The Shin Megami Tensei series is finally coming back after 10 years without a direct sequel to the series in the form of Shin Megami Tensei IV. This entry takes place after the apocalypse from Shin Megami Tensei III, and players play one of an organized band of survivors called Samurai. The game features the series classic demon summoning and fusion, as well as the ability to talk to and sway demons. Shin Megami Tensei IV will be released on July 11th for the 3DS.

-

VPC: $8.35 ▲Value Per Click

-

VPCO: $0.00 ▲Value Per Comment

-

VPL: $0.00 ▲Value Per Like

-

VPM: $0.00 ▲Value Per 1k Impressions

-

VPS: $0.00 ▲Value Per Share

-

VPV: $0.00 ▲Value Per View

-

VPCO: $7.71 ▲Value Per Comment

-

VPL: $0.00 ▲Value Per Like

-

VPM: $0.00 ▲Value Per 1k Impressions

-

VPV: $0.00 ▲Value Per View

-

VPC: $2.85 ▲Value Per Click

-

VPCO: $0.00 ▲Value Per Comment

-

VPFAV: $0.00 ▼Value Per Favorite

-

VPL: $0.00 ▲Value Per Like

-

VPM: $0.00 ▼Value Per 1k Impressions

-

VPR: $0.00 ▲Value Per Reply

-

VPS: $4.08 ▲Value Per Share

-

VPV: $0.00 ▲Value Per View

-

VPC: $20.78 ▲Value Per Click

-

VPCO: $0.00 ▲Value Per Comment

-

VPL: $0.00 ▼Value Per Like

-

VPM: $0.00 ▼Value Per 1k Impressions

-

VPS: $0.00 ▼Value Per Share

-

VPV: $0.00 ▼Value Per View

Analyzing The Console Marketing At E3

The marketing battle for the hearts, minds and wallets of consumers this holiday has begun, and as the armies have taken the field we can analyze their strategies and initial positions. While the statements from Microsoft, Sony and Nintendo can provide clues to their strategies, how the companies chose to spend money at E3 is more revealing.

Microsoft led off the E3 week with a presentation at USC’s Galen Center. The presentation focused mostly on the Xbox One with two important exceptions: Introducing a new version of the Xbox 360 (with no pricing announced), and a version of World of Tanks for the Xbox 360, as well as some upcoming games available free to current Xbox Live members. Microsoft used the bulk of the presentation to show a series of exclusive games coming to the Xbox One, with some mention of additional features of interest like the integration of Twitch TV to allow easy sharing of game content. The presentation closed with the release schedule (November) and the price: $499.

Microsoft did what it set out to do: Show off some of the best games headed to the Xbox One, and drum up excitement and interest in the hardware and software. The price point wasn’t really a surprise, but it was greeted with silence as the audience thought about the implications. Microsoft didn’t go into details of what the Xbox Live service would look like or cost on the Xbox One. Details about used games and connectivity requirements for the Xbox One had been posted prior to E3 on a special web site Microsoft set up, with the obvious hope that those issues would be forgotten in the excitement over the games being shown.

Sony’s presentation strategy was very different than Microsoft’s. For starters, Sony invited attendees to the event two hours early, and gave them free food (from gourmet food trucks) and free beer. Nothing like some free beer to put an audience in a receptive mood. The presentation itself was very different than Microsoft’s in a number of important ways. Yes, Sony spent the bulk of the time showing off new and exclusive games to generate excitement, just as Microsoft did. The main difference was that Sony led off with the PS Vita, describing the new titles coming and the underscoring the handheld’s utility with the PS4. It was, effectively, a relaunch of the PS Vita.

Next Sony showcased a number of strong PS3 titles that are arriving this year before moving on to the PS4. In its presentation, Microsoft spent very little time on the Xbox 360, though its fall lineup is scarcely less impressive than Sony’s PS3 lineup. Sony also took pains to highlight its movie and music divisions and how they would bring media content to the PS4. Ironically, Microsoft did essentially the same thing in its May 21 Xbox One event and was panned by gamers for it; here the gamers seemed happy to hear about non-game content.

Sony made sure in its presentation that Microsoft’s hopes for no further questions on used games and connectivity would be dashed. Sony declared there would be no restrictions on used games and no connectivity requirements for the PS4. Unlike Microsoft, Sony went in to some detail about how its PlayStation Plus program would work for the PS4, announcing that members will get a free version of Drive Club for the PS4 as the start of a series of free games. At the same time, Sony announced that a PlayStation Plus memebership would be required for multiplayer online play, a change from the PS3. Capping off the event, Sony announced the PS4 price: $399, undercutting Microsoft by $100.

While much has been made at E3 and afterwards of the rival showings, and Sony’s initial PR advantage, it’s easy to overlook some important facts. First of all, the Xbox One and the PS4 are virtually identical in the broad sense, with the same basic architecture, I/O, and storage. The primary difference is the inclusion of Kinect with the Xbox One; on the PS4 you’ll have to buy the Eye for $60 to get some of the same functionality. The more powerful Kinect hardware easily accounts for the price difference.

The real differences between the two consoles will come with services and policies, as well as the lineup of exclusive games. While right now Microsoft’s policies are not as popular as Sony’s, it’s perfectly possible to change policies with a single press release. Microsoft can do that at any time — as could Sony. There’s also the persistent rumor that Microsoft may offer a subsidized package for the Xbox One, with an ISP offering a discount on the hardware if you sign up for a long-term contract. That could mean a chance to get an Xbox One for $399, or even $299 or less up front. That could completely change the value equation.

Finally, Nintendo had a non-event event; instead of inviting the press and others to the Nokia Theater for an event like Microsoft’s or Sony’s, Nintendo brought people into its E3 booth. The idea was to avoid talking at length, and instead give the press a chance to get their hands on the games. Hardware (whether the Wii U or the 3DS) was de-emphasized to the point of invisibility; the games were front and center. The decision made sense on several levels. Nintendo can avoid direct comparisons of its presentation with Sony or Microsoft, because Nintendo didn’t really have a presentation. There was no news to announce about hardware, so why spend time talking about hardware The weakness of the Wii U is currently its lack of compelling games, and Nintendo demonstrated that there are some very desirable games coming soon for the Wii U. The fact that there was only a handful of games compared to other platforms let Nintendo focus on presenting each title to its best advantage.

The company booths echoed the presentations. Microsoft’s booth was all about the Xbox One, with the Xbox 360 relegated to a corner area. Sony’s booth spread its signage and game demos equally between the PS Vita, PS3, and PS4. Nintendo’s booth focused on games, devoting the most space to the key games coming for the Wii U. Here we see what the fall strategy will be: Nintendo will focus on a few key games, Sony will try to sell all three of its platforms, and Microsoft will focus most of its attention on ensuring the Xbox One gets off to a good start.

The actual spending involved for each company will make a huge difference as to the outcomes. Microsoft is rumored to have spent over $400 million launching Windows Phone 7, so a marketing spend on that scale is certainly possible. Nintendo has plenty of cash to spend, but will find itself constrained by Iwata’s promise of 100 billion yen in profit for the fiscal year; the company will want to get a quick return on any marketing spending to achieve that goal. Sony is recovering from its financial troubles, but it still isn’t swimming in cash, so the marketing spend will probably be closely scrutinized.

Predicting which console will sell more this holiday is a fool’s game. We still don’t know the final pricing of all hardware and services from all players; there may be more bundles or deals (or price cuts for the Wii U) yet to come. We also don’t know the scope or scale of the marketing campaigns planned. Finally, all of these companies are in it for the long haul; whether one company or another sells a million more units this Christmas isn’t critical. Each manufacturer needs to establish a good user base and continuing sales momentum, and more importantly to keep that going in the slower times of February and March of next year. It’s perfectly possible that all three console makers can ‘win’ this Christmas on those terms; it’s not a zero-sum game. Keep that in mind as you watch the marketing battle unfold.

Forbes Told Women What To Wear To E3, Users Tell Forbes Where To Go

Last week Forbes’ Style File section released an article offering fashion advice for women professionals attending E3 (Electronic Entertainment Expo) which has since received a flurry of backlash from females and males in social communities. With an ongoing struggle to fight sexism in the gaming industry still close at bay, contributing fashion writer Kristina Moore seemed to unknowingly feed into the problem which had many users thinking (and hoping) the article had to be satire, but alas, this was intended as no joke.

Users’ main qualms with the article were that the author seemed to completely miss the mark on the pulse of the industry.

“How do you convey credibility in promoting your game, your studio and yourself at the convention in a room full of guys gawking at larger-than-life, theme-park-like attractions and scantily clad ‘booth babes,’ “asked the Moore, which seemed to imply that appearance was the sure fire way to garner that validity. The intended rhetorical question was answered in two fold across social.

“Let me get this straight — not only are women being told that they need to dress a certain way to have any credibility at E3 (definitely not like one of those booth babes! nothing below a scoop neck!), they’re also being told to later dress themselves in a completely ridiculous outfit to fit in,” user Jessy Ellenberger said in the comment thread.

In fact, so many disgruntled users took to social media channels to vent, that Forbes social media manager Kashmir Hill took to the comment thread to offer an explanation. “This article is getting negative feedback in the comments and on social channels. (I manage Forbes social media team, and we’ve alerted the editor of this page.) I think part of the problem here is contextual. The Forbes Style File is a page on Forbes that offers fashion advice to women, mainly in professional settings. Given that filter, it’s on topic to provide clothing suggestions for women attending a male-dominated conference while acknowledging the continuing debate over ‘booth babes’ and the discomfort that results for women in attendance.”

But Hill’s #1reasonwhy the article was topical still could not make up for one commentary in the piece that sent users to vent on social. At one point in the text the author completely misses the mark on the post-apocalyptic term, steam punk, for the genre of style and music, punk. Although, the article has since been updated and that was the first faux pas edited out.

In her defense Moore took to the comment thread to offer her response to the community, “I am a staunch defender of women being all they can be in the professional and business world, and because I am passionate about style, I see it as a tool for empowerment for women. It should be totally their choice of whatever they wear, just as long as it lets them feel self-confident in every situation they find themselves. If they don’t need it as a tool, then that’s their choice. I just see style as a dynamic introductory tool for women (and men).”

All controversy aside, the [a]list daily attended the event (interviews to come!) and did not see too “many bright blazers and neon cross body bags” in attendance.

Source: Forbes

Exclusive: Watching The Buzz On New Hardware At E3

Who’s winning the buzz war over new console hardware is going to be one of the big questions coming out of the show. Of course, marketers for each company will be busy measuring tweets and likes, and compiling figures for the CEO to admire. We don’t have access to that internal data, but there are other ways to figure out who’s coming out ahead in the buzz battle. One simple way to watch the buzz is to use Google Trends; put in the search terms (like Xbox One or PS4) and get some quick comparisons.

There’s more than just Google Trends to watch, of course. Check out the support from major publishers for the next-gen consoles. Are the AAA titles appearing on both PS4 and Xbox One, or only one of those Given the architectural similarities between the two platforms, major publishers would generally be developing a title for both platforms — unless given an incentive to do otherwise. Or the executives at a company may have decided that, based on what they know, that one console will do substantially better than the other. That seems unlikely, though; there are too many unknowns at this point to be picking a winner at this stage. The general approach is to maximize the return on development by porting a game to all possible platforms — unless there’s a very good reason not to.

It will be tough to pick leaders by looking at gaming-focused media, because they are going to have huge amounts of coverage of all the major players. A better bet to get a read on what the average consumer might think is to look at mass media’s coverage. They will tend to cover all the major players fairly equally, but they may zero in on one as possessing some feature or exclusive game that makes a particular impression.

The really important item to look at is the number of exclusive games for the platform. Here are three time frames to look at: Launch titles, titles appearing before the end of the year, and titles announced for 2014. While media and the publishers may make a fuss over launch titles, what matters more to the sales over the holiday is the number of titles available before the end of the year. Even customers who buy the new console at launch won’t likely buy more than one or two titles at the same time. New software appearing over the following month might as well be a launch title for most buyers.

The longer term sales picture for the next-gen consoles depends mostly on the flow of new games. While titles of any kind are good, exclusive titles help make the buying decision in favor of one platform over another. This is particularly true in the case of the PS4 and the Xbox One, which are generally similar in architecture and features and will have many of the same AAA titles from major publishers. It’s important to note that a revival of Wii U sales will depend greatly on Nintendo’s ability to deliver a steady stream of solid new games, whether their own or from other publishers.

Let’s not forget, too, that asking around can provide some useful insights. If everyone you ask mentions the same console as the winner, somehow or other that console has managed to get ahead of the competition. Don’t forget to ask why someone thinks more of one console or another; the answers will give you clues as to the most effective selling points that have swayed opinions. You may get some ideas on what makes for good buzz for your own products, as well.

While some media may feel the urge to crown a ‘winner’ of E3 between the different consoles, or between the new games being introduced, that’s not going to matter much to the ultimate bottom line. Sure, it’s a nice thing to mention on package copy or in an ad, but ‘Best of E3’ isn’t something you can deposit in the bank. The battle for market share is only beginning at E3, and will continue for years. It’s quite possible that each manufacturer can ‘win’ on their own terms, by meeting sales and profitability projections, even though only one can be the best-seller in a given market over a given time period. Let’s not lose site of the ultimate goal of all of the marketing and PR activity: Generating higher profits. In the long run, if marketing can’t do that it’s a failure, no matter what customers (or marketing execs!) may think.

Exclusive: The Publisher Challenge For E3

This year’s E3 will be dominated by the introduction of two new consoles, Sony’s PlayStation 4 and Microsoft’s Xbox One — and Nintendo will be striving to get renewed attention for the Wii U. The media’s attention will naturally be focused on the shiny new consoles, and the hardware makers will be doing everything possible to keep and hold that attention. If your job is marketing games, though, it’s looking like E3 will be a very difficult show.

The problem won’t be with marketing games for next-gen consoles; after all, those games will be the real focus of attention for next-gen consoles. Once you’ve seen the box and the controller, the excitement is pretty much over — until you launch a game. Console makers will be showing off what games can be like on new hardware.

Unfortunately, this will also be true for publishers like Activision, Electronic Arts, Ubisoft and others. The media will be swarming over the publisher’s booths specifically to see what Call of Duty: Ghosts or FIFA looks like on next-gen hardware. That’s fine as far as it goes, but the reality is that next-gen software sales for the holidays will be only a very small fraction of overall publisher revenue, no matter how enthusiastically consumers buy new consoles.

Let’s run a few numbers to examine this. Suppose Sony and Microsoft have a fabulous introduction of new consoles, and buyers snap up them up as quickly as new consoles have ever sold. There will be, at best, two months of sales for new consoles in 2013. That would mean perhaps 3 or 4 million new consoles sold for both Microsoft and Sony; perhaps 8 million between the two companies. From all indications, there will be a fair number of titles available at launch — perhaps as many as a dozen for each console.

So a hit title on one of the new consoles might sell as many as a million units . . . maybe even two million units. That sounds impressive, until you think about Call of Duty’s ability to sell 20 million units of a new title without even trying hard. EA’s big hits like FIFA will likely be in the 10 to 15 million unit range. Next-gen title sales, therefore, will likely be on the order of 10 percent to 20 percent (at best) of current-gen software sales for the holidays. That’s a nice addition to the holiday revenues, but marketers have to worry about that 80 percent of revenue coming from games for current-gen consoles.

There’s the challenge: Draw the attention of the media, and the buyers, and the attentive gamers to your new games for current-gem consoles. Somehow convince people that despite the lack of next-gen power, these games are deserve $60 of their love. (And don’t forget the DLC! Can I interest you in a collector’s edition ) Here, then, is the true indicator of marketing success at E3: Getting substantial attention for a game on current-gen hardware. If you see a company doing that, you can expect that company will have a good Christmas.

It’s going to make for some interesting tactics as marketers strive to overcome the attraction of shiny new hardware. Will we see more video More people dressed up in costumes Perhaps some unusual giveaways, contests or events Expect the unexpected. E3 will be the place to watch for game marketing next week.

Exclusive: How Microsoft Can Win E3

Microsoft’s Xbox One reveal generated an immense amount of coverage in game media and the mainstream media as well, and also some criticisms among gamers. The challenge facing Microsoft at E3 is to fully win over gamers and set the stage for the company to become the #1 next-gen console this holiday season. Beyond that, Microsoft also wants to lay the foundation for victory against rivals Apple and Google for control of the television set into the future. The Xbox One could be the cornerstone of Microsoft’s grand crossover strategy involving smartphones, tablets, PCs and consoles. It’s an incredibly ambitious marketing task, and it begins with E3.

The console marketing struggle seems much like a presidential campaign. The three major candidates all need to appeal to their base (in this case, gamers) in order to win the primary (the E3 show). When the fall campaign for the all-important audience in November (when next-gen consoles begin selling), the prize goes to the candidate who can appeal to the largest possible audience – and thus get the most sales. Winning the hardcore gamers will not be enough to beat a console that has appeal to a broader audience.

Microsoft and Sony are clearly the two major-party candidates, well-funded and with powerful backing from key groups (big publishers), albeit with two widely different messages. Nintendo is the wacky third-party dark horse candidate, with the offbeat policies and perhaps some compelling new ideas that may appeal to a broad swathe of the audience.

So far, at least, it appears that Sony will be making its appeal primarily as a game machine, and in the fall perhaps alluding to some media features in an effort to make the console more appealing to people whose primary use case may not be games. Microsoft, by contrast, appears to be aiming to win the hearts, minds and wallets of the broader audience of TV watchers, sports fans, and media consumers. Nintendo is probably going to focus on key Wii U titles shipping for the holiday season, stressing the strong appeal of familiar brands in new and hopefully exciting games.

The E3 show will see Microsoft working to shore up its image among gamers, which it must surely be aware it needs to do after the criticisms in the game media. Microsoft has to clarify the situation with used games and whether or not the Xbox One needs to be connected all the time. At the same time, expect Microsoft to stress the advantages that gamers will gain from being on a connected platform.

Beyond that, Microsoft needs to display an impressive set of games both for launch and in the next year to convince gamers that the Xbox One is a great investment in cutting-edge, immersive gaming. Microsoft will have to resist its impulse to talk about non-game features of the Xbox One; the company should save that for the marketing aimed at the mass audience. Microsoft must give the gamer audience watching E3 coverage the exciting new games they are craving.

We can expect a Microsoft presentation focused relentlessly on games, and a booth to match. Third-party publishers will be featured along with Microsoft games, as the company will wish to show the broad support expected for the Xbox One. More interesting will be to see the range of genres on display; will Microsoft reach out to casual gamers and the younger gamers as well as the hardcore, older crowd It’s likely that we will see some titles showing a lighter side, but the proportion will be illuminating. Microsoft has to choose between strengthening its appeal to the hardcore, or broadening the appeal to the mass audience. Odds are we’ll see more hardcore titles showcased in prime spots, given that this is E3 and that Microsoft’s first concern will be the most committed gaming audience.

Microsoft will also be revealing more information on its services for the Xbox One. Sure, we expect to see all the familiar things from Xbox Live, no doubt enhanced in many ways. The question will be how is this service made available Will there be an annual fee What’s the price point Will some Xbox Live features be available to all for free These are critical questions in gauging the likely market acceptance of the Xbox One. A $10 monthly fee on top of several hundred dollars for hardware might be a significant barrier to sale, if the perceived value of the services provided is not sufficiently high.

There’s also a persistent rumor that Microsoft might offer a version of the Xbox One at a lower retail price, such as $299, with a commitment to a $10 or $15 per month, 2-year contract (what services this contract might include, if any, are unknown). While this would boost the overall price, it would give Microsoft a strong selling point for the Xbox One – “it’s less money up front than a PS4 or Wii U.”

Microsoft has a larger target than the game industry, and the marketing of the Xbox One will doubtless reflect this. Microsoft intends to not only exceed Sony and Nintendo in market share for the next round of consoles; it wants to preempt Apple and Google from owning the television experience. Keeping the lead in the console market is just an early battle in this long-term marketing war. We won’t see this strategy emerge until closer to the launch date for the Xbox One, when Microsoft will be unleashing a broad marketing campaign. If this is indeed Microsoft’s marketing plan, we’ll see advertising targeted to a broader demographic that focuses on the TV experience and other non-game aspects of the Xbox One.

Microsoft cannot allow the long-term goal to get in the way of the short term objective of being seen as the leader coming out of E3. There’s a fine line to walk, with the necessity to highlight the Xbox One’s exclusive games and gaming features, yet make sure to reference the non-gaming features that could appeal to gamers and that set the console apart from the PS4. Done properly, Microsoft will emerge roughly equal to Sony in terms of horsepower, and the nature and number of exclusive game titles. There may be some games with features using the advanced Kinect functionality or other Xbox One features that may give Microsoft an edge over the PS4. Microsoft will certainly try to make that point, but we don’t yet know if all the PS4 capabilities have been revealed.

The service comparisons will be important to gamers. Broadly, PlayStation Network and Xbox Live will both offer achievements, connections with friends, multiplayer matchups, and a wide variety media to devour. Pricing models and details of what you get could be a strong differentiator here. Sony may have a rotating supply of free titles, like they do with PlayStation Plus; Sony’s also already strongly committed to supporting free-to-play titles, which Microsoft is just toying with now. Sony appears to have a much more friendly environment for indie developers, and may end up with a broad array of innovative, inexpensive titles that Microsoft won’t be able to match.

Microsoft and Sony may hold back the most important thing fans want to know: How much will these new consoles cost Pricing can be a powerful marketing tool, and announcing a price first gives your competitor a chance to craft a strategy in response. Still, retailers will need to know the price before placing orders, so neither Sony nor Microsoft can wait too long. Don’t be too surprised, though, if we still don’t know the pricing by the end of E3.

One important thing to look for at E3 is the placement given to Sony and Microsoft in the booths of major third-party publishers like Activision, Electronic Arts, and Ubisoft. Will Sony and Microsoft get equal billing, or will one be favored over another Clearly Microsoft and Sony have both been working with major publishers, and we’ve already heard some of the deals. Will Microsoft end up with better placement at third-party publishers, or will Sony Parity should be expected; if one company has better placement with a key publisher, that can be significant boost in the tough holiday market. Of course, the danger for the third-party publisher is picking the wrong console to back, with possibly painful results to the bottom line.

Get your popcorn ready, because the marketing battle will take center stage at this E3.

Exclusive: How Sony Can Win E3

Sony’s eager to regain the unquestioned leadership in the console business it enjoyed back in the PlayStation 2 days. Since that time, the company has struggled against larger corporate issues (the massive losses in the television business, tough times in the movie business, missteps in mobile devices) while losing the console leadership to Nintendo’s Wii (and in the USA, to the Xbox 360). The PlayStation 3 was powerful yet expensive initially, and the complicated architecture made it hard for developers.

Now Sony is looking to correct the problems of the past with the PlayStation 4, seeing in this console a chance to regain leadership in the console business, secure a stronghold in the family room, and help bring Sony back to profitability while burnishing the company’s brand. So far, the company has revealed basic hardware specs for the PS4, and featured some partial game demos and enthusiastic developers at its initial unveiling in February.

Going into E3, Sony knows that Microsoft is going to come at it full force with a very competitive console and the ability to spend massively on marketing. Plus, Microsoft has timed its console unveiling to be close to E3, hoping to dominate the media between now and the show. Sony needs to put on a powerful E3 performance to blunt Microsoft’s momentum and regain the spotlight.

Realistically, neither Sony nor Microsoft should expect to run away with a clear lead in buzz after E3. Both companies will be showing lots of games with spiffy graphics and interesting features; some of the games will, probably, be the same titles. The biggest titles from Activision and EA and Ubisoft aren’t going to be exclusive to any one console, after all. The consoles from Sony and Microsoft are going to have the same basic architecture (the CPU and GPU), and probably similar I/O, memory, and storage. Sure, there will be differences in controllers, and motion detection and other features, but there won’t be immense differences.

There lies Sony’s first challenge: Differentiate the PS4 from Microsoft’s console. Journalists (especially mainstream media) will tend to lump them together; what’s key will be the differences that get mentioned. Sony’s task is to make sure that people talk about the PS4, they mention key things about it that Microsoft’s console doesn’t have. (Perhaps the controller’s Share button The touchpad The network features ) Sony needs to clearly identify its key advantages and make sure everyone knows them — and agrees that those features are key reasons to buy the console.

We can expect an array of software in various stages to be shown at the show. One of the key selling points is going to be the starting lineup of software for the PS4; what will you actually be able to play this Christmas (And the answer better not be “Ridge Racer!”) Sony has some strong studios that should provide interesting exclusives. Sony will be leaning on exclusives to sharpen the distinction between the PS4 and Microsoft’s offering.

Sony may or may not reveal details of its marketing plan at E3. Usually, that’s not considered to be something the media or the consumers are interested in, but it’s something retailers are keenly interested in. What sort of marketing spend will Sony commit to How much TV advertising Who’s the target audience The big retail chains will certainly want to know these things, but Sony may keep that a secret until later, in order not to give Microsoft any help in figuring its strategy.

Sony will be more constrained than Microsoft when it comes to budgeting. While Sony has eked out a modest profit for the fiscal year, that was achieved mostly through the sale of assets and careful cost controls. Until the good times return, Sony’s going to be careful with its spending. The PS4 launch is important, though, and will likely command a healthy budget. It will almost certainly not be all Sony marketers could wish for; they will have to be creative to get the most impact.

The biggest weapon in the marketing arsenal is, of course, the price point. We may or may not see pricing announced at E3. On the one hand, if Sony announces a relatively low price (like, say, $349 or even $399) and Microsoft doesn’t announce a price (or does, and it’s higher), Sony will get a solid head start in winning consumer hearts and minds. On the other hand, what if the yen suddenly drops in value; Sony could wind up losing a lot of money if it chooses a price for the PS4 too soon.

It’s quite possible both Sony and Microsoft may wait a while longer to reveal pricing; this gives the competition less time to craft a strategic response, after all. However, it’s unlikely that Sony will be pricing the PS4 to lose a lot of money. The company just can’t afford that sort of investment right now. Microsoft has piles of cash in the bank so it can afford to take a loss, but the company’s recent pricing of its Surface tablets shows it’s reluctant to lose money on hardware even to buy long-term market share.

Sony has also hinted that the PS4 will maintain a solid price point, which probably means that the PS4 will be more like $400 or $500. Ultimately, though, Sony will probably stress value: if you get any games or other content with the console, for instance. The company could decide to pre-load content on the PS4 hard drive to give consumers a taste of the various media (games, movies, music) it’s possible to buy on the console.

Sony’s initial February event was relentlessly focused on games, games, game designers, indie games, and games. Oh, and the PS4 also plays games. Did we mention games You may be forgiven if you aren’t sure whether the PS4 plays movies or music, too, because Sony sure didn’t spend a lot of time on that. Sure, E3 is focused on games, but if Sony expects consumers to shell out hundreds of dollars for its new console hardware, they’ve got to show people the PS4 plays movies and music and sports just fine, thank you. Just how much Sony chooses to showcase the non-gaming features of the PS4 at E3 will tell us a lot about how the company intends to market the PS4 to consumers.

It will be interesting to see how much effort Sony puts into the PS Vita for E3; that will tell us how important Sony considers that device to its holiday success. This could be a chance to effectively relaunch the PS Vita, stressing its connectivity with the PS4 and ability to play PS4 games remotely. Or, Sony could ignore the PS Vita in favor of the PS4, which would effectively mean that Sony has given up on the PS Vita and is letting die a natural death. Watch the Sony E3 presentation carefully, and see what percentage of it is devoted to the PS Vita. That will tell you exactly how important Sony considers the PS Vita, no matter what they may say later. That event time is precious, and will be measured out to precisely what Sony thinks will provide the best return on that time investment.

The holiday season will be marinating in game marketing, between the three big console players, upstart Android consoles like Ouya and GameStick, AAA titles like Call of Duty: Ghosts and Battlefield 4, and a slew of tablet and mobile hardware and games. Sony’s challenge is to find a way to stand out in the crowd and convince consumers to drop hundreds of dollars on what may well be the last console the company will ever produce. This will require a clear message, compelling value, and the resources and creativity to get that message to every possible target. Will Sony pull it off We’ll check in after the dust settles from E3 and reassess the situation.

Exclusive: How Nintendo Can Win E3

Is there really such a thing as ‘winning’ E3 There is the external victory of being the thing most talked about in the mass media, in the game media, and on social media. Those are really three different audiences: The broadest possible audience of anyone who sees, hears or reads news; the audience of gamers who are always interested in game news, and hardcore Nintendo fans. Then there’s victory internally for Nintendo, by whatever standards it chooses to set. Ultimately, it’s the votes cast by consumers in the form of spending that counts.

Nintendo is heading into this E3 in a difficult position. Sales of hardware and software have not been meeting the company’s projections. CEO Satoru Iwata has gone on record that he intends to deliver a billion yen in profits for Nintendo this fiscal year, and implied that he may step down if that’s not achieved. This puts Nintendo in a difficult position for marketing strategy, since any marketing spending has to return a profit within the fiscal year. No long-term brand-building here; Nintendo will be looking for marketing efforts that can produce solid short-term results.

This may be the reasoning behind Nintendo’s decision to forego the usual massive E3 press event, instead having a smaller media event and a separate event for trade partners and analysts. Nintendo also announced it will step up its production of Nintendo Direct videos, a cost-effective way of directly reaching Nintendo fans.

Nintendo has not shared any more about its marketing strategy, but we can make some guesses. Nintendo put out a flyer at PAX East that compared the Wii U to the Wii, clearly indicating Nintendo feels gamers aren’t really sure of what the Wii U is or why they should own one. Worse, if gamers are confused, the mass market must be completely baffled. Effectively, Nintendo needs to relaunch the Wii U and make sure the audience understands what it is. Unfortunately, Nintendo will have to do this in the face of what is sure to be a major push from Sony and Microsoft for their next-gen consoles. Nintendo will need to have clear, focused television ads hitting the key demographics, and those ads will need to be memorable to overcome the barrage of ads hitting the same audience.

One of the biggest weapons Nintendo could use in this battle is a price cut for the Wii U, but that is unlikely. Nintendo’s already losing money on each one sold, and dropping the price $50 would just mean an additional $50 loss on each unit. That might get made up in software sales eventually, but it would have to be at least three or four titles during a time when Nintendo doesn’t have all that many compelling titles for the Wii U. Hopefully we’ll see some strong Wii U software for the holiday season, more than just Pikmin 3.

The best asset Nintendo has right now is the 3DS. This handheld console has been selling well (though still under Nintendo’s projections), has an impressive array of good games, and a price point that’s not too high. Nintendo will probably put more emphasis on the 3DS for the holidays, as a way of keeping Nintendo fans spending money on Nintendo when they can’t afford a Wii U.

Key things to look for at E3: How much space in the Nintendo booth is devoted to the Wii U versus the 3DS That will show you where Nintendo hopes to make the most revenue over the holidays. What key software titles are showcased for the Wii U and the 3DS, and how compelling are they If Pikmin 3 is the best Wii U title for the holiday, Nintendo will have a difficult time. What genres are being given prime marketing support This will tell you if Nintendo believes the Wii U’s market is primarily the casual gamer that was the mainstay of the Wii market, or if Nintendo is hoping to get a more hardcore audience excited about the Wii U. What third parties are being showcased at the Nintendo booth, if any This will tell you how much third party support Nintendo has been able to attract, and how important it may be to Nintendo’s holiday sales.

Also look for the presence of the Wii U in the booths of other publishers like Activision, EA, and Ubisoft. If the only Wii U titles you see are stuck in a dark corner, that means Nintendo won’t be getting much help from that publisher. Ubisoft will likely have some space devoted to the Wii U, but you may have to look hard to find it at the EA or Activision booths.

If the Wii U can’t have a price cut, and Nintendo can’t spend huge amounts of money on advertising, what marketing options does Nintendo have Increase the value of the Wii U by bundling in more software. This can be in the form of digital downloads, or a disc pack-in. Perhaps NintendoLand will be included with the $299 Wii U, and the $349 Wii U could get that plus another title or two.

Nintendo has put itself into a tight corner by setting the billion-yen profit goal. The company has $10 billion in cash, but can’t spend it on marketing unless the return is short-term. The usual way to increase sales easily, a price cut, would therefore seem unlikely. The most powerful tool of all would be a must-have game or three for the holidays; can Nintendo come up with some game magic that will have the Wii U flying off the shelves this Christmas It’s a long shot, but Nintendo has pulled off such surprises before. There’s a saying around the game industry: “Never count Nintendo out.” Good advice for this E3 as we wait to see if Nintendo can surprise us all.

Exclusive: The Other Consoles To Watch At E3

All gamer eyes will be focused on the E3 show next week to see what the PlayStation 4 and the Xbox One have to offer. Nintendo will also be hoping to renew interest in the Wii U with announcements of upcoming games. But there are other consoles that will be at E3, and the revenue generated from them may be greater than the revenue from next-gen consoles. Keep your marketing sensors tuned for these other consoles, and see what may be The Next Big Thing.

First off, there are the portable consoles from Nintendo and Sony to look at. Nintendo’s 3DS line, after a rocky start, has gone on to become a solid replacement for the aging DS line. Nintendo is continuing to expand the software lineup, and with more impressive titles the 3DS looks to generate some welcome profit for Nintendo this year. Expect Nintendo to devote a fair piece of its E3 marketing effort to the 3DS lineup; judge for yourself how impressive it looks.

Sony has the opportunity to relaunch the PS Vita at this E3, and the company has already shown the PS Vita as a remote player for PS4 titles. The big question is this: Can Sony generate some serious sales energy around the handheld console Many expected a price drop after Sony cut the price in Japan, but prices in the Americas and Europe remained unchanged. Watch for a price drop to be announced at E3 if Sony is serious about giving the PS Vita a boost. More importantly, what sort of software lineup can we expect The titles so far have not been real system-sellers, much to Sony’s disappointment. Has the company been able to generate some third-party enthusiasm Can smaller developers show the platform some love Does Sony have a killer title or two of its own to show off Examine the Sony event and the Sony booth to see what percentage is devoted to the PS Vita; that will tell you just how important Sony thinks the PS Vita will be going forward.

Beyond those two obvious consoles, though, we have some serious contenders from left field. The Ouya, the GamePop and the GameStick represent the first Android-based consoles, and the pricing represents a serious challenge to the established console business. The Ouya is priced at $99, the GamePop at $129 (with a $6.99 per month subscription to all the games you want) and the GameStick at $79. That’s not so far off from where the Wii, the Xbox 360 and the PS3 are headed (they may all have a version at $99 by Christmas) — until you consider the price of games. True, for older consoles you can find classics or used games for $20, but Android is awash in free games, or games priced at just a dollar or two, or free-to-play games. Casual gamers, or families interested in getting a simple gameplaying solution, may well be interested in these alternative consoles.

Expect to see all of these consoles at E3 in some form or other. Ouya will be conducting a guerrilla marketing operation outside the convention, symbolizing the company’s strategy as being outside of the . . . conventional game industry. Android consoles may not be inside the halls, but their shadow will be falling on the show. Android has thousands of casual games, and developers are busy crafting more hardcore experiences for mobile platforms. Over the next six months, the titles available for Android platforms will continue to increase. The graphics may not be next-gen, but gameplay can generate great sales — just look at Minecraft.

The final console to watch for is quite possibly the biggest one of all: The Tablet. Whether Android or iOS, 7 inch or 10 inch, tablets are growing at an astounding rate. Tablets have already reached the size of the largest console installed base, and estimates show tablets will continue to grow rapidly. Companies like Supercell have shown there are tremendous profits to be made with tablet games; Supercell is looking at an estimated $500 million in profit for this year on just two games. Every game publisher is either developing tablet games, or at least thinking about it. Blizzard will be showing a tablet game at E3, and that should be a clear indicator that this platform has truly arrived.

As you look at what E3 has to offer, look to see what tablet games are being offered up. While tablets may or may not have much of a presence on the show floor, they are exerting tremendous power in the marketplace. Even the next-gen consoles will be acknowledging the ubiquity of smartphones and tablets with initiatives such as Microsoft’s SmartGlass. Sony’s PlayStation Suite is already making classic PlayStation games available on Android tablets. The rise of the tablet gaming platform is inevitable; the only question is how fast revenue from tablet games will surpass revenue from traditional console games. It may take a year or three, but the trend lines are impossible to ignore.

The Biggest Hidden Story Of E3: Mobile

The most important story for the game industry may not be what you saw at E3. Maybe it’s what you didn’t see– or rather, what you didn’t really notice. Like a black hole, it may best be detected by its invisible pull on its surroundings. On the surface E3 is all about consoles, the current ones and next-gen consoles arriving this fall, and to some extent about PC games (usually versions of console games). Look closer and a different picture begins to emerge amidst all the noise and visual clutter.

The massive and continuing growth of smartphones and tablets has resulted in enormous revenue from games on those platforms. In turn, that has lead to mobile games being developed by leading publishers like EA, although mobile games are still a small part of EA’s overall revenue. If you look closely you can see a number of mobile games being shown at E3, mostly in meeting rooms rather than the show floor. Some of them are from major publishers (like Blizzard’s upcoming tablet game Hearthstone: Heroes of Warcraft, or Zynga’s Solstice Arena), and others are from newer publishers (like Outfit 7’s Talking Friends series, celebrating 1 billion downloads). Mobile game publishers like King are even taking out booths at E3, the show supposedly about console games.

The interesting thing happens when you look closely at key new console games. Destiny, the game from Bungie that Activision is hoping will be an enormous franchise, has a mobile app that allows you to do important things in the game. EA’s FIFA is now deriving a lot of revenue from mobile apps that give you access to your teams. Sony is making old PlayStation games available on Android devices. Microsoft’s SmartGlass integrates tablets and smartphones into the Xbox and Xbox One experience.

From using mobile devices as controllers, to having mobile apps extending console gameplay, to mobile devices plugging into a TV to act as consoles, it’s clear that mobile devices are fundamentally changing the console game market. The influence is here, it’s growing, and companies that deny that mobile is important or that it affects the console business (and especially the handheld console business) are deluding themselves. Savvy companies are trying to figure out how to turn the continued success of mobile platforms to their advantage.

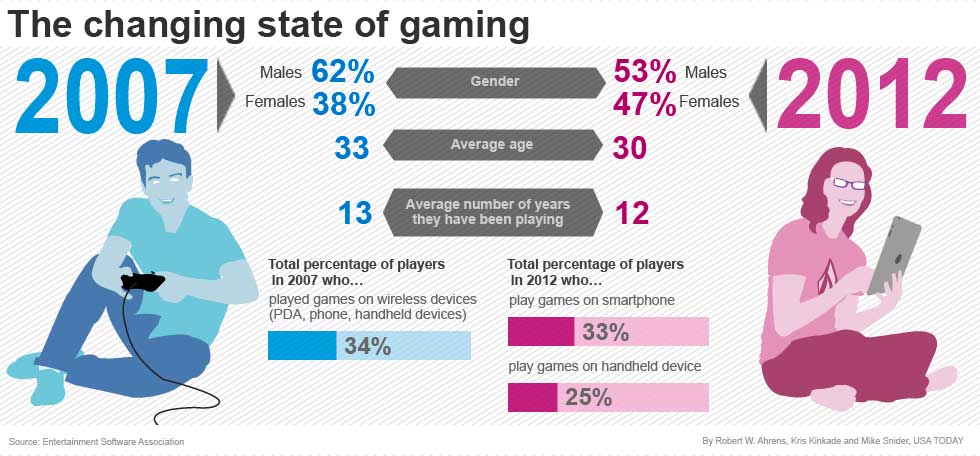

It’s not just gameplay that mobile is changing in the console business; it’s game marketing as well. The majority of Americans now have a smartphone, and it’s with them generally every waking minute. A smartphone is checked dozens or even hundreds of times in a day. What better place to contact an audience about your game The marketing potential in an intelligent device that already engages you multiple times a day is huge. Advertising and marketing on mobile are still evolving and changing, but it’s already an important marketing tool. New forms of marketing are being developed and tested, and the field is wide open for creative experiements.

It’s clear, though, that with all of this that mobile is exerting a huge influence on the gaming industry in every way, from marketing to game design to revenue. As the world continues to embrace mobile platforms, game companies and game marketers need to be prepared to do the same.