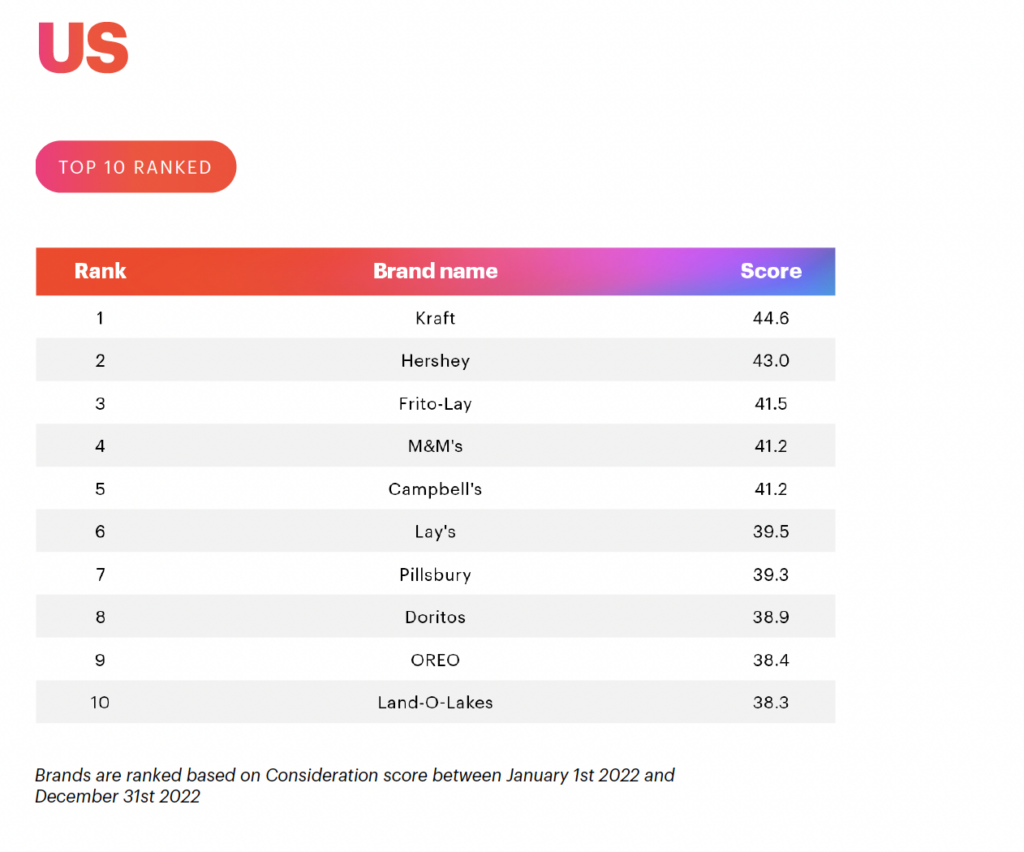

YouGov’s most recent report covers CPG brands that are top of mind when consumers go shopping. We found that the top five food brands have accelerated in-game and gaming platform marketing in response to consumers’ brand loyalty coming up against inflation concerns.

Brands Matter—But So Do Consumers’ Budgets

There’s some good news for brands. Consumer loyalty is up slightly from 2021. According to Emarsys’ Annual Customer Loyalty Index, consumers stating that they are loyal to brands rose from 74 percent in 2021 to 79 percent in 2022. There’s some bad news as well: 60 percent of consumers report that inflation concerns have made them abandon brands that they were previously loyal to for cheaper alternatives. According to the survey, 58 percent of consumers state that discounts, incentives and rewards drive their loyalty, with just 42 percent stating that poor quality products and only 30 percent stating that poor shopping experiences would cause them to leave a favorite brand.

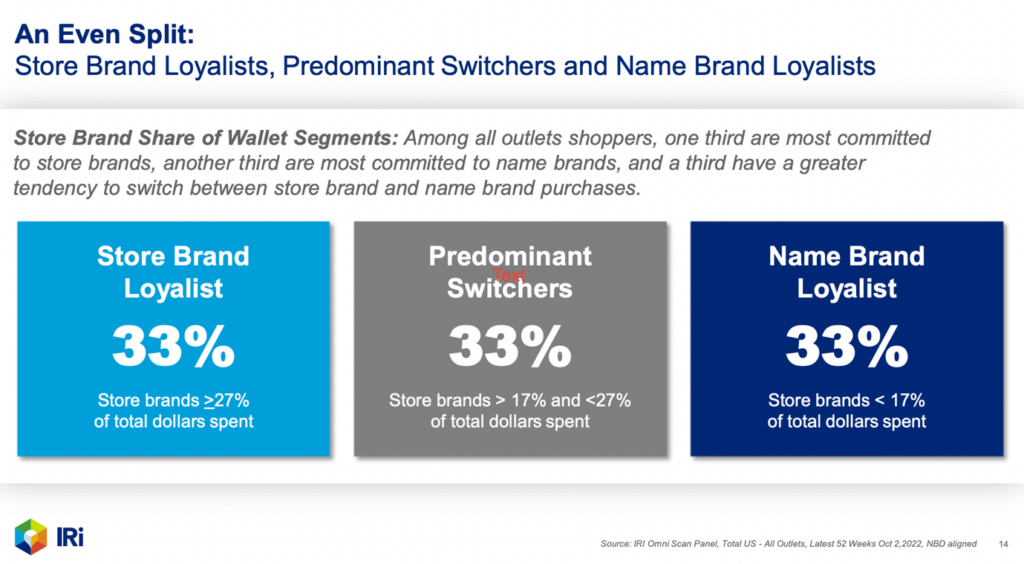

In fact, this may be an inflection moment for well-known name brands. A recent survey by IRI shows that inflation concerns may provide lesser-known “private” brands an opportunity to gain loyalty from consumers looking for bargains. It may also provide iconic brands with a pathway to solidify brand affinity by improving consumers’ perception of their value. The shares of consumers spending only with their favorite brands, on less-expensive “store brands,” or both are evenly distributed.

That means most consumers will still spend on the brand that offers them the kind of value they prioritize, regardless of the name on the label. Enter marketing and the new challenge brands, especially CPG food brands, face.

The CPG Brand Challenge Amid Economic Concerns—And Who Is Winning

The 2023 FMCG report by YouGov ranks FMCG brands across 18 key international markets in terms of their level of consumer consideration: how readily consumers would choose a brand among others when deciding what to buy. The most competitive brands not only have the most to lose amid inflation as consumers hunt for bargains, but they also must avoid launching discounts that can negatively impact their bottom line when costs rise. Added to that is the pressure from stores that may resist rising prices for fear of alienating consumers.

“Supply chain slowdowns, in tandem with inflation-fueled cost increases, have further driven consumers to adapt their shopping behaviors,” the report reads. “Amidst these rising prices and product shortages, some people have started buying less, and some have switched from brands they typically buy.”

That adds pressure to the most popular consumer food brands to engage consumers with a new concept of value, not just offering discounts but reminding them of why they shop for their favorite brands in the first place. That’s marketing’s job, and we’ve found that each of America’s top five most considered brands in 2022 also amplified their efforts to engage consumers in new arenas, like gaming platforms.

Leading Brands Are Venturing Into Gaming To Connect With Loyal Consumers

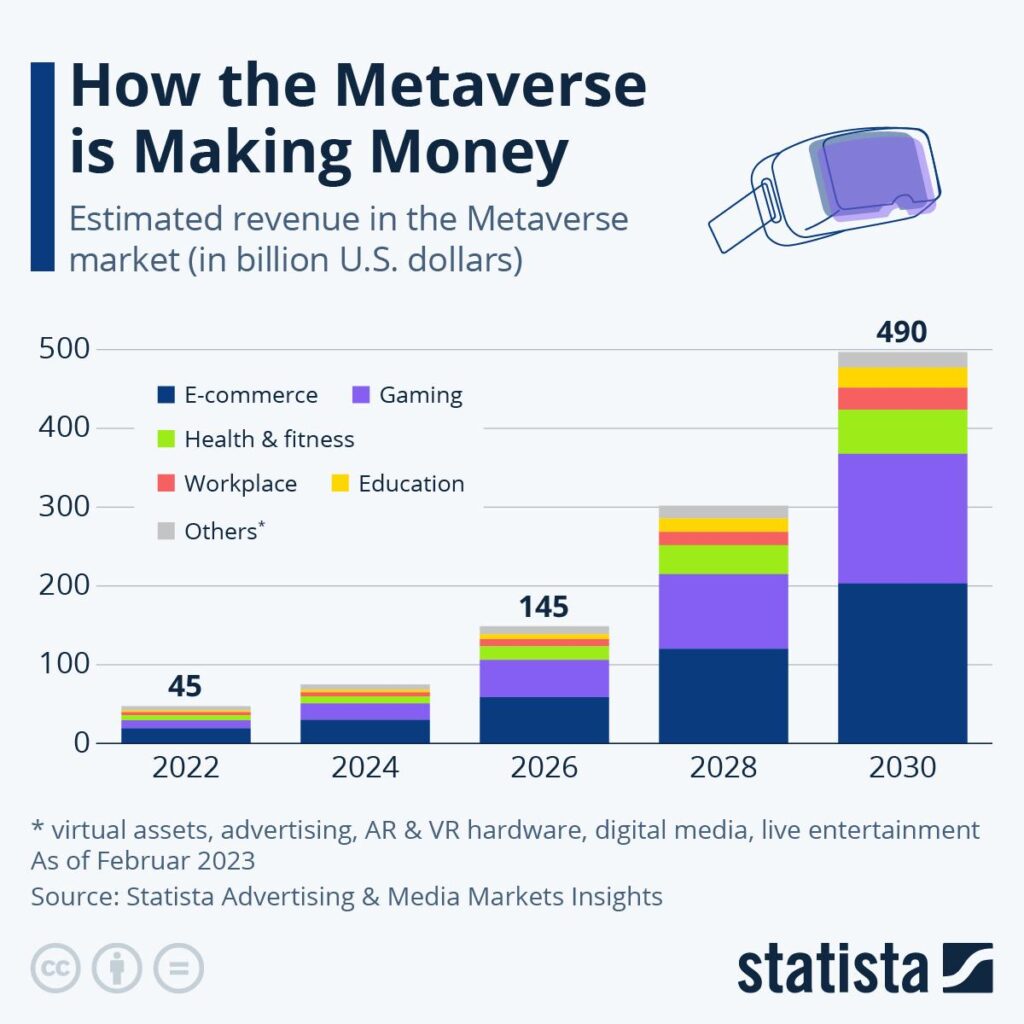

Kraft, Hershey, Frito-Lay, M&M’s, as well as Campbell’s all launched marketing initiatives that appeared on gaming platforms or used mobile games as a platform to reach audiences within the past twelve months.

“Launching a Chunky metaverse experience is another step forward for the brand to intersect sports and culture,” stated Marci Raible, Vice President, Integrated Marketing Campbell’s Meals & Beverages, in a press release. “As we leverage our 25-year NFL partnership, this activation allows Chunky to connect with the gaming audience and offer an innovative brand interaction.”

Kraft, in addition to other gaming-related promotions, created teams in Call of Duty and Overwatch in an effort to raise brand profiles in-game.

According to Statista, 65 percent of adults game, with over 3 billion gamers active globally for nearly six hours per week. Gen Z and millennials spend about 11 hours per week gaming, according to a Deloitte study.

The Takeaway:

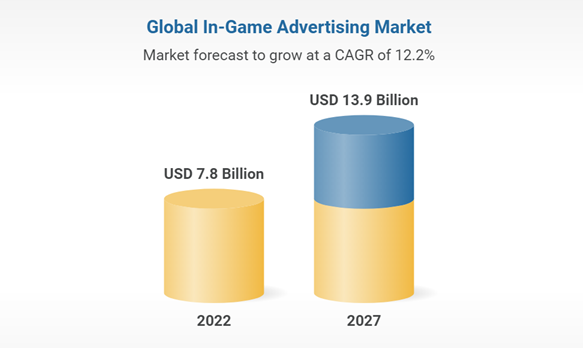

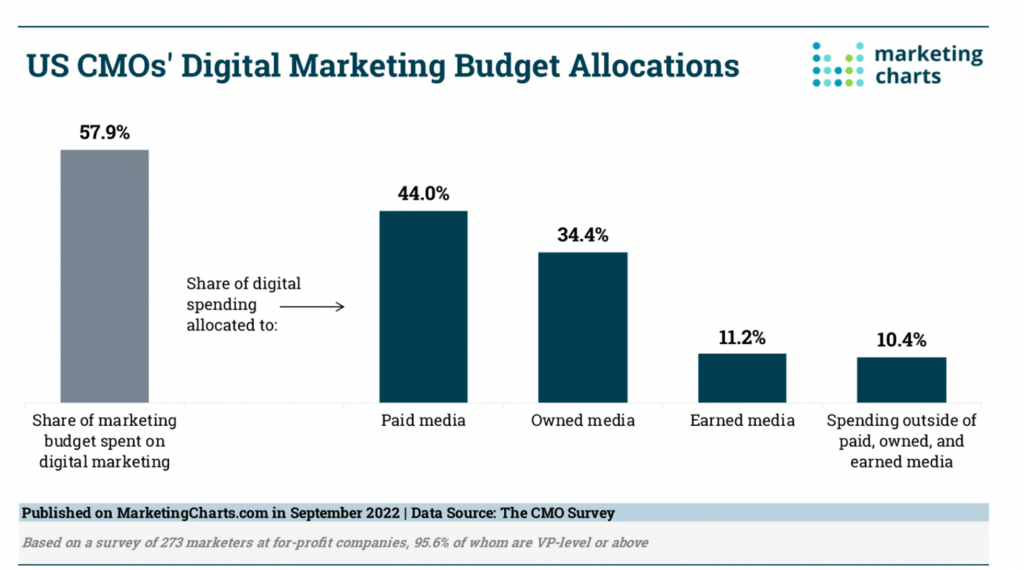

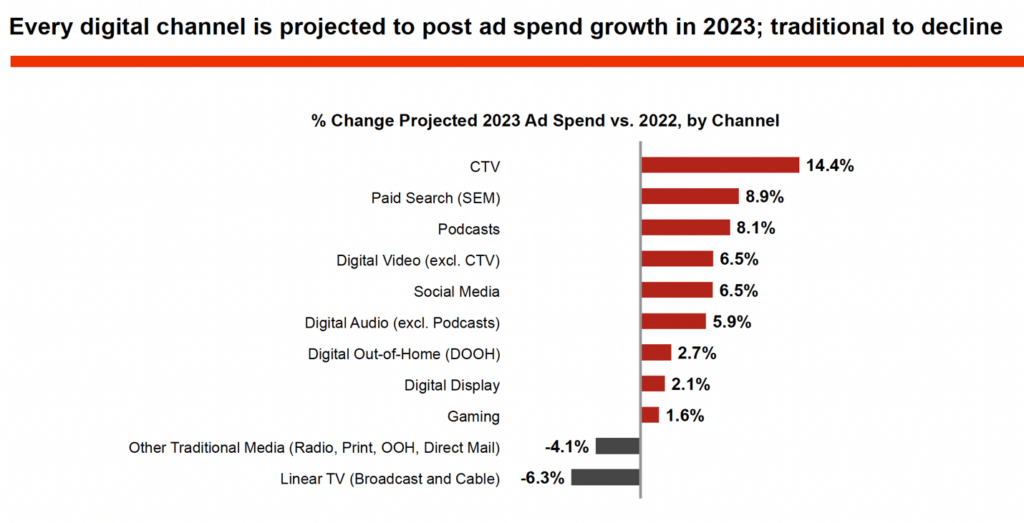

Reminding consumers of their connections to brands and why they’ve been loyal over the years may be hard in a 30-second ad, but perhaps easier when consumers are in lean-back mode, gaming or interacting with a branded gaming experience. While gaming holds only a 6 percent share of digital advertising spending, according to recent IAB data, brands are now turning to creative game marketing to recapture the imaginations of their audiences.