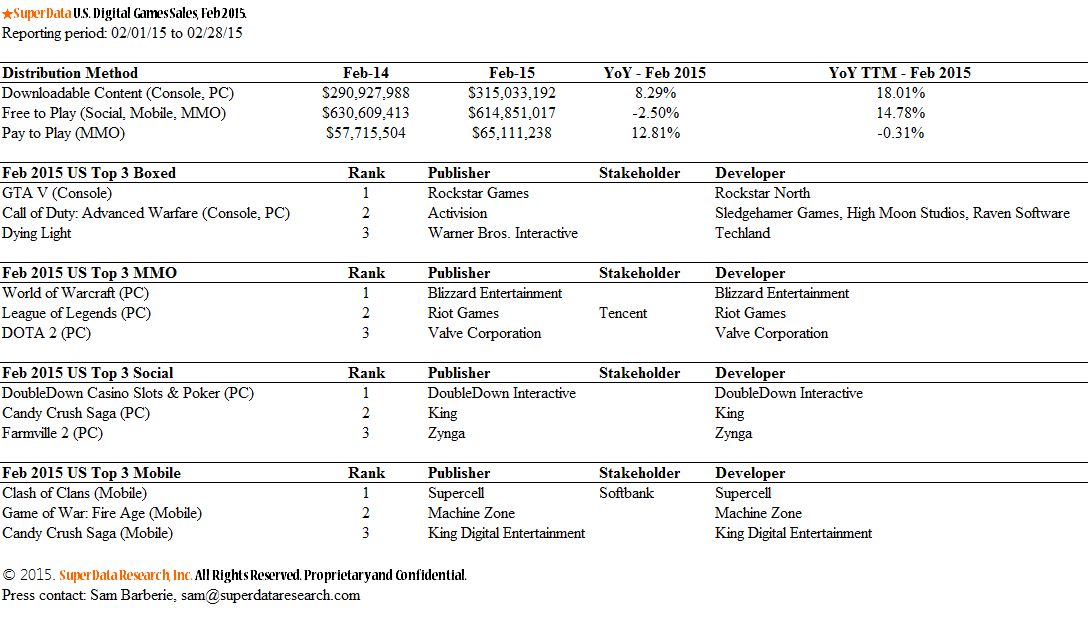

- Subscription MMOs drive $995 million February US digital games market.

- Valve stumbles into pay-to-win as DotA2 breaks 1M concurrent users.

- VR, cross-platform gaming and diversity steal the show at GDC15.

The overall US digital games market generated $995 million in revenues in February, a modest 2 percent increase from the same month last year. A big surprise this month was the enduring strength of the subscription-based MMO market, which earned $65 million, up 13 percent from February 2014. We do, however, expect this to taper off in the coming months as earnings return to the level before the release of World of Warcraft‘s most recent expansion. Activision’s release schedule for Heroes of the Storm and cross-promotion via Diablo III and Hearthstone may counteract this downward momentum. Mobile gaming dropped almost 10 percent month-over-month to $329 million after breaking $400 million in monthly spend during the holiday season. The social games segment is peering into the abyss as revenues reached an 8-month low of $151 million.

NCsoft and Nexon release strong earnings, but still have a limited presence in West. After reporting their quarterly earnings earlier this month, it is clear that top performing Asian publishers like NCsoft and Nexon still mostly rely on the Eastern market for the lion’s share of revenues. For Nexon, 93 percent of last quarter’s earnings came from China, Korea and Japan, compared to a measly 7 percent from North America and Europe combined. NCSoft earned 12 percent of Q4 revenues in the West. Despite the success of titles like Guild Wars 2, which generated approximately $77 million in revenues last year, Wildstar has so far failed to capture a significant market share, generating only $45 million in revenues and showing a clear drop. This forces a greater reliance on NCsoft’s much older titles Lineage ($237M) and Aion ($85M). A notable exception so far has been TERA, which generated 58 percent of its January revenues in Western territories as a result of having a strong local publisher network in Europe and North America including Ubisoft and Gameforge. Vice versa, the success of Western publishers entering the Asian markets is still under debate. Activision’s recent beta release of Call of Duty Online, aimed at the Chinese free-to-play market with the help of Tencent, looks promising. However, if these two industry giants can’t make a monster franchise like CoD work in a market this size, then perhaps it simply cannot be done.

DotA2 reaches 1,153,407 concurrent users but stumbles into pay-to-win. The success of the MOBA genre continues as one of Valve’s top-tier titles broke the symbolic threshold of one million concurrent users in February. Worldwide, the game has a monthly active user base of well over 10 million players, earning Valve just over $18 million a month. However, the Year Beast Brawl event hosted by DotA2 in honor of the Chinese New Year tiptoed into dangerous pay-to-win territory. With the ability to add a giant monster to their crew, players can upgrade their new friend either through gameplay or the cash shop, making this contrary to the game’s usual free-to-play monetization strategy. Following the criticism from its fan base it is unlikely that Valve will pursue this further as games like DotA2 and League of Legends generally emphasize a high-quality user experience over monetization. The overall MOBA market in the US generated $54 million in earnings in January. The popularity of the genre has convinced several legacy publishers to develop their own MOBA titles, like the upcoming Heroes of the Storm by Activision/Blizzard and the recently announced Supernova by Bandai-Namco.

Three take-aways from GDC that will change the industry. First and foremost, virtual reality is a thing now. And a slew of big, billion-dollar companies are putting their money where their mouth is. Valve announced several hardware improvements to strengthen its position in battling over the center of the living room. While most of the industry’s attention was in San Francisco, HTC unveiled its new Vive device, a virtual reality head-mounted display powered by Valve’s Steam VR technology, at the Mobile World Congress in Barcelona. And we saw the latest incarnations of the Oculus Rift and Morpheus, with the latter making the most meaningful improvements. Sony also revealed the device will launch in early 2016, as anticipated in our Virtual Reality Market Brief. Second, Microsoft is aggressively pursuing cross-platform play between its Xbox One and Windows 10. Creating an ecosystem across platforms might prove instrumental in expanding the Xbox user base and helps the company capitalize on growing trends like streaming and eSports. And the announcement of Gigantic (Motiga), which can be played across platforms, proves that Microsoft is serious and may just finally silence the eternal question: PC or console The third and final big take-away was the standing ovation following the #1ReasonToBe panel led by Brenda Romero and Leigh Alexander. As the industry has become more mainstream in recent years, diversity in game development has become a center topic in the industry. The panel tackled issues like harassment and the misconceptions about women in gaming. The positive tone of the presentation and its warm reception tells us that the industry is undergoing real change, allowing us to both appeal to a more diverse audience and elevate game development to the art form it really is.