Starting a game company is always a leap of faith into the unknown. You have a vision, a need to create a certain game, the right combination of people and talent and determination. The market for games today makes it both easier and harder to launch a new game and a new game company. Easier, because you don’t need massive amounts of money to get a game distributed. Harder, because there are thousands of new games appearing every week.

Proletariat is tackling those challenges in an ambitious step into the difficult genre of multi-player strategy games with World Zombination, designed for iOS and Android tablets (and also for PC and Mac). The [a]list daily spoke with Seth Sivak, CEO of Proletariat, about the game and how the company will find a market for it.

Proletariat is composed of game industry veterans from companies like Zynga, Insomniac, and Turbine, who decided to start their own company and move in a new direction. “The stuff that’s on tablet right now is just scratching the surface as far as multiplayer goes,” said Sivak. “We tried to figure out how we could make something more team-based, real-time strategy gameplayer in a shared world. It sounds like a lot when you think about it altogether, but we thought ‘what was the one game we wish we could play on tablet’ and this is what came out of that.”

Finding the audience is the real challenge when you don’t already have an audience of millions of players. “It’s certainly the thing that keeps me up at night,” admitted Sivak. “The core team here has experience making AAA games, but it’s really this part that scares me the most. That’s why we’re announcing the game now and we don’t plan to release it until Q1 of next year. The goal is to build excitement and let people know and get them involved. One of the things we really wanted to do with Proletariat was to build and cultivate a community of players that enjoy the same type of team-based multi-player games, and to grow that over time.”

We plan to have a good, extended beta, and whether or not that will be geolocked, we’ll see. There is no easy way to do it, especially with mobile right now,” said Sivak. “When you’re dealing with a lot of very deep-pocketed developers who are able to get lots of ads, it can be challenging. We’re hoping that it will grow in a grass-roots way. They’ll see the game, they’ll see the trailers, what we’re trying to do and what we’re trying to buld and they’ll get excited about it.”The game will be at PAX Prime, where Sivak hopes to get gamers excited with some hands-on time with the game. “We have a demo that shows both sides, the Human gameplay and the Zombie gameplay, and the goal is just to see if players are excited about that,” said Sivak. “Is there something you’d like to see more of Would you join an early beta on this To get a read on what people think, it’s a great show for that.”

Proletariat plans to have the iOS and Android versions come out first, with the PC and Mac versions following later. Sivak believes the game will appeal to PC players, but the teams’ focus will be on mobile first. “A lot of mobile games are OK with in-app purchases, but with PC games that’s less the case,” noted Sivak. “How do you balance that It can be tough. These are competitive games, so we have to make sure there’s no imbalance there.”

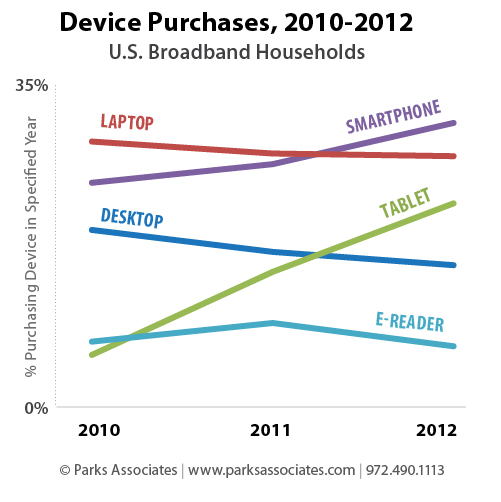

The massive growth of the tablet market and the increasing power of the platform led Proletariat to focus development there initially. “You can actually do some really high end stuff, you can have really great graphics,” said Sivak. “The ecosystem hasn’t fully evolved there yet, you still see a lot of games that aren’t that hot in terms of overall quality, but that will change.”

You need a large audience to make a free-to-play game profitable, but there are many paths to monetization. “The jury’s still out on the exact monetization scheme we’ll go with,” said Sivak. “There’s some interesting experimental things going on, especially with PC titles, paying to get into the early alpha that would certainly be awesome. Whenever you’re talking free-to-play you need a massive audience to support that sort of thing. Free-to-play is tough because you need to have players coming back all the time to build up that investment. So you’re constantly working to keep them involved and interested. It’s not easy to do a niche title with free-to-play.”