Mobile Internet has become a huge driving force in revenue for various companies and marketers, and it will continue to be so for some time, as revenue is likely to grow past $700 billion within just a couple years’ time (by 2017). This year has also brought quite a few shifts in itself, with $19 billion in investments and $94 billion in exists. The market also has its fair share of competitors, with 32 billion-dollar mobile Internet companies making the rounds.

So what’s really driving this community TechCrunch has a pretty good idea, as it’s drawn up six main points when it comes to what’s made the market so big. Here they are, in condensed form, but you can find more details here.

The growth of revenue by 2017

Per a report by Digi-Capital, growth is expected to reach $700 billion in revenue in just a few years, which will triple the amount of $200 billion made last year. mCommerce will be a huge part of that market, with half a trillion dollars calculated from sales. Other top earners in the market include consumer apps ($74 billion), enterprise mobility ($53 billion), ad spending ($42 billion) and wearable tech ($11 billion).

Asia will also play a huge part with mCommerce, clocking in at $230 billion, while America will be in second place with $144 billion and Europe in third with $113 billion.

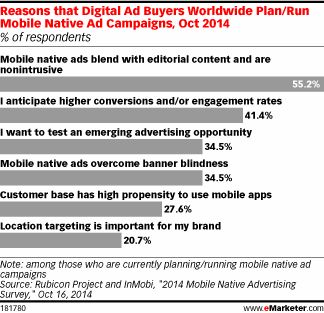

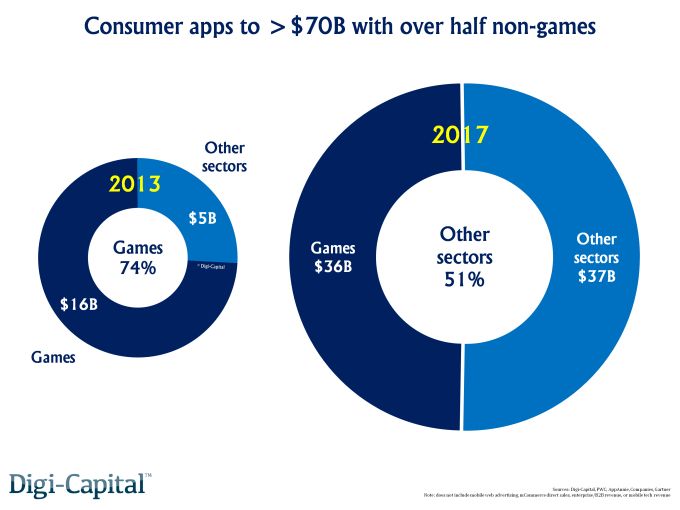

Consumer apps will be a driving force, but not necessarily about just mobile games. While games drive three-quarters of all mobile apps purchased last year (despite only 40 percent of overall downloads), other factors will rise up in the market over the next few years, such as app-as-a-service business models.

$19.2 billion invested over the last year

Startups managed to raise over $19.2 billion in private investments (not including IPO’s) over the last year, a huge increase of 232 percent over the previous year. mCommerce took a huge chunk of that with $4.2 billion, followed by travel/transport ($3.3 billion), utilities ($1.8 billion) and games ($1.1 billion). Smaller commodities like food and drink, music and finance also play a part as well.)

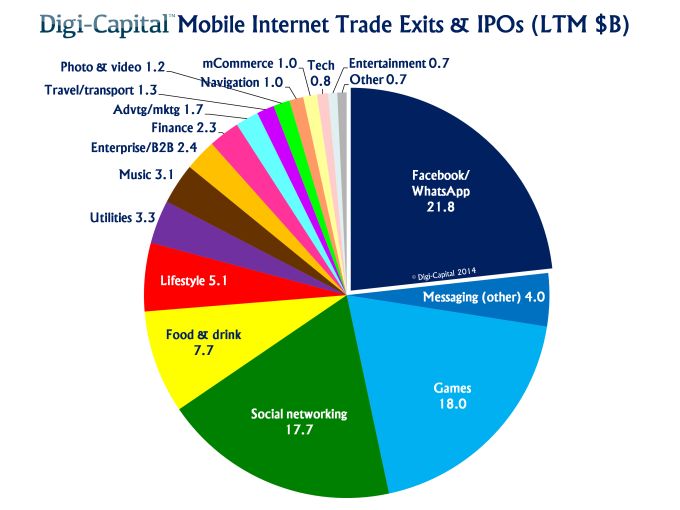

Exits rose to $94 billion over the past year

Mobile Internet exits also saw a huge increase, up seven times its normal amount to $94 billion over the past twelve months. Making the largest impact was the Facebook/WhatsApp trade exit, although the general IPO market managed to take 39 percent of all overall exits.

Various sectors reached over $5 billion, with messaging leading the charge at $25.8 billion (or $4 billion without WhatsApp), games in second place with $18 billion, and social networking with $17.7 billion in third.

Exit returns engaged nearly 16 times from previous year

While billion dollar exits do leave quite an impact, VC and growth equity investors (and institution backers) show great interest in exit returns. Three-year average return for investments in mobile Internet for the past year showed an increase of 3.5 times normal value, across all 27 mobile Internet sectors. That’s quite an increase, but merely just the averages.

There were even higher returns across different areas, including navigation, which saw a whopping 15.6 times increase. Messaging was close behind with 15.4 times (2.7 without WhatsApp), social networking (15 times) and lifestyle (11.4 times). 12-month exit returns have shown a general average of 4.9 times the general amount of increase.

As far as the other two factors, the return of public stock market sectors was noted, with a 78 percent increase in the last 12 months, as well as 32 companies ranging in the “billion dollar” mobile Internet market, worth a total estimated value of $163 billion. Out of those, Twitter showed the highest value with $29.8 billion, followed by WhatsApp with $21.8 billion and Uber with $17 billion.

Graphs for each of these sections — and more detail on which ones made the highest difference — can be found here.