Market intelligence firm App Annie has released a fascinating report on mobile game TV ad spend in Japan, which should be of great interest to game marketers around the world. The use of TV ads for game marketing has been growing in recent years, and mobile games have led the way. The appeal of the TV ad spend is that you can reach a broad array of customers in a variety of demographics, many of whom would never be likely to encounter an ad in a mobile app. Plus, with ads for mobile games during live sporting events, tracking the response to the ad is something that game publishers can easily do by looking for spikes in downloads during the time of the event.

In Japan, TV ads have been a powerful marketing tool for mobile games going back many years. Japan’s fascination with mobile games began well before the current smartphone era, when Japan had “feature phones” that could play some pretty nice games and acquired a devoted, high-monetizing audience. This enthusiasm for mobile gaming has transferred to smartphone games, and so has the use of TV ads.

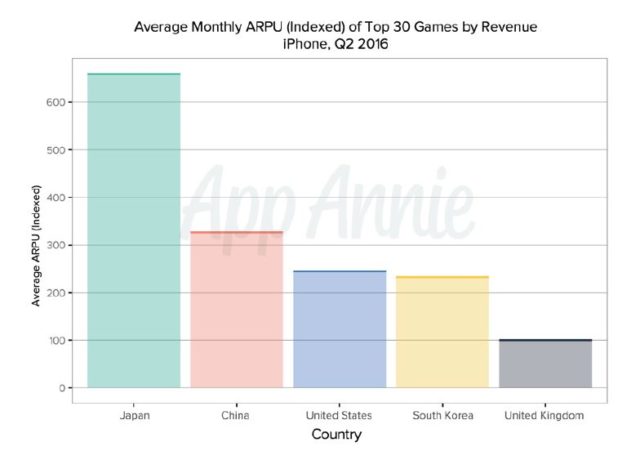

Why is Japan of great interest to mobile game marketers? The answer to that is simple: Japan is where the big money is in mobile games. “During Q2 2016, the average revenue per user (ARPU) of the top 30 highest-grossing games in Japan far exceeded that of the top 30 games in the other major markets we analyzed,” App Annie’s report noted. The first conclusion drawn from those figures is that mobile games should launch in Japan when it makes sense, because there is a lot of money to be made. That’s not very likely, since Japanese prefer games made in Japan: “90 percent of 2015 mobile games revenue generated in Japan came from games published by Japanese companies,” App Annie noted.

The deeper insight is that mobile games in Japan may augur a potential future for mobile games in other countries. What if you could increase the ARPU of games in other markets to get near the levels in Japan? Massive revenue could be achieved even without obtaining the very largest audience. There’s some evidence that this is possible. Pokémon GO is getting some 10 percent of its users to spend money, an astonishing figure when the average is nearer one or two percent. Could more games be able to reach this sort of monetization?

Television advertising is an important tool for Japanese mobile games and an important part of the overall ad spend in Japan, accounting for some 30 percent of ad spend over the past ten years. App Annie looked at data from 2013 to 2016 in three large regions of Japan that represent the majority of the market. App Annie’s analysis showed that TV ad spend in Japan grew nearly 70 percent from 2013 to 2015, according to data from Video Research and Dentsu. While Japanese companies dominate the mobile game market in Japan, the data suggests that foreign companies are increasingly using TV ads to break into the market. “Foreign game companies’ ads went from representing less than 4 percent of the ad spend in Video Research’s data in 2013 to over 20 percent in 2015,” App Annie noted.

It’s not a surprise that mobile games in Japan are using TV ad campaigns when you look at the numbers: “On average, the first month of a mobile game TV campaign in Japan saw an increase in downloads and revenue of roughly 225 percent and 25 percent (respectively) from the previous month,” according to App Annie. While revenue isn’t impacted anywhere near as much as downloads are, the higher amount of downloads sets the stage for future revenue growth, as the monetization tends to occur after the user has been playing the game for some time.

It’s not a surprise that mobile games in Japan are using TV ad campaigns when you look at the numbers: “On average, the first month of a mobile game TV campaign in Japan saw an increase in downloads and revenue of roughly 225 percent and 25 percent (respectively) from the previous month,” according to App Annie. While revenue isn’t impacted anywhere near as much as downloads are, the higher amount of downloads sets the stage for future revenue growth, as the monetization tends to occur after the user has been playing the game for some time.

Television ads for mobile games are important not just for user acquisition, but for re-engaging lapsed gamers. Since 2013, TV ads for mobile games in Japan have focused more on older games, showing that publishers are looking to use TV to lengthen engagement as well as attract new users and increase monetization. This can be seen in the data that shows the average age of games being advertised on TV in Japan has more than doubled since 2013. Some of the top games in Japan, like Puzzle & Dragons and Monster Strike, continue to be solid performers years after release. Keeping that up is achieved partly through heavy TV advertising.

One more important point that App Annie’s report makes concerns the role-playing game (RPG) category, which is the most important genre in Japan’s mobile games market. “In addition to having higher engagement in terms of sessions and time per user, RPGs also receive higher ARPU than other categories in Japan,” said the report. The importance of RPGs could also be seen in TV ad spend, where the median RPG had a 75 percent higher TV ad spend than the median non-RPG, which was also about the same ratio between the two types of games for revenue.

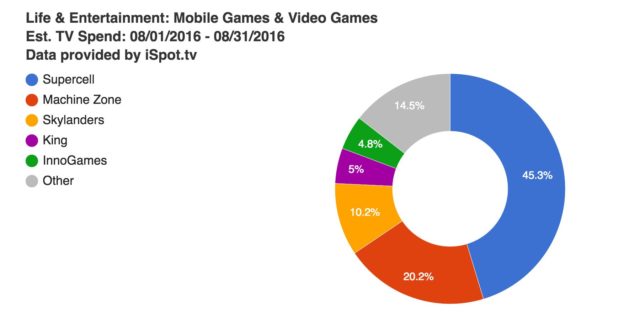

The importance of TV advertising for mobile games isn’t just in Japan—the US is seeing increasing TV ad spend for games, with mobile leading the pack. The total estimated spend for August was $27.2 million, according to a report by VentureBeat and iSpot.tv. Some 21 different brands ran 64 spots almost 13,000 times in August, the report noted.

Mobile games led the pack in US TV ad spending, with over 75 percent of the ad spend. The leader by far was Supercell, with 45.3 percent of the spend, followed by Machine Zone at 20.2 percent and King and Innogames at about 5 percent each. Activision jumped in with Skylanders ad spending that accounted for 10.2 percent of the total ad spend, but it can certainly be argued that a significant portion of that will mean added mobile game sales for Activision, since smartphone and tablet versions of Skylanders have the same functionality as the console games.