Analysis from SuperData CEO, Joost van Dreunen, follows:

- PC gamers carry digital games market through summer period.

- Apple TV limited as a gaming platform despite content exclusives.

- Growing pains pester $3.8 billion market for game streaming.

- Guild Wars 2 embraces free-to-play to boost additional content sales.

- Get a job! SuperData is looking to fill two positions.

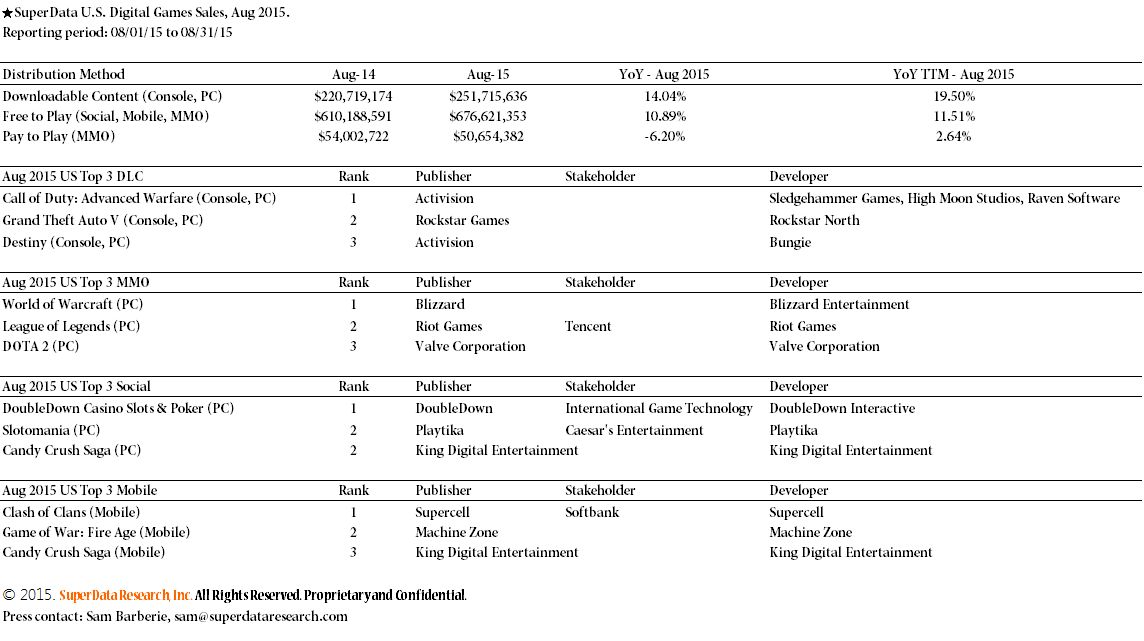

PC gamers carry digital games market through summer period. Consistent with a historical dip in sales during the month of August, this year, too, sales proved to be more sluggish than usual. Monthly earnings total in the US digital games market totaled $979 million, an 11 percent increase compared to the same month last year. Especially the PC gamer segment proved resilient, as the combined sales of downloadable content (PC + console) reached $250 million last month. With many of the major title releases only a few weeks out, we anticipate a strong resurgence in the coming months, as consumers ready themselves. Early estimates indicate that the upcoming holiday season may prove to be the industry’s biggest yet, due to the momentum from mainstream consumers adoption interactive entertainment in combination with the console cycle reaching its zenith.

Renewed Apple TV limited as a gaming platform despite content exclusives. Following the usual fanfare from its major press conferences, Apple’s announcement of a more game-focused Apple TV sent a surge of optimism through the games industry. Critical to the success of the renewed Apple TV is the availability of new, innovative content. With both industry-heavyweights Harmonix and Disney preparing titles for the device, Apple is, at least initially, banking on a more mainstream gamer audience. This is not surprising, given its massive success with mobile games on the iPhone. But mobile gamers are just that: they prefer to play on their smartphone or tablet and are ultimately much less likely to switch to a large screen in their livingroom.

Similarly, the notion that the Apple TV poses a threat to the console market is poorly informed, as the market for dedicated gaming devices is currently at its peak. With an action-packed holiday season ahead, newly minted owners of the PS4 and Xbox One will be keen on building out their library rather than playing mobile games on their television sets. Meanwhile, its startup darling from yesteryear, Angry Birds, which at the time showcased the unique features of the iPhone has since fallen from grace. With its long-awaited sequel underperforming, publisher Rovio recently announced its plans to lay off another 260 people, less than a year after it had already let go of another 130 people last October. Despite another slick delivery, the current potential of the Apple TV as a gaming platform remains limited.

Growing pains pester digital channels as $3.8 billion market for gaming video content matures. With the gloves officially off, Google (NASDAQ: GOOG) recently took aim at Amazon-subsidiary Twitch (NASDAQ: AMZN) with the launch of YouTube Gaming. The company is seeking to claim king of the hill in the $3.8 billion market for gaming video content. The importance of interactive entertainment for Google can not be overstated as YouTube celebrity PewDiePie announced the threshold of 10 billion views earlier this week. Despite its higher volume, however, it lags behind Twitch when it comes to revenue, earning 36 percent of global gaming video content revenue compared to 43 percent for Twitch. Despite YouTube Gaming’s sleek UI and higher video quality, Twitch’s focus has been on cultivating a strong community. Later this month, the company is scheduled to host its first annual TwitchCon in San Francisco. Overall, gaming video content has become an important market in the games industry. Consumers use digital channels to find out more about new and upcoming titles, look for advice on what to buy and find tips on how to beat difficult levels. Different from news publications, however, is the absence of a clear ethical code of conduct, and the industry is currently going through a series of growing pains with regards to copyright infringements and paid product endorsements. Multi-channel network Machinima recently settled with the Federal Trade Commission after several of its members posted positive videos about the Xbox One without disclosing that they were being paid to do so.

Guild Wars 2 embraces free-to-play to boost additional content sales. Another major title just went free-to-play. ArenaNet’s (KRX: 036570) MMO has never required a subscription fee since its launch in 2012, and now players will no longer need to buy the game upfront either. Currently, 14 percent of monthly earnings come from the sale of new copies of Guild Wars 2 and the rest from in-game content. With the game’s first paid expansion, Heart of Thorns, launching next month, ArenaNet stands to benefit greatly from an influx of new potential customers. So far, 2015 has seen two other major MMOs (The Elder Scrolls Online and WildStar) change their revenue model, dropping mandatory subscription fees to focus on selling in-game items. Category-leader Blizzard (NASDAQ: ATVI) is taking a different path with World of Warcraft as the game’s subscriber numbers slide to 5.6 million, the lowest subscriber count since 2005. It is one one of the only publishers to stick to a subscription model as players increasingly opt for free-to-play equivalents and MOBAs. To combat its falling user base, Blizzard is upping the frequency of expansions, like the recently-announced World of WarCraft: Legion, to entice lapsed players to re-subscribe.

Get a job. SuperData is hiring! We’re currently looking to fill two positions: Junior Market Research Analyst and Data Analyst. It’s been a super-busy year for us and we’d love to add a few more rockstars to the team to help us round out the year. More information available here on the SuperData site.