To get players excited for Final Fantasy XIV: A Realm Reborn game, coming to PlayStation 3 and PC later this month, Square Enix has released a new trailer featuring 13 minutes of gameplay footage and a small explanation of how to use the PC benchmark tool. It is in Japanese, but most of it is easy to understand – and the new footage is certainly a treat for the eyes.

-

VPC: $8.36 ▲Value Per Click

-

VPCO: $0.00 ▲Value Per Comment

-

VPL: $0.00 ▲Value Per Like

-

VPM: $0.00 ▼Value Per 1k Impressions

-

VPS: $0.00 ▲Value Per Share

-

VPV: $0.00 ▲Value Per View

-

VPCO: $7.72 ▲Value Per Comment

-

VPL: $0.00 ▲Value Per Like

-

VPM: $0.00 ▼Value Per 1k Impressions

-

VPV: $0.00 ▲Value Per View

-

VPC: $2.86 ▲Value Per Click

-

VPCO: $0.00 ▲Value Per Comment

-

VPFAV: $0.00 ▼Value Per Favorite

-

VPL: $0.00 ▲Value Per Like

-

VPM: $0.00 ▼Value Per 1k Impressions

-

VPR: $0.00 ▼Value Per Reply

-

VPS: $4.08 ▲Value Per Share

-

VPV: $0.00 ▲Value Per View

-

VPC: $20.80 ▲Value Per Click

-

VPCO: $0.00 ▲Value Per Comment

-

VPL: $0.00 ▲Value Per Like

-

VPM: $0.00 ▲Value Per 1k Impressions

-

VPS: $0.00 ▲Value Per Share

-

VPV: $0.00 ▲Value Per View

Smartphones Now Dominate In Japan

According to a report from the Mobile Content Forum in Japan (as translated by Dr. Serkan Toto), the market for mobile gaming in that country brought in $5.1 billion in 2012. The Japanese market for mobile games has been largely based on feature phones, but smartphones are rapidly gaining market share.

Feature phones in Japan in 2012 brought in $2.4 billion, which mostly ($2 billion) from ‘social’ games distributed through networks like GREE or DeNA’s Mobage. About $410 million came from other mobile games not through those networks.

Smartphone games all told brought in $2.7 billion, showing over five-fold growth in the last year to surpass feature phone game revenue for the first time. Overall, mobile content in Japan (including games) generated $8.8 billion in 2012.

Source: Serkan Toto

Fashion Designer Michael Kors Launches Game

Though it’s not like the old “Choose Your Own Adventure” books, Michael Kors’ new Facebook app will have you making some interesting decisions anyway. It’s advertising that’s starting to feel more like a game.

The company launched a new app which shows video from the various fragrance and beauty collections, then lets you make decisions depending what you’re in the mood for – Sporty, Sexy or Glam.

In addition, the app encourages visitors to take pictures to share on Facebook, Twitter and Pinterest, along with shopping the collections and entering a sweepstakes for various prizes.

Source: Mashable

Marketers Unfazed By Gmail Redesign

When Google announced that they would be redesigning Gmail back in May with a new tab filtering system that keeps marketing emails out of the standard inbox, many companies feared that this would be the end of their email marketing programs. However, that hasn’t been the case. Marketers and email vendors spoke to Ad Age about how there are ways around the problem.

“We’ve found there’s been really no impact in our business overall. In fact since the redesign launched, we’ve seen no change in (email) open rates, and response rates have stayed almost exactly the same,” said Jeffrey Lack, director of marketing at Jiffy Lube. Their email base remains high with a couple of million of email addresses.

Other companies, like Responsys and Epsilon, haven’t seen much change either. “We’re seeing a slight decline in Gmail opens, but we’re seeing conversion rates and click-to-open rates staying steady,” said Epsilon’s VP-customer experience designer Shannon Aronson. That’s good news for email marketers, who worried that the increasing popularity of Gmail with its filtering feature might affect their business.

Source: AdAge

Supercar Dream Collection For $80

Microsoft is building up some serious energy behind its next-gen racing game Forza Motorsport 5, which is set to be a launch title for the Xbox One later this year. Today, the company announced a pair of limited editions shipping around the system’s release, which racing fans won’t want to miss out on.

Both editions, the $79.99 Limited Edition and the $59.99 Day One Edition, will come with a VIP membership with special rewards, exclusive events and in-game player car badges from the Forza team, as well as a car pack that includes the 1965 Shelby Cobra 427 S/C, the 1987 RUF CTR Yellowbird, the 1991 Mazda #55 787B, the 2011 Ford F150 SVT Raptor and the 2011 Bugatti Veyron Super Sport.

Those who invest in the Limited Edition will also get the 2011 Audi RS3 Sportback, 2012 Aston Martin Vanquish, 2013 Ford M Shelby Mustang GT500, 2013 McLaren P1 and 2013 SRT Viper GTS. The Day One car pack comes with the 2010 Audi TT RS Coupe, 2013 Ford Focus ST and 2011 Lamborghini Gallardo LP570-4 Superleggera, all in Xbox One Day One-themed package.

Both editions are available for pre-order from retailers now. Forza Motorsport 5 will ship later this year for Xbox One.

Source: Polygon

Analysis: PSN Payoff Coming For Sony

There’s been a lot of focus on Microsoft’s changing policies for the Xbox One, but little attention has been paid to a major policy change Sony has made. The PlayStation Network will continue to be free, but the ability to play multi-player games online on the PS 4 will be put behind the PlayStation Plus paywall.

Analysis by IHS Electronics and Media indicates that with this change PlayStation Plus could generate $1.2 billion in subscriptions for Sony by the time 2017 rolls around. That’s a big change from the estimated $140 million PlayStation Plus subscriptions generated for the company on PS3 in 2012.

In comparison, Microsoft’s Xbox Live Gold generated $1.25 billion in subscriptions in 2012, according to IHS, and has made $4.7 billion from Xbox Live Gold since 2002. That’s a lot of potential revenue that Sony missed – but they don’t plan to miss it in the future.

Source: GamesIndustry International

‘Skylanders’ Still Soaring

When Activision introduced the Skylanders franchise a couple of years ago, no one had any idea that it would grow into such a successful juggernaut. However, between game sales and the number of figures available, it’s become exactly that.

Activision Publishing announced that Skylanders figures have managed to outsell all other action-figure properties in both the U.S. and Europe as of June 2013. How popular is it, you say? The franchise has managed to generate more than $1.5 billion in worldwide sales.

“We began something very special with Skylanders, and the magic of bringing toys to life through a video game,” said Eric Hirshberg, CEO of Activision Publishing. “But it’s not just about the game. We know the toys have to be just as creative and imaginative as the kids that play with them, and that’s why we’re so excited to bring even more innovations to this genre when Skylanders SWAP Force comes out in October.”

Even with Disney Infinity releasing this Sunday, Activision is primed and ready for battle with its latest Skylanders property.

Source: Skylanders.com

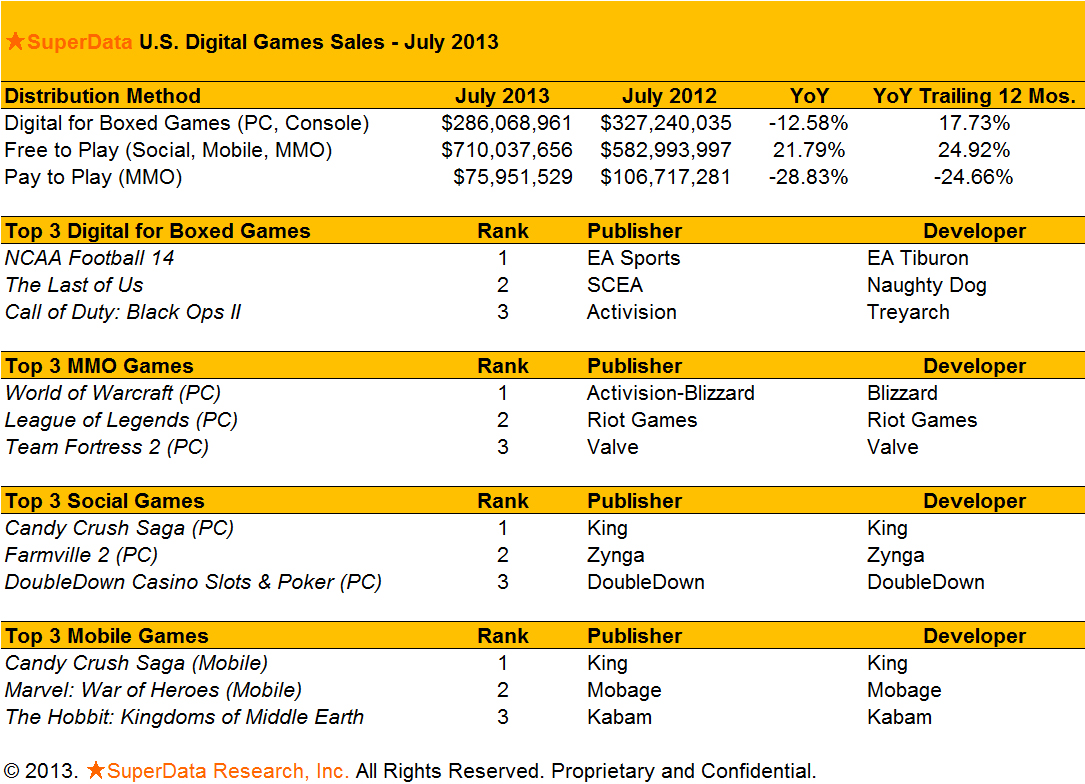

Digital Game Sales For July 2013

SuperData released data for top digital game sales in July 2013, which we run as part of a monthly column on [a]list daily.

For methodology, SuperData collects anonymized user data directly from publishers and developers, looking at spending by more than 2.8 million unique paying online gamers across 50 publishers and 450+ game titles.

Joost van Dreunen, co-founder and CEO of SuperData, provides insight for the report.

The overall digital games category totaled $1.1 billion in sales in the month of July, representing a year-over-year increase of 5.4 percent. Major growth drivers were social games and the summer sales in PC DLC, which offset declines in subscription-based MMOs and console DLC.

Social Games

Overall revenues for social games improved to reach $164 million compared to $133 million last month. The underlying metrics for social games are improving, with July’s conversion rate reaching 2.11 percent across all categories. Nevertheless, we foresee a decline for the category in August because of the summer season.

In early July, King dethroned Zynga as the leading social game developer on Facebook by number of monthly active users (MAUs) despite having a much smaller portfolio of titles. With social platforms maturing, game companies that offer more complex gameplay and make better use of social functionality will continue to do well. King’s Candy Crush Saga generated an estimated $438,000 per day in July.

Free-to-Play MMO

The overall audience base for the free-to-play category declined slightly in July, likely due to the month as a prime vacation period. The total number of free-to-play MMO gamers dropped to 45.8 million. Overall spending remained strong however, with an average revenue per paying user just south of $40.

Trion World announced that End of Nations, a real-time strategy game, is to become a multiplayer online battle arena (MOBA) game that features “heroes” with special abilities. With a growing number of MOBA titles announced for the coming year, it is clear that the saturation of the free-to-play MMO market is accelerating.

Pay-to-Play MMO

The total number of subscription-based MMO players continued its decline to 5.8 million in July. This is consistent with market leader World of Warcraft’s announcement that it lost 600,000 subscribers since its previous quarterly report. The overall segment contracted 9 percent month-over-month as revenues totaled $76 million.

After buying back $5.8 billion in shares from Vivendi, Activision has gained more autonomy in its decision-making and has indicated a departure from the traditional subscription model. The company’s Blizzard division is currently in the process of selecting a new direction for its unannounced project, code-named Titan, which it has stated is “unlikely to be a subscription-based MMO.”

Mobile

Mobile games continue to do well, totaling $271 million in revenues in July, up 32 percent from a year earlier. Overall conversion rates have been consistently above 5 percent, indicating that mobile gamers are becoming increasingly accustomed to spending on mobile games.

In July, it was again Candy Crush Saga from King and MARVEL War of Heroes from Mobage that featured as top grossing apps in the US. Kabam’s The Hobbit: Kingdoms of Middle Earth came in as the third top grosser across all app stores, taking the spot at the expense of Supercell’s Clash of Clans.

Facebook’s announcement to enter the mobile games market as a publisher may bring a wind of change to the top of the mobile games food chain, which has been dominated by a small group of titles. However, the effects may be a few months out as Facebook is selectively working with medium and small game developers.

Noteworthy mobile game launches in July were Magic 2014 from Wizards of the Coast, which hopes to repeat the success its predecessor by offering more varied and improved multiplayer game play. Indie darling LIMBO from Playdead was released on iOS after winning a slew of industry awards on PC.

Downloadable (PC and console)

The PC DLC summer sale across digital distributors such as Steam and GamersGate drove an estimated increase of 15 percent in downloadable PC sales in the U.S. for a total $158 million. This offset the decline in console DLC sales, which is currently at one of the low-points of its digital cycle with little expected change until the upcoming holiday season. We expect the eagerly anticipated GTA V to invigorate sales in September.

Despite losing licensing rights to the NCAA, EA’s NCAA Football 14 was a top-seller in July, proving the strength of the franchise. In all likelihood, EA will continue the series under a different name. Total sales for the DLC category were $286 million in July, 2013, up 5 percent from the month before, but down 13 percent year-over-year.

A note from the author: Over the summer SuperData secured several important data sets. With more transactional data available we’ve been able to adjust our models and improved our accuracy. As a result the observant reader may notice a change in some of our previously reported averages. For any questions regarding our methodology, don’t hesitate to contact us.

For full reports, visit SuperData Market Data.

About the Author

Joost van Dreunen, Ph.D., is CEO SuperData Research, a market intelligence provider specialized in online games. He has written extensively on online audiences, monetization strategies, virtual goods, social games, free-to-play, online gaming and entertainment.

Eminem Debuts Track In Call Of Duty: Ghosts Trailer

Activision turned the volume up to 11 with a new Call of Duty: Ghosts trailer, featuring rapper Eminem debuting Survival, a loud and aggressive track from his upcoming fall album. The rapper’s new album, the follow-up to 2010’s Recovery, is expected to be released by the end of the year.

Activision revealed the multiplayer component of its forthcoming Call of Duty: Ghosts during a special presentation in Los Angeles. Afterward, Eminem appeared in a video with news that a Survival video is on the way. The combination of a best-selling rapper and the best-selling video game franchise is a solid PR coup that will help boost visibility for the game.

Activision has worked hard to make this new Call of Duty game special. The sequel has seven new modes, 20 new killstreaks, 30 new weapons and customization features galore, including the ability to fight as a female soldier for the first time in the series. Maps can also dynamically change over the course of the game, as a result of the player’s actions.

“This is the biggest overhaul of multiplayer since the original Call of Duty: Modern Warfare,” said Mark Rubin, Executive Producer, Infinity Ward. “We’re pouring our hearts and souls into making Call of Duty: Ghosts multiplayer the best it can be on next gen and current gen alike. With all the customization options, our new Create-a-Soldier system, dynamic map events, new perks and killstreaks, tactical player animations, new Squads mode, Clan support in-game and on second screen, it’s the complete online experience.”

In addition, two special editions for Ghosts have also been unveiled, including a Hardened edition and a special Prestige edition, which comes with a mountable digital camera that supports 1080p. The game hits the shelves on November 5.

The multiplayer trailer shows off tight editing with Eminem’s track:

Check out the special editions of Call of Duty: Ghosts in this “breachin’” video:

Katy Perry Features WhatsApp In New Video

Katy Perry has easily grown into one of this generation’s more popular performers, so it’s always interesting to see what she does next for her videos. For her latest song, “Roar,” she based the video around the group messaging application called WhatsApp, showing her conversation as it happens in the video. This was not planned or paid for by WhatsApp, but it’s surely going to help out the app as the video has already had over six million views! You can see it in action below, and see all the lyrics in action.

Source: AdWeek {link no longer active}