One of the most important marketing tools we have is also the simplest to use. It’s the price tag. This has been one of the core issues facing the console business lately as we watch retail sales drop year by year, month by month. Game publishers have been privately (and sometimes publicly) asking console makers to reduce prices in order to stimulate demand for software. Of course, reducing prices is the last thing anyone wants to do. Hardware makers in particular have a lot of costs that need to be covered somehow.

Hardware makers would much rather talk about value than price. And, it’s true, value is important. When you add in enough goods and services to something, its value increases — and so does its desirability. This is the basic argument going on between the Xbox One and the PlayStation 4 right now, between $499 and $399. Sure, the PS4 is cheaper, but for $100 more you get the improved Kinect and all the additional cool features it brings. Even so, it will be easier for people to put together $399 to spend on a new console than it will be to get $499. Microsoft will certainly work hard to make people understand the value of the Xbox One at $499, but an extra $100 may be a deal-breaker for some buyers.

An example of just how important pricing is can be seen with the Nintendo 3DS. The handheld console debuted at $249 in the US, and while it had some good initial sales demand fell off sharply. Yes, there was a lack of great software. The 3DS sales began climbing once good titles began appearing . . . but only after Nintendo dropped the price to $169. Suddenly the hardware looked much more reasonable, and people started buying it.

This is why many publishers are hoping Nintendo will drop the price of the Wii U, currently at $349 (for the version most people buy). The hardware isn’t selling well right now, and its prospects look even dimmer when it’s up against a PS4 at $399 in a few months. Nintendo’s CEO Iwata has staunchly resisted any idea that a price cut is needed or imminent, and no doubt will continue to do that right up until the day when the price cut happens. The strength of the Wii U’s Christmas may depend on what its price tag will be — at $299 it would sell better, and at $249 it would probably fly off the shelves.

Hardware is not the only part of the game business where price is a big issue. Games have been suffering serious price erosion over the past decade, though you wouldn’t know it by looking at the standard retail price for new software. The massive growth of free-to-play games on PCs and mobile platforms has transformed consumer expectations for game pricing. The fact that you can download and play thousands of top-quality games for free means that people don’t think games need to be $60.

It’s not just free-to-play games that have caused this transformation. The growth of the used games trade has had a similar effect; if you’re not getting a collector’s edition, why not get a game for a little cheaper because someone else has already played it If you shop around on eBay and other sites, games can get remarkably cheap. The continuing value of online multiplayer also affects consumer attitudes and behavior. Why buy a new game if you’re still having plenty of fun playing Call of Duty with your friends As for PC game, Steam has changed player behavior dramatically with its steeply discounted sales. Not sure if you want that new game for $60 If it’s available on Steam, wait a while and see if it goes on sale.

Publishers have tacitly acknowledged this price erosion with bundles (Game of the Year Editions) and programs like Platinum Hits for the Xbox 360, where games that once sold for $59.99 go for $19.99. If you don’t need to have the latest game right when it comes out, you can get a great deal on it. There are so many games available now that you could make a huge stack of really great games to play and never spend more than a fraction of the original retail price.

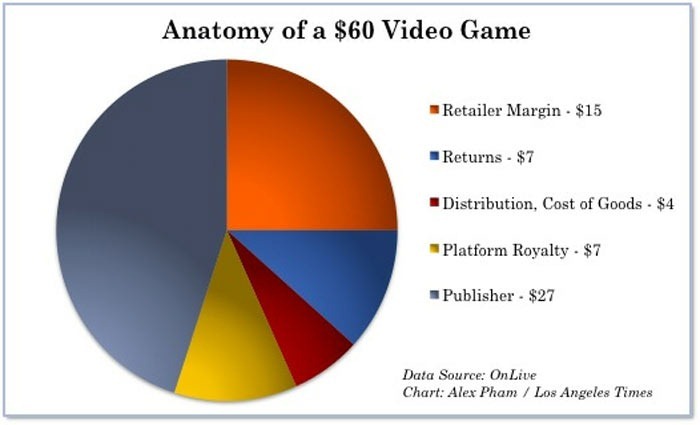

Is it any wonder, then, that new game sales at retail have been declining for the last five years Publishers have wisely decided, so far at least, to avoid hiking prices on new games for next-gen consoles. We’ll continue to see high-priced Deluxe Collector’s Editions in an effort to wring more profit from the most enthusiastic fans. And new games will almost always be appearing with downloadable content (DLC) available on day one in order to goose the profit margins. Yet budgets continue to climb for game development, and pressures to reduce pricing continue to increase. What’s the answer?

Digital distribution holds part of the key by taking all the physical costs out of the equation. No more manufacturing and shipping costs means more margin, if you can hold the same retail price. Increasingly, though, we’re seeing that holding the same retail price is getting harder. No, changes will have to come either from switching business models or from changing the way games are developed.

The business model change is not easy. Games can either become free-to-play, or perhaps ad-supported or subscription-supported. All are difficult to implement on existing brands, as Activision discovered when it tried to add a subscription fee for the Call of Duty Elite service. Many MMO’s are transitioning to the F2P model, and it look like World of Warcraft is preparing to do just that in the future.

The development change is also not an easy one. Games could be designed on a less epic scale, with smaller teams and shorter development times, and then sell them digitally for $20 or $30. If it’s a new IP, that’s a faster and less risky way to see if there’s an audience for it. Yet game designers have to wrap their heads around an entirely different concept of the scale and scope of a design. Tim Schafer famously failed to do just that when he recently told the world his Kickstarter-funded Broken Age game would be delayed by more than a year because he “designed too much game.”

The amount of play time you get with a new game was set for years by the cost of putting a disc in a box, which meant the retail price had to be high enough to allow for a good profit. That lead to games being long enough to justify the price, and since games were sold mostly on having better graphics than the last game, budgets kept rising. Now it’s time to break that cycle and rethink everything from the ground up. Many new publishers are already doing that with success, but it’s a far more difficult task for large publishers with decades of experience doing things the old way.

In the end, the game industry has to come to grips with the fact that customers now have an enormous array of options for playing games, and many of them are free or low cost. Twenty years ago, if you wanted a new game you would go to a retail store every month and see a dozen choices over all the platforms. If you didn’t like one of those, wait for next month. Now, thousands of new games are released every week. High-quality games like League of Legends and World of Tanks are free, and have new content appearing every week or two. Many console games have strong multiplayer audiences and new DLC for them every month or two for only $10, and that can give a game a whole new life.

Does this mean the death of the AAA game Not at all. Publishers will continue to look for ways to make massive development pay off, and to reduce risks. We’re going to see new IP spread across multiple platforms, including mobile (such as Ubisoft’s helper applications for new console games). Marketers will be an important part of this discussion at all levels, from design to business models. It’s time to get creative with development and business models and marketing, not just with the game design. There’s no one guaranteed way to make money from a game. Customers are much more hesitant to spend a lot of money on a new game that can’t be returned. (Taking away the potential for resale was a big part of the backlash against Microsoft’s initial Xbox One policies.)

Pricing is going to be a very important issue this holiday season, as older consoles struggle to boost sales in a difficult environment. Most analysts expect price cuts on existing consoles to boost demand while making room for new consoles at the high end. Next-gen games will probably come without a price increase, and as digital distribution becomes standard practice on next-gen consoles we may see more titles from major publishers at lower initial prices.