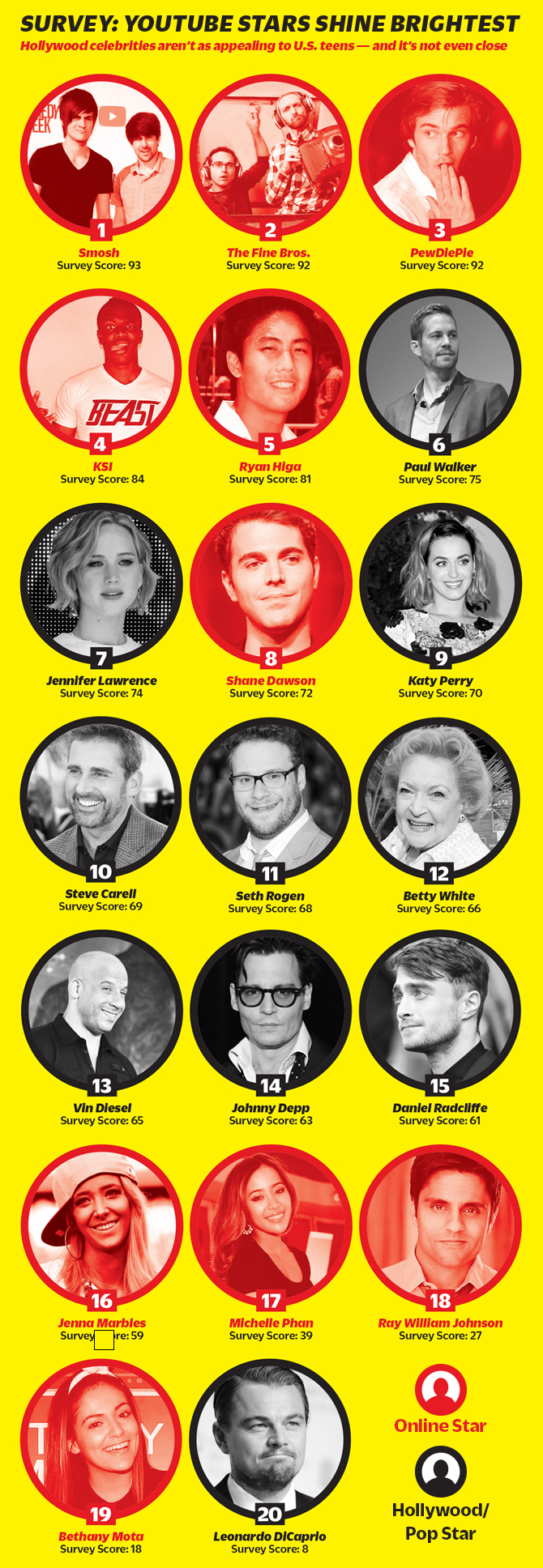

Now that the console hardware giants have reported their earnings, it’s time for the console software giants to weigh in. Times are good all around, it would seem, for those making AAA console games. Activision and TakeTwo all reported better-than-expected numbers, though in TakeTwo’s case it’s losing less money than they anticipated. It is both interesting and educational to compare the results from these three companies, and to read between the lines of the official comments made during the earnings calls.

Starting with Activision Blizzard, the company reported a strong second quarter, with both GAAP and non-GAAP revenues beating the company’s prior outlook, though GAAP revenues were below last year’s level. Activision Blizzard brought in $970 million in GAAP revenue, beating the $910 million projected, and down from $1.05 billion in the same quarter last year. On a non-GAAP basis (usually the better way to assess a company’s revenues when digital products are important), revenue was $658 million compared to last year’s $608 million.

Activision’s CEO Bobby Kotick noted a key fact: “On a non-GAAP basis, we generated $658 million in revenues, with a record 73 percent from digital channels and earnings per share of $0.06.” Quite impressive for a company so heavily invested in the traditional packaged goods business model, but rather a scary indicator for retailers like GameStop. The march towards digital continues, and it’s not slowing down.

Activision’s dependent on five franchises now, and hoping to make that six when Destiny comes out next month. “Our strong performance was driven by 5 distinct franchises, which highlights the increasing breadth and depth of our expanding portfolio,” noted CFO Dennis Durbin. “Blizzard Entertainment’s strong results were driven by World of Warcraft subscriptions, Warlords of Draenor prepurchases and paid character boost, Diablo III: Reaper of Souls expansion pack sales and sales of Hearthstone cards. On the Activision Publishing side, performance was driven by Call of Duty: Ghosts, and Skylanders SWAP Force.”

It’s quite impressive how Hearthstone continues to grow, showing the strength of the collectible card game model when properly executed. It’s also a strong performer for Activision in the mobile space, where the company hasn’t previously had a major impact.

While the company expects a strong second half driven by releases like Destiny, Call of Duty: Advanced Warfare, the new Skylanders: Trap Team, and the Warlords of Draenor expansion for World of Warcraft. Still, there are some cautionary notes embedded in the good news.

“We see industry-wide, that there’s been sort of a secular downturn as it relates to preorders,” said Activision president Eric Hirshberg, while noting that Destiny is on track to have the highest pre-orders ever for any new IP in the industry. “We think that’s happening due to a number of factors, things like increased digital consumption, particularly on the next-gen consoles, titles being widely available on day 1 and the decline overall for demand on previous-gen consoles. ” Also in the category of things to be concerned about, Blizzard saw a drop of 800,000 subscribers for World of Warcraft, which they claimed was to be expected.

TakeTwo’s earnings call, held at the same time as Activision’s, was quite different. There TakeTwo was careful to try and position its earnings in the best light, but it’s tough to do that when you (a) lost money and (b) had less revenue than last year. On the bright side, TakeTwo lost less money than it did last year, and the company was also quick to point out that it made an enormous pile of money from Grand Theft Auto V last year. So who cares about a few million lost this last quarter

The lackluster results were probably why TakeTwo put them later in the earnings call, and CEO Strauss Zelnick’s statement focused on the past (making great money from GTA V last year) and the future (there’s a great lineup of products ahead) rather than talking about the unpleasant present. TakeTwo lost $35.4 million on net revenue of $125.4 million for the quarter, compared to a loss of $61.9 million on $142.6 million in the same quarter last year.

TakeTwo would prefer that we look ahead to the fall, when Grand Theft Auto V will be coming out on Xbox One, PlayStation 4, and PC. Will current owners (all 35 million of them) buy a new version of the same game That’s tough to say, but TakeTwo is allowing transfer of characters to the new versions. Aside from GTA V, TakeTwo is also looking to NBA 2K15 to be a hit, as the game makes it to next-gen consoles and PC as well as current-gen consoles. Also coming out this fall will be Borderlands: The Pre-Sequel, Civilization: Beyond Earth, and WWE 2K15. Sadly, though, one of TakeTwo’s most anticipated titles, Evolve, has been pushed out to 2015. Still, the company should have more than enough new product this fall to make up for it.

TakeTwo’s digitally delivered revenue grew 43 percent in the quarter, to $106.4 million. That’s impressive growth, but the company is still far behind both Activision and EA, where digital revenue is now providing the majority of the company’s sales. TakeTwo is still far behind, with 16 percent of its revenue coming from digital. “Nearly 90 percent of this growth came from recurrent consumer spending, which accounted for approximately 60 percent of our digitally delivered revenue during the period,” said CEO Strauss Zelnick. “The remainder came from full game downloads across console, PC and mobile platforms. The largest contributor to recurrent consumer spending was virtual currency for Grand Theft Auto Online and NBA 2K14.”

The bottom line for both Activision and TakeTwo is that new releases are important to keep the companies growing and to deliver good results. Catalog sales are important, to be sure, but gamers want new experiences constantly. Digital delivery is increasingly important, too. It’s great to focus on extending successful titles, and making sure each title is a hit, but reducing the experimentation on new titles is going to increase a company’s risk in the long term. New IPs like Destiny and Evolve are critical to keeping game publishers at the top of their game.