The trend in the past few years has been growth in digital sales and a reduction in retail sales of games. Certainly, much of the digital sales growth can be attributed to downloadable content, subscriptions, and sales of virtual items. For the most part, that’s the sort of digital sales the console industry relied upon, since the Xbox 360, the Wii and the PlayStation 3 didn’t allow the digital download of full copies of games sold in retail stores, with minor exceptions.

That picture changed last year, as both Sony and Microsoft noted (without much fanfare) that full digital downloads of all games would be available on their next-gen consoles, and those copies would be available on the same day as the retail copy. GameStop seemed serenely unworried by this development, confident that this wouldn’t really affect their sales. After all, if you buy a digital copy of a game, you can’t resell it to GameStop for credit towards a new game, and you can’t lend the digital version of the game to a friend.

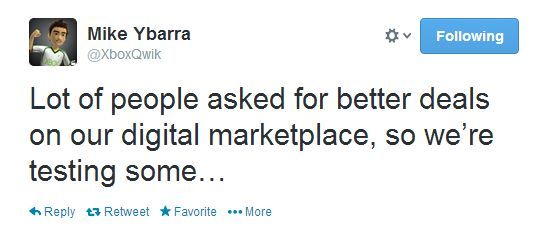

The future may have revealed itself with a move Microsoft made recently, one which didn’t get much notice in the press. Microsoft revealed a sale on the digital full version of Ryse: Son of Rome with this tweet from Microsoft Studio manager Mike Ybarra: “2/18 through 2/24 you can get Ryse: Son of Rome off digital marketplace for $39.99!” GameStop had been selling the used version of Ryse for $55, but following Microsoft’s sale the price was reduced to $38.

This may not seem like much until you remember that GameStop derives the majority of its profits from the sale of used games. Is this a sign that Microsoft will be cutting digital prices more in the future, and trying to drive more direct sales at GameStop’s expense Or is this just a response to Ryse not selling so well . . . but if that’s the case won’t Microsoft employ that any time a title slows down. Will Sony follow suit?

Certainly digital sales are increasing, but does this point to a faster shift towards digital that GameStop in particular should be worried about If Microsoft and Sony begin regularly discounting full digital versions of the games, and perhaps bring back some of the digital permissions that Microsoft briefly offered for the Xbox One (sharing your digital games to some extent), could this cause problems for GameStop On the consumer side, if digital games become more popular will the 500 GB hard drives in next-gen system start to seem too small. Is Microsoft throwing down the digital gauntlet and challenging GameStop to a duel over game prices. The [a]list daily consulted some digital experts to get their take on the situation.

David F. Cole of DFC Intelligence sees this as just a further move in the struggle over digital versus physical sales. “This is an ongoing battle,” Cole said. “Publishers will continue to look to drive direct digital sales but they also have to balance not upsetting retailers too much. I think this is just part of a trend that is underway and digital will grow at a steady pace.”

As far as Ryse: Son of Rome goes, Cole believes this is something particular to this game. “I don”™t think the Ryse issue is that big a deal,” Cole said. “Ryse was a title that had a lukewarm reception and as of February 22 it was three months on the market. That is a time when sales start to cool and prices start to drop.”

Overall, Cole sees retail continuing to shrink its share of sales. “Retail is not going away even as digital sales continue to grow. Nevertheless, DFC Intelligence is forecasting that sales of new products at retail will be lower this generation than they were the previous generation,” Cole said. “However, with the growth of online sales DFC Intelligence predicts overall console game software sales will reach record levels. Combined online and retail sales of game software are forecasted to reach $29 billion in 2017 compared with around $22 billion at the peak of the last generation.”

“GameStop has a leg up on other retailers because of their used game business,” Cole pointed out. “So the play for them is to build market share in the retail business.”

Joost van Dreunen of SuperData doesn’t think this represents a major battle between Microsoft and GameStop. “I don’t think Microsoft is trying renegotiate its relationship with GameStop in such an indirect manner,” said van Dreunen.”It’s likely a minor decision in their larger digital games experiment.”

“GameStop continues to play a vital role in marketing games to consumers,” van Dreunen said. “Their ability to generate pre-orders and create buzz for new titles will not be replaced by digital distribution any time soon. Ask yourself why else people insist on standing in line at midnight to get their hands on a copy at retail that’s also available via download. That said, publishers and platform holders do have more options available, which weakens GameStop’s position long-term. Chances are that GameStop will have to reduce its footprint, but since we’re currently in the first year of a new console cycle, that isn’t likely to happen until 2015.”

As for the capacity of next-gen consoles, van Dreunen thinks the problem is solvable. “For the dedicated gamer audience it’s no problem to expand their storage capacity. External drives are cheap today and easy to connect,” van Dreunen noted. “Sony’s announcement of its streaming services might bypass the issue of limited storage, but let’s wait and see how that plays out first. The hardware manufacturers will, ultimately, have to make the digital experience seamless and fast if they want to plug into a mainstream audience. Nintendo’s 3DS approach of using standard hardware like a 4Gb SD card fits well with this, and, I expect, will continue to drive digital download sales.”