By Alex Konda

I was lucky enough to intern at Ayzenberg over the summer. The reason I chose to intern there is that it’s an ad agency focused on youth marketing, and with deep roots in the video game industry. Many of the senior executives there have worked at major game publishers and developers, and Ayzenberg has even launched its own digital game start-up in [a]list games. I want to be a marketer in the game industry, and so it was a perfect fit for me. As part of my internship, I was able to leverage Ayzenberg’s experience in the free-to-play (F2P) game category for my undergraduate thesis. The agency is one of the first to launch major campaigns around F2P, introducing Nexon’s games in the West, and launching titles for F2P game makers such as NC Soft, Perfect World and Turbine.

I chose F2P as the topic for my thesis through a recommendation from Craig Mitchell at WB Games, whom I met at E3 2011. I then came across Michael Pachter’s keynote at Ayzenberg’s [a]list Summit San Francisco (incidentally through a piece posted here in [a]list daily), and soon decided to focus on the monetization strategies of F2P.

This article contains the main points of a presentation I gave as my final project at Ayzenberg and based on research that I conducted there. It’s the basis of my thesis, and a primer for anyone — game maker, marketer or player — curious about the economics of the F2P game category.

What is the Free-to-Play Business model?

Free-to-Play (F2P) is more of a service than a product, with some people categorizing them as “games as a service.” As a business model, free-to-play is a digital hybrid model usually consisting of freemium, microtransactions, and a virtual economy.

Freemium is simply giving a full product for free and offering a premium version, which usually needs to be subscribed to. Microtransactions involve transactions of small value, and this is usually the main source of revenue for Free-to-Play games. Virtual economies is broader implementation of microtransactions, for instance a platform where players in a persistent world game such as an MMO can continually buy, sell or exchange virtual goods. The beauty of a virtual economy is the fact that you can retrieve real time data and know pretty much what is actually going on in your economy rather than estimating what it’s earning. What a F2P game earns can be broken down into soft currency (earned by playing) and hard currency (earned through real money).

Psychology and Free-to-Play

Knowing the mind of the consumer is very important in a F2P game, whether knowing their motivations to keep coming back to your game, when to upsell, or how they view game balance (i.e. whether they perceive it as fair or pay-to-win).

For this, the following two psychological principles, one being a theory, are very important to know when approaching monetization strategies.

- Flow Theory

Introduced by Mihaly Csikszentmihalyi, flow theory is something all gamers have been through. It’s that feeling of being fully immersed in a game not knowing how much time has passed. Flow theory can be defined as a state of positive immersion in an activity. Its components are full absorption in that activity, clear goals, a high degree of concentration, and a distorted sense of time.

I believe flow theory is a state that can lead to impulse purchases due to the player being fully immersed in the game. It forms one basis for why monetization must be considered part of the game design process throughout the development of a F2P game.

- Impulse Purchases

Purchasing virtual goods largely relies on impulse buying, as there is little planning involved. Players usually purchase virtual goods after playing the game a certain amount of time and this differs for each game. There are two factors with impulse purchases. First is seeing the product and its value. An example of this is Team Fortress 2, where when players get killed they see what weapon their opponent had equipped at the time. The second is convenience, where items are clearly defined as ways that will make the game easier or enhance the experience by making the player more powerful.

Virtual Goods

Now that we know what motivates players to make in-game purchases, let’s look at virtual goods categories that have proven to be the most effective. These goods can be divided up in four categories.

- Vanity Items

Vanity items provide purely aesthetic purposes, such as items that can change the look of an in-game avatar. They serve no functional value, yet they have a value to players for whom self-expression and displaying their style is an important part of their experience.

- Power Enhancements

Power enhancing items elevate the player’s abilities in the game, and therefore affect game play overall. The most common examples are upgrades to weapons and attacks, enhancement to character health and stamina, or quicker progression of game elements that make the player more powerful. These types of items must take overall game balancing into account before being introduced into the game.

- Boosts

Boosts accelerate progression or make the game easier to play by speeding up game play elements, such as making it faster to build or repair structures in a tower defense game. Balancing is also an important consideration for boost items.

- Consumables

Consumables can technically fall into Power or Boost categories, as they can give the player the same kinds of upgrades. However they are one-time or limited use items.

Monetization Strategies

Now that we know what to sell, how do we sell it The most basic necessity is having multiple ways to pay to remove any friction and help increase conversion of non-paying to paying players. According to a PayPal sponsored survey, just adding one alternative payment method can increase conversion by 14 percent.

Retention is also very important. The longer a user plays, the more likely they will pay. And the best way to retain consumers is to get them to pay, which is why it’s important to know the right time to upsell (which is different for each game).

Other strategies include having a store that’s simple to navigate and constantly checking metrics. The latter is a must. With cost per acquisition (CPA) to bring players into F2P games on the rise, it’s critical to continually evaluate whether players’ lifetime value (LTV) is higher than the game’s CPA.

The Old Standby — Subscription Fees

Offering subscriptions can be part of almost any monetization strategy, and it offers great flexibility. Subscribers are power users. They are not whales, but they could be. It is important to pay attention to these users, since they will usually be the ones who keep playing and keep coming back, given that they have a financial stake in the game. Offering discounts, giving hard currency each month, having subscriber-only events, these are all ways to create more value and give players incentive to become subscribers.

Virtual Currency

Let’s look at virtual currency. As stated, virtual currency can be divided into soft currency earned through game play and hard currency that involves spending real money. The point of soft currency is to drive retention. It rewards players for just playing the game, and the ways to earn it is up to game design. One example is picking up coins in Offensive Combat after getting a kill. Hard Currency offers the ultimate convenience for players. Instead of having to grind through game play to acquire items, they can just buy them with real money. One way a game can encourage players to spend real money is to introduce items that can only be bought through hard currency.

Worth noting, when it comes to exchanging currency for hard currency usable in the game, it is beneficial to give users a greater perceived value for the money they spend. Take the currency conversion table in Tetris Battle:

There is bonus currency for nearly every purchase, and the more you spend the bigger it gets. Valuating virtual currency differently than real world dollars can influence purchase decisions because players see items priced with the game’s arbitrary values rather than real currency. A good example of this is Microsoft’s pricing scheme for Xbox Live.

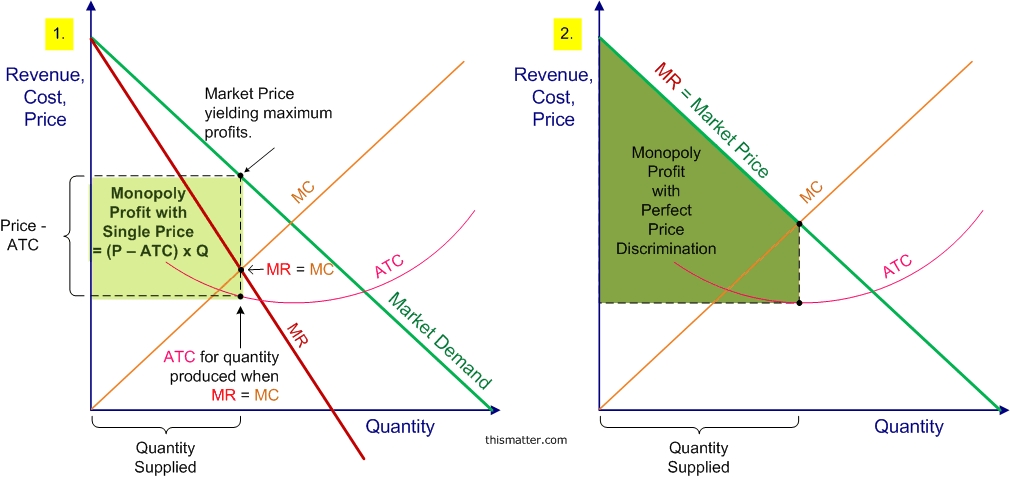

Perfect Price Discrimination

Also known as dynamic pricing, perfect price discrimination revolves around having consumers pay the maximum value that they see in the product. The best example of this pricing model is in the airline industry, where booking later will give you a higher price due to the fact that the purchaser has more of a need for the ticket. Though this pricing model is sound, it’s difficult to implement because it relies on continuous data. Yet a F2P game’s virtual economy, where you can attain a steady stream of granular data, this pricing strategy can be effectively applied.

Economists argue that dynamic pricing can only work in a pure monopoly. I would argue that a F2P game is a pure monopoly, in the sense that inside the game the store itself is a monopoly on its own. It’s worth noting that factors for dynamic pricing to work will have to be created by game designers, for example having in-game events.

Here is a comparison between regular pricing (left) and dynamic pricing (right), where you can see the benefits of being able to implement dynamic pricing.

Scarcity & Luxury

Scarcity is very straight forward. It comes down to only selling a certain amount of items to increase demand. With scarcity, there is also a dynamic pricing opportunity as well, where an item can have a low starting price and limited quantity with price increases as it gets close to selling out.

While not for every game — and more importantly, not for every game community – overly expensive luxury items have been known to generate money for F2P games. The strategy behind these items is to price them prohibitively, for instance thousands of real world dollars. These are intended for players whose passion for the game and access to expendable income is boundless.

Rentals

Since F2P games should be constantly updating and delivering new content (operating the game as a service), rentals are very useful. With new items constantly released, players can quickly feel what they’ve purchased is out of date. If they can rent items, they won’t get this feeling, and they will be more inclined to rent the next batch of new items.

Also, rentals can help lessen buyer’s remorse. Even though most in-game transactions are usually for small amounts of money, many of them are impulse purchases and buyer’s remorse is a common and un-favored byproduct.

Seasons

Using “seasons” to introduce new tiers of items is a concept introduced to me by Steve Fowler, who heads up [a]list games at Ayzenberg. [a]list games is a division at the agency focused on digital, mobile/tablet and F2P games.

The basis of the “seasons” concept is releasing batches of items according to a calendar and making them available to different tiers of players. Say a game is in its fifth season and has elite or high-end items that can only be purchased through soft currency. These are priced so that they’re only accessible by top players (because hey, they earned it). When season 6 items are released, and assuming those top players have continued to rack up soft currency, they’ll be able to quickly upgrade. Meantime season 5 items will then go on sale for hard currency, incenting lower level players to spend real money get their hands on them even as they try to earn the newest items through game play and soft currency.

With seasons, rentals are very useful. It goes back to players wanting to feel up-to-date. Seasons are meant to increase purchase frequency and make sure the game doesn’t start to feel old, and thereby help player retention.

Looking Ahead

There is still a lot to understand and discover about the F2P category, and a few trends are just starting to emerge.

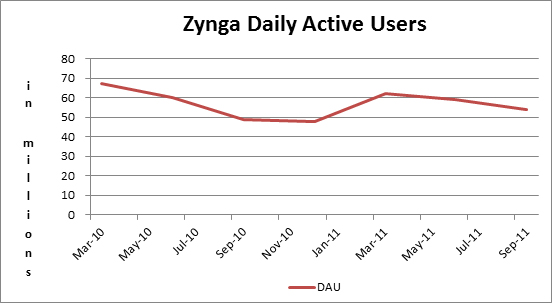

The percentage of players who become paying customers in F2P games varies but is generally below 10 percent. Finding alternative ways to monetize the other 90 percent without the use of advertising, which is costly, is key. Market saturation is making discoverability challenging for new games, with some game makers struggling to find alternative ways to get their products known. Both of these are challenges that game makers working hand-in-hand with marketers need to creatively overcome.

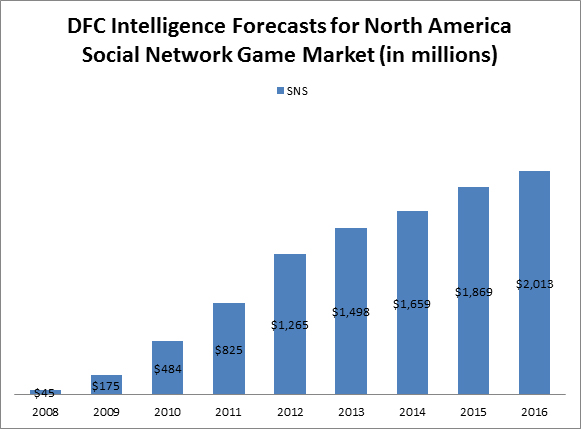

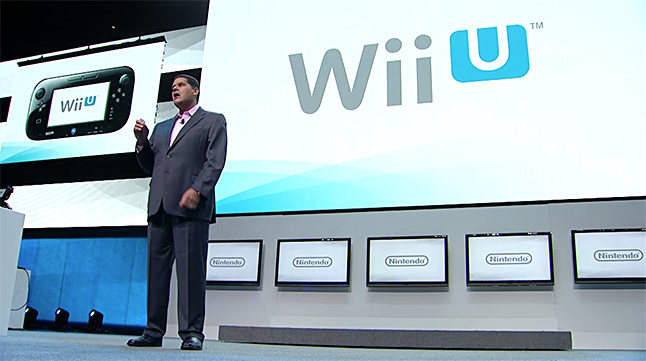

Other trends point to a bright future for F2P. More and more AAA quality games are now attracting more hardcore, mid-core and traditional console gamers to the category. F2P titles on consoles will also help broaden the audience for these games. The business model is also being used to penetrate global markets like Brazil and is being looked at to be used in countries like India and Africa.

On the technology side, better optimized cloud gaming will give more players access. And NoSQL Databases capable of collecting more data, including scattered/de-normalized data, will allow for micro-segmentation within F2P games.

The F2P space is quickly growing. It will be very useful for marketers — even hopeful future ones like me – to understanding its monetization strategies and the category in general. As part of my studies, I will be defending my thesis on this topic for the Barrett Honors College at Arizona State University in fall 2013. In it, I will be exploring different strategies for different types of F2P games, such as social, mobile, or MMO, and how to best monetize players in these types of games.

In closing, I would just like to give a big thank you to everyone at Ayzenberg; I enjoyed my time there and learned so much.

—

About the author:

Alex Konda is currently a senior at Arizona State University majoring in Marketing and Computer Information Systems. You can find him on LinkedIn or reach him at kanishkonda@gmail.com.

Michael Pachter

Michael Pachter

Not in the game (yet).

Not in the game (yet).

The Last of Us

The Last of Us

Peter Della Penna

Peter Della Penna

Greg Agius

Greg Agius