Is there really such a thing as ‘winning’ E3 There is the external victory of being the thing most talked about in the mass media, in the game media, and on social media. Those are really three different audiences: The broadest possible audience of anyone who sees, hears or reads news; the audience of gamers who are always interested in game news, and hardcore Nintendo fans. Then there’s victory internally for Nintendo, by whatever standards it chooses to set. Ultimately, it’s the votes cast by consumers in the form of spending that counts.

Nintendo is heading into this E3 in a difficult position. Sales of hardware and software have not been meeting the company’s projections. CEO Satoru Iwata has gone on record that he intends to deliver a billion yen in profits for Nintendo this fiscal year, and implied that he may step down if that’s not achieved. This puts Nintendo in a difficult position for marketing strategy, since any marketing spending has to return a profit within the fiscal year. No long-term brand-building here; Nintendo will be looking for marketing efforts that can produce solid short-term results.

This may be the reasoning behind Nintendo’s decision to forego the usual massive E3 press event, instead having a smaller media event and a separate event for trade partners and analysts. Nintendo also announced it will step up its production of Nintendo Direct videos, a cost-effective way of directly reaching Nintendo fans.

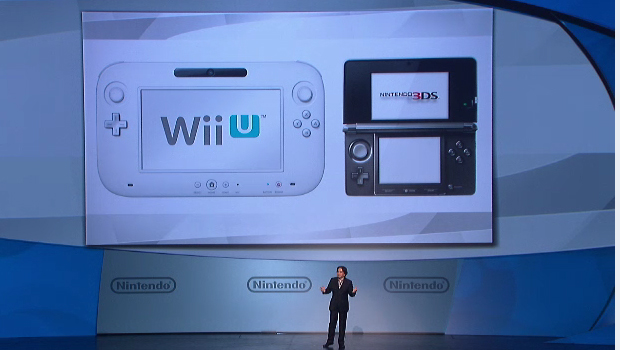

Nintendo has not shared any more about its marketing strategy, but we can make some guesses. Nintendo put out a flyer at PAX East that compared the Wii U to the Wii, clearly indicating Nintendo feels gamers aren’t really sure of what the Wii U is or why they should own one. Worse, if gamers are confused, the mass market must be completely baffled. Effectively, Nintendo needs to relaunch the Wii U and make sure the audience understands what it is. Unfortunately, Nintendo will have to do this in the face of what is sure to be a major push from Sony and Microsoft for their next-gen consoles. Nintendo will need to have clear, focused television ads hitting the key demographics, and those ads will need to be memorable to overcome the barrage of ads hitting the same audience.

One of the biggest weapons Nintendo could use in this battle is a price cut for the Wii U, but that is unlikely. Nintendo’s already losing money on each one sold, and dropping the price $50 would just mean an additional $50 loss on each unit. That might get made up in software sales eventually, but it would have to be at least three or four titles during a time when Nintendo doesn’t have all that many compelling titles for the Wii U. Hopefully we’ll see some strong Wii U software for the holiday season, more than just Pikmin 3.

The best asset Nintendo has right now is the 3DS. This handheld console has been selling well (though still under Nintendo’s projections), has an impressive array of good games, and a price point that’s not too high. Nintendo will probably put more emphasis on the 3DS for the holidays, as a way of keeping Nintendo fans spending money on Nintendo when they can’t afford a Wii U.

Key things to look for at E3: How much space in the Nintendo booth is devoted to the Wii U versus the 3DS That will show you where Nintendo hopes to make the most revenue over the holidays. What key software titles are showcased for the Wii U and the 3DS, and how compelling are they If Pikmin 3 is the best Wii U title for the holiday, Nintendo will have a difficult time. What genres are being given prime marketing support This will tell you if Nintendo believes the Wii U’s market is primarily the casual gamer that was the mainstay of the Wii market, or if Nintendo is hoping to get a more hardcore audience excited about the Wii U. What third parties are being showcased at the Nintendo booth, if any This will tell you how much third party support Nintendo has been able to attract, and how important it may be to Nintendo’s holiday sales.

Also look for the presence of the Wii U in the booths of other publishers like Activision, EA, and Ubisoft. If the only Wii U titles you see are stuck in a dark corner, that means Nintendo won’t be getting much help from that publisher. Ubisoft will likely have some space devoted to the Wii U, but you may have to look hard to find it at the EA or Activision booths.

If the Wii U can’t have a price cut, and Nintendo can’t spend huge amounts of money on advertising, what marketing options does Nintendo have Increase the value of the Wii U by bundling in more software. This can be in the form of digital downloads, or a disc pack-in. Perhaps NintendoLand will be included with the $299 Wii U, and the $349 Wii U could get that plus another title or two.

Nintendo has put itself into a tight corner by setting the billion-yen profit goal. The company has $10 billion in cash, but can’t spend it on marketing unless the return is short-term. The usual way to increase sales easily, a price cut, would therefore seem unlikely. The most powerful tool of all would be a must-have game or three for the holidays; can Nintendo come up with some game magic that will have the Wii U flying off the shelves this Christmas It’s a long shot, but Nintendo has pulled off such surprises before. There’s a saying around the game industry: “Never count Nintendo out.” Good advice for this E3 as we wait to see if Nintendo can surprise us all.