A lot more companies are adopting digital game distribution on their platforms, including Microsoft with its Xbox consoles, Sony with the PlayStation systems, and Valve’s Steam service. However, that’s not to say that some gamers still don’t prefer the “old-school” method of physical games.

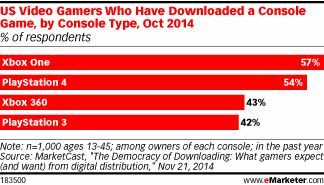

A poll posted by eMarketer, conducted by MarketCast, indicates that half of video gamers in the U.S. who own an Internet-connected console have purchased a game via digital download in the previous year. That said, though, 53 percent of those polled still prefer the physical copy of games in comparison to digital. By comparison, only 22 percent indicated that they prefer the digital approach.

The numbers also show that, in the past year, digital distribution of gamers made up only 18 percent of total console game purchases, compared to 82 percent of physical copies bought.

That’s not to say that these trends will stay that way, however. People are starting to lean more towards the convenient digital download method, with 76 percent of those polled indicating that the method was the future of game buying, even if some didn’t prefer that method (due to the lack of holding a game physically in their hands).

48 percent of those polled expected to personally download more games via digital over the next two years as well, which could show an upswing in favor of online services.

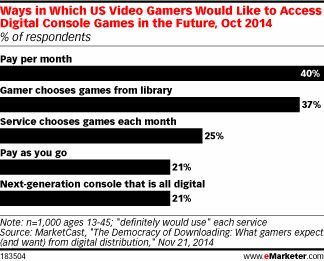

With such subscription plans as EA Access and PlayStation Now in place (see our previous story today), it appears that gamers are starting to get hooked on the idea of a Netflix-style service as well. 40 percent of those polled said they would be interested in some form of streaming subscription service, while 37 percent prefer a service that allows the ability to subscribe to specific downloads per month, so they can choose from a virtual library. (This is where something along the lines of Sony’s service would definitely come into play.)

That said, while online purchases and services are surging, the online console gamer audience continues to be rather small. eMarketer estimates 49.1 million U.S. online console gamers in 2015, which makes up less than one-fifth of Internet users in general and just over 15.3 percent of the general population. This number will grow over the next few years, but only in a minor sense, to 55.2 million in 2018 – which still just goes over one-fifth of the overall Internet audience. By comparison, mobile gaming will see a bigger increase, going up from 133.9 million to 170.7 million over the next three years for smartphones, and 115.8 million to 136.6 million for tablets.

Snail’s OBox, demonstrated at CES. (photo credit: TechCrunch)

Snail’s OBox, demonstrated at CES. (photo credit: TechCrunch)