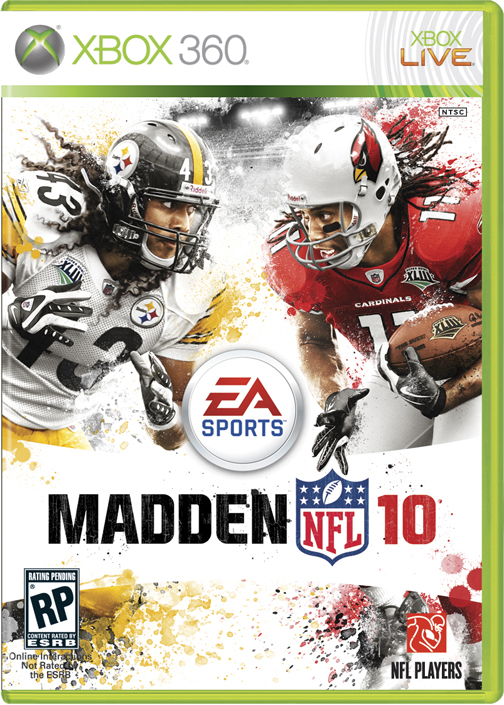

The Madden football series has been an annual winner for publisher Electronic Arts, and is considered one of the classic video game series of all time. The latest version, Madden NFL 10, is its 21st edition, but one of the most important ones since its launch in 1989.

Madden is largely attributed with creating a new type of gamer which, for the purposes of this feature, we’ll call the “Madden gamer” (how convenient). The Madden gamer is the type of gamer who is the perfect demographic: young, male, and diversified over a lot of forms of entertainment.

Rather than spend their money on video games, they tend to buy a few key games throughout the year with a passion, but are passionless when it comes to some of the more hardcore releases out there (you won’t see too many Madden gamers purchasing Eternal Sonata anytime soon).

So when Lazard Capital Markets analyst Colin Sebastian started looking at initial Madden NFL 10 sales this week, they were interesting for a couple of reasons.

Madden NFL 10 As Bellwether

Sebastian identified sales as tracking “slightly below plan out of the gates” and “slightly below the company’s plan.” The economic recession has already impacted video games with console and software sales down year-over-year, but Madden NFL 10 is a significant bellwether that portends continued doom and gloom, or invariably a return to form for the once recession-proof industry.

Another interesting note is the fact that sales to the hardcore audience are still showing strength, with the specialty retailers marked as flat or slightly up. It’s the mainstream buyers, a lot of them Madden gamers, who seem to be hedging their bets on the new Madden.

The news isn’t all bad, though, as Sebastian is quoted as saying, “We also note that upcoming PS3 pricing promotions, co-marketing on EA Sports titles, Xbox 360 price cuts, and the busier back to school period could provide a later lift for the title.”

No Longer Recession Proof

Still, the weak start does beg the question, “Does this mean we are officially no longer recession proof?”

We can get that question answered straight away: No, we’re not recession proof. We’re not bread. We’re video games.

The argument that in times of need, people need an escape is valid. But a $60 escape No, we’re not recession proof.

Now that doesn’t mean we can’t be. In recent years, we’ve seen console video games shoot up in price while adoption has slowed, especially in the past year. The price of entry for these games and their consoles are significant, and we can never lose sight of that.

The Apple Factor

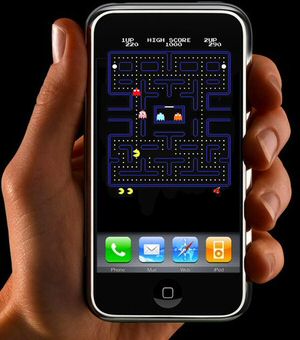

In addition, you have to look at a company like Apple as a market disruptor. Their ability to churn out games that are priced as low as free is something that makes consumers start to think differently about how much a game is actually worth.

Of course, we’re not arguing that a free or 99-cent game’s quality can compete with a $60 console title (though, in some cases, they do). But when you look at the highest quality games on iPhone, be they Civilization Revolution, Tetris or Metal Gear Solid Touch, they are very rarely above $9.99.

And look at the titles mentioned above: these are original PC and video game IPs that found their success in the big leagues, only to go off and create fun product with those brands on the iPhone and iPod Touch.

Video games like Pac-Man, Super Monkey Ball and Space Invaders have their own portable versions, many with enhancements and new levels and gameplay techniques, that can be extremely profitable for companies with those IPs. And when you look at an app like Call of Duty: World At War Companion, you can see how these apps can leverage back to the console base (just make sure that console counterpart is good!).

If there’s one short-term way marketing groups can benefit their video game brands, it’s to hop on this bandwagon and quickly. Even if it’s for brand exposure or an increase in perception, this is a low cost way to take advantage of a market that is absolutely thriving, recession be damned.

DLC Savior

As for the original consoles, what can be done We see the normal business routes being taken, whether through price cuts of rebranding, new marketing efforts and such.

But maybe, instead of asking if we’re recession proof, why not ask what we can do to actually get there. Stop assuming we’re there, and start working to get us there.

One of the biggest opportunities for that is through downloadable content (DLC), both for full SKUs and also expansions on IP. Games like Halo 3, Call of Duty 4: Modern Warfare and Call of Duty: World at War show continued strength years after their release because of the multitude of DLC available for them. The fact that a two year old game is still at the top of the Xbox Live charts (Halo 3) should serve as a wake up call that your market is not only on the blogs and magazines.

It’s already on Xbox Live. It’s already playing your game. You just need to keep them playing.

So it’s back to Madden NFL 10. The doom and gloom could all be for nothing as it’s still very early in that game’s schedule. The NFL season hasn’t even begun, and we expect the mainstream to eventually come through in making yet another Madden a blockbuster hit.

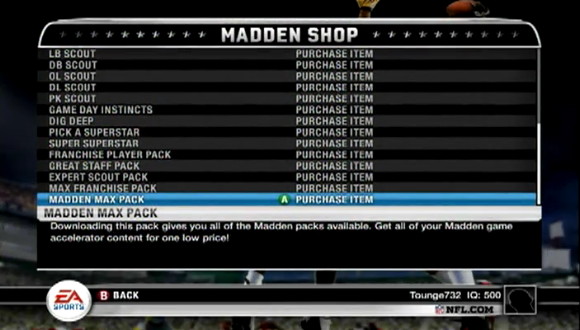

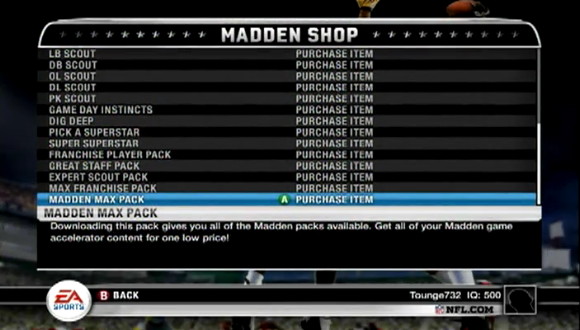

EA seems to understand the concept that their gamers, and their biggest potential for increased revenue and success, is through the game itself. Madden NFL 10 is chockful of ads with Snickers gaining particular prominence. The Madden Shop part of the game is also a sign of things to come, with things like stats bonuses and elite membership for sale, anywhere from $1 to $10.

But EA needs to head off the inevitable decline in mainstream sales at the pass. The game features have been negligible at best compared to the previous year’s model, and this has been the case for a few years now. The Madden graphics engine is beautiful, but there are very few discernible differences between Madden NFL 10 and last year’s edition.

It’s time for a subscription model.

Instead of having gamers fork over $60 for what is essentially the same engine with just roster updates and a couple of new features, EA needs to offer up a Madden subscription model where players digitally received a significant update to their core game.

Rather than charge them $60 for the hassle of creating the retail version, shipping them, dealing with all the associated costs, a $30 Madden subscription is just the thing DLC needs to really make a test of whether or not publishers can go it on their own.

The profit margins on such a case would be higher even with the lower cost, and we’re not taking into account the in-game ad revenue which will continue to increase, or the add-ons that are being tested now in the Madden Shop.

It may sound like a pie-in-the-sky idea, but it’s not that absurd, especially with Xbox 360 retail games debuting just a couple of weeks ago on Xbox Live, and full games like Burnout Paradise already on PS3 and Xbox digital storefronts

EA needs to be proactive and not just wait for the inevitable weakness in retail sales before they do something about it. The steps in in-game advertising and microtransactions are solid ones for Madden NFL 10, but NFL 11 has to go subscription before more consumers sack it.