Two different services now list the Top 20 PC games every month using different methodologies and different data sets, which is terrifically useful for anyone trying to get a sense of what’s popular in PC gaming. Retail sales just don’t begin to address where the money is in PC games these days, with most sales conducted digitally — and with huge revenues coming in from free-to-play games as well. Raptr tracks actual play time, and Newzoo/Overwolf tracks unique play sessions, which are both interesting looks at where players are spending time (and, by implication, money) in PC gaming.

Raptr has 30 million users playing PC games, and seeing what games they are playing offers useful insights into the popularity of various PC games. Especially for games that are free-to-play, the amount of time the game is being played is a crucial factor in how much money the game is making. Even paid games are concerned with this metric — if they are selling DLC, those sales will be affected by how much people are playing the game.

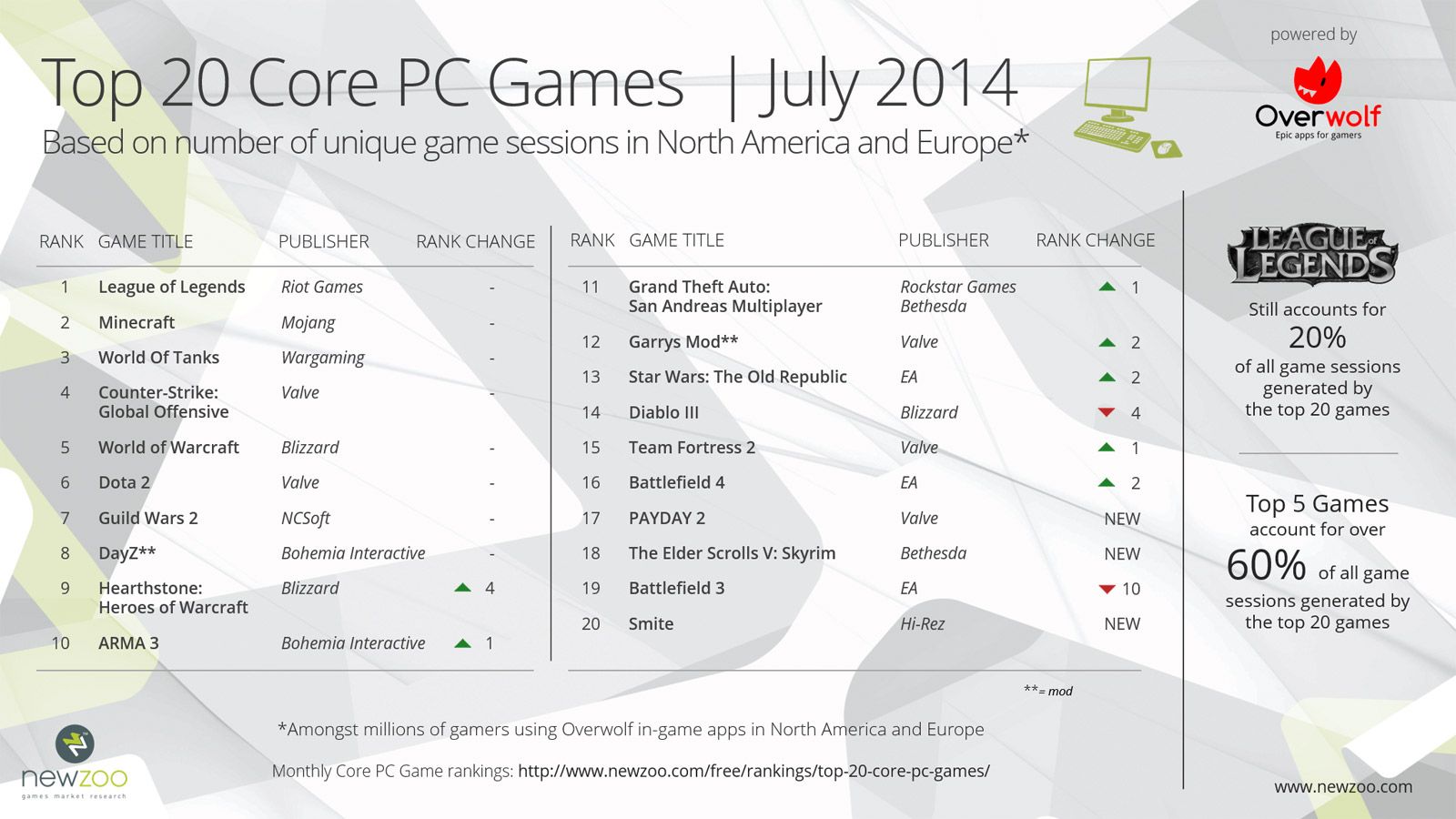

Overwolf has 8 million customers of its in-game software, and thus generates data about monthly players. Newzoo/Overwolf’s rankings are based on the number of unique play sessions per month rather than actual play time as with Raptr’s numbers. Working with analyst firm Newzoo, the monthly ranking service gives insight into the popularity of PC games in North America and Europe.

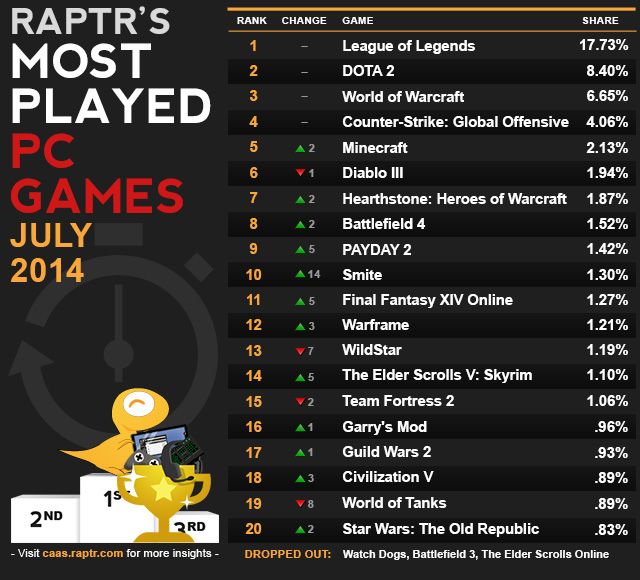

For Raptr, the top two slots were held, as usual, by League of Legends and DOTA 2, both muliplayer online battle arenas (MOBAs). Those two MOBAs held 26 percent of all time spent playing games — no wonder so many more MOBAs are in development, whether on PC or tablet. Riot and Valve have demonstrated the value of being on top in that genre, and even a small part of that market can be worth a lot of money. The MOBA genre is a difficult one, though, and it’s not a genre where you can expect to reach a huge audience right away. A stern chase is a long chase, and the leaders are continuing to sail ahead at full speed. To be a successful MOBA, it’s not sufficient to be fun and balanced and fast with beautiful graphics. The meta (what players call the various strategies involved in creating teams and choosing abilities) has to be interesting too, and crafting a game with not one but two levels of fascinating play is a tall order.

In the Newzoo/Overwolf numbers, League of Legends is still on top but DOTA 2 is in sixth place, while Minecraft takes the #2 position.

It’s interesting to note that six of the Raptr top 20 games are MMORPGs, or nearly thirty percent; the number is similar in the Newzoo/Overwolf numbers. It’s also instructive to see how much of the total playing time belongs to free-to-play (F2P) games. Of the Top 20 Raptr games, five of them are F2P, but they account for almost one-third of all the time spent playing games on PCs. For Newzoo/Overwolf, F2P games are even more dominant. Both in terms of time spent and number of unique play sessions, F2P games are coming to claim an ever-greater share of the PC game business. F2P is not as overwhelming as it is in mobile, but it may yet get to that point.

Another interesting thing to note is how far new MMORPG WildStar fell in both indices, though it’s perhaps not unexpected given that the initial newness has worn off. It remains to be seen if WildStar‘s impressive pace of new content releases will drag in a lot of players. How long should we give this strategy to know how well it’s working

Raptr Analysis

You might expect overall gameplay hours to fall in the middle of summer, but they haven’t, at least not among Raptr members: Total monthly play time was up 30.19% from June. And while Counter-Strike: Global Offensive, Hearthstone: Heroes of Warcraft, Smite, and Payday 2 all had big gains, Diablo III, WildStar, and Watch Dogs headed in the other direction.

Highlights

June’s top four games, League of Legends, DOTA 2, World of Warcraft, and Counter-Strike: Global Offensive, retained their respective rankings in July, and all enjoyed month-on-month play time increases of over 30 percent.

League of Legends’ highest peak in July was on the 27th, the final day of the featured game mode Doom Bots of Doom, where the AI bots were set to an extreme difficulty level. LoL was relatively quiet on the eSports front.

DOTA 2′s premier tournament, The International, took place mid-month and led to a significant play time increase.

Despite Blizzard’s announcement of a decline in WoW players, Raptr members showed no signs of slowing down. We’ll be watching to see what kind of impact WoW’s 10-year anniversary events have in the run-up to, and through, November.

CS:GO’s new Operation Breakout DLC introduced new missions, weapon balancing, skins, map fixes, and various other tweaks to the game at the beginning of the month, and had a significant impact. CS:GO gameplay time was up a staggering 65.19 percent versus June.

The news wasn’t so good for Diablo III, which slipped just one spot despite losing 20.66 percent play time compared to last month.

Hearthstone’s Curse of Naxxramas DLC started rolling out in July and had a very strong impact; the game was up two ranks and play time climbed 53.33 percent over June. The weekly content roll-out schedule seems to be working very well for retention.

Battlefield 4 also climbed two ranks, thanks in part to its Dragon’s Teeth DLC that went live in mid-July for premium members, with everyone else getting the extra content at the end of the month. EA also kicked off Battlefest — a series of community contests and activities, including Raptr’s own Instant Replay contest — in July.

Payday 2 rose five places, riding the tail end of a big sale and a big boost from the Gage Shotgun Pack DLC, which included new weapons, masks, ammo, and achievements.

Smite was the biggest gainer of the month, shooting up eight spots and 128.27 percent over June, although a series of rewards in Raptr’s Rewards Store was certainly a significant factor there.

Final Fantasy XIV Online also had a big month, gaining five spots thanks in large part to a free login weekend in the latter half of the month as well as the Defenders of Eorzea content update.

The new MMO WildStar lost seven spots in its second month of release – but more worryingly, gameplay was down 45.63 percent. We’ll see if its latest PvP game mode, Sabotage, launched on July 31, can help spur a rebound, though initial signs point towards probably not.

Though we predicted last month that both The Elder Scrolls games likely wouldn’t chart in July, a major Quakecon-related sale proved us wrong — at least about Skyrim, which jumped five places. The Elder Scrolls Online, however, dropped six ranks to 26.

Throwback RPG Divinity: Original Sin missed the top 20, coming in at the 25 spot, while Watch Dogs tumbled 25 ranks to #33, with gameplay down 67.72 percent.

Note: The Share number by each game represents that title’s gameplay time as a percentage of the total time spent on all the PC games played by Raptr members, and is useful for comparing the relative amount of playtime between particular games.

Overwolf/Newzoo Analysis

July’s 2014 rankings reveal some surprising shifts compared to the previous month, especially in the area of MMO’s and Free To Play. The Top 8 core PC titles in July compared to June remain unchanged, with Riot’s League of Legends maintaining its pole position, followed by Minecraft (number 2) and World of Tanks (number 3). Two of these three titles are Free to Play, illustrating the consumer attractiveness of the business model in the core PC gaming segment. Impressively, League of Legends accounts for 20 percent of all the game sessions generated by the top 20 games while the top 5 games account for over 60 percent. The full monthly rankings can be found here.

The biggest change in the top 20 rankings is Blizzard’s Hearthstone: Heroes of Warcraft moving up 4 positions to number 9 (13 in June) for July 2014. This success is no doubt due to the tricks that Blizzard employed in creating a title that appeals to new gamers and hardcore World of Warcraft fans alike. EA’s Battlefield 3, after a strong showing in June at number 9, has quickly fallen 10 places to no 19 by the end of July 2014 — influenced perhaps in some measure by the decision of EA to stop releasing it for free and also gamers migrating to the newer Battlefield 4. EA now have three titles in the top 20 rankings, with Valve taking the lead with an impressive four titles.

Perhaps the biggest surprise is the complete disappearance of NCSoft’s WildStar. While it debuted in June at number 19, the game has dropped 3 places and vanished from the Top 20. NCSoft’s Aion has also vanished from the top 20 Rankings (number 20 in June), with Hi-Rez’s Smite rising up 1 rank to take the number 20 spot. The title with the biggest month on month shift was Bethesda’s The Elder Scrolls V: Skyrim, which rose up 5 ranks from June to take number 18 in the July core PC Games Rankings.

Matt Wolf

Matt Wolf

Zynga COO Clive Downie

Zynga COO Clive Downie