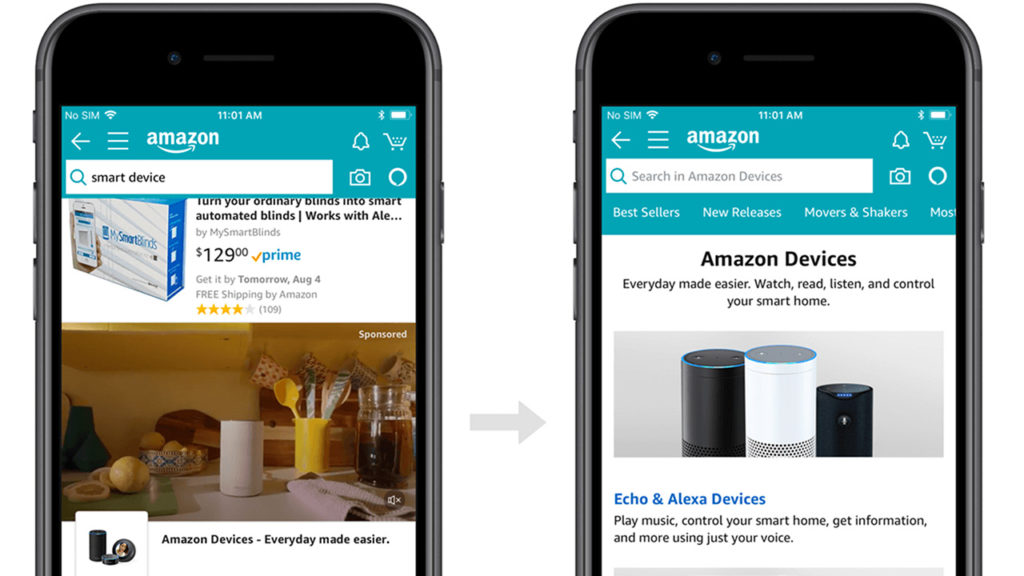

Amazon has begun testing video in mobile search results, in clear competition with the two biggest advertisers in the world, Google and Facebook.

Amazon Echo, Sonos and Neutrogena are already in the beta test and incorporating their campaigns. The ecommerce giant is taking full advantage of shifting buying habits by promoting mobile ads with video, while enticing advertisers with the chance to stand out among millions of products on display. Standing out with video in Amazon searches won’t be available to just anyone, however—the product is offered as a premium service for businesses with budgets of at least $35,000.

Amazon’s new video in search ads are currently supported in two types of campaigns—product detail pages and custom landing pages. For now, the video ads cannot be embedded outside of Amazon and are available only on iOS devices.

Each video is limited to 90 seconds or less and will be displayed in an endless loop. Amazon requires all video in search ads to include audio, although they will automatically play on mute until a consumer turns the sound on. A “sponsored” label will appear for the first three seconds before fading away.

According to Alexa (the website, not the voice assistant), Amazon is the number 10 most-popular website globally and number four in the US. Nearly a quarter of its traffic (22 percent) is acquired through search results, so Amazon needs to engage consumers once they arrive.

The company may soon compete with visual search, as well. In July, a hidden feature called “Eagle” was discovered in Snapchat’s Android code. According to the code, a feature called Visual Search directs users to “Press and hold to identify an object, song, barcode, and more! This works by sending data to Amazon, Shazam, and other partners.” Once an object or barcode has been scanned, users will be able to see all the results on Amazon.

Analysts are confident in Amazon’s strength as an ad seller. In a note to investors Monday, Piper Jaffray predicted that advertising will surpass Amazon’s cloud computing business.

“By 2021, we believe it is likely that advertising operating income will exceed AWS [Amazon Web Services],” analyst Michael Olson wrote Monday. Olson expects advertising income to reach $16 billion in 2021 compared to AWS at $15 billion.

By the same year, mobile could make up 72.9 percent of ecommerce sales and total $3.5 trillion, according to forecasts by eMarketer.