The old adage, “never count Nintendo out,” couldn’t be more true today. Who would have thought a game for a console (the Wii U) that’s in a distant third in the current video game battle would be the talk of E3 2016? Yes, it’s an amazing new Zelda game, but it’s one that’s been delayed numerous times for a platform that many people have written off, especially with the NX on the horizon for a March 2017 launch. Yet Nintendo has proven once again that the power of its core franchises still entice fans and influencers to stand in line for hours to play for 30 minutes.

And those E3 accolades came before the company announced that it will be launching a mini collector’s edition NES, based on its original Nintendo Entertainment System console from 1985, this holiday season, and the Pokémon GO phenomenon that catapulted Nintendo’s stock and instantly turned augmented reality into a mainstream sensation.

Nintendo’s long-delayed entry into the mobile gaming space has seen two hits out of the gate, with more lined up and waiting in the wings. The company has also generated excitement about the NX, even with no real information about it revealed yet.

Nintendo of America president, Reggie Fils-Aimé, talks to [a]listdaily about the power of Zelda, the evolving E3 trade show, and why Nintendo has always done things its own way in this exclusive interview from the Nintendo E3 booth on the last day of the trade show.

What are your thoughts about the evolution of E3 into a trade show that’s partially now open to the public?

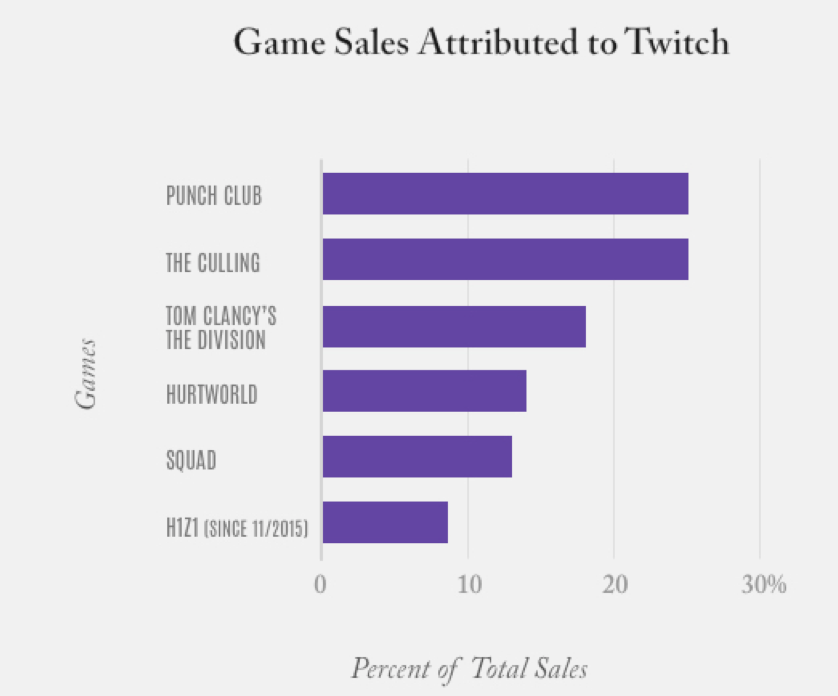

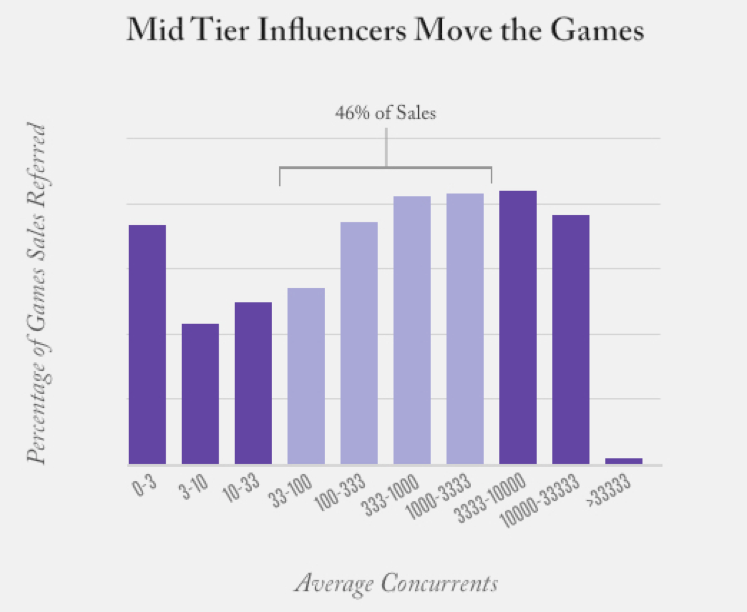

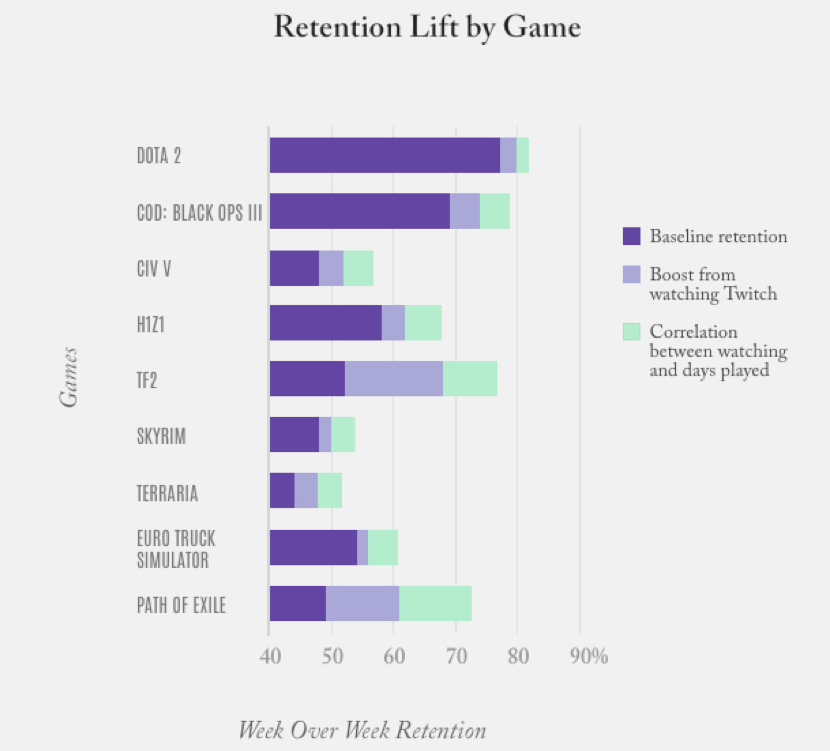

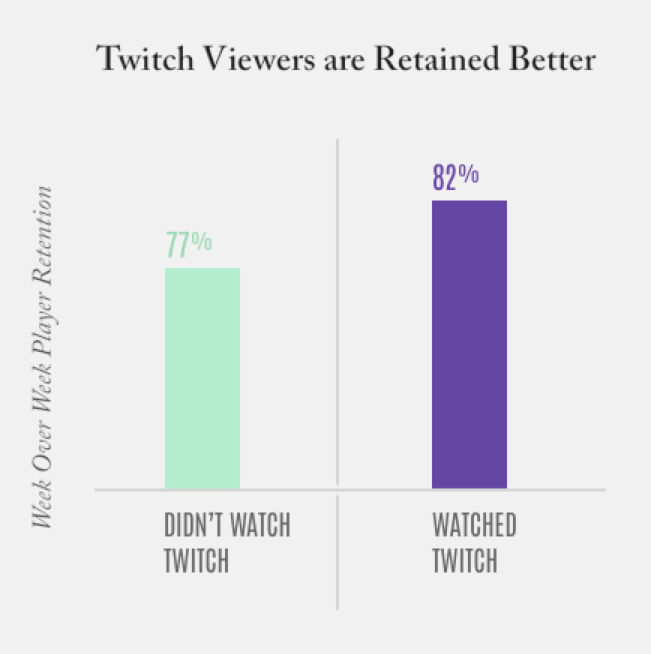

This is my 13th E3 and each one is different. There’s always an evolution. From that standpoint, the evolution to have more influencers participate is wonderful. The evolution that we’ve gone through with doing much more broadcast activity has been a tremendous evolution for us. We essentially were streaming constantly from E3. Our average viewership was very strong—double the Twitch stream—which was great to see. For us, E3 is going to continue to evolve. And as a member of the ESA, I’ll be helping to push for continued evolutions that work for this event and to keep it as the premier gaming event in the world.

Gamescom in Germany has a separate business area and public area that overlap. Do you see that as a model for E3?

It could be. The Gamescom happens in a huge facility, much bigger than what we have here in LA. So the facility is one aspect that needs to be taken into mind. The other piece that needs to be considered is timing because Gamescom happens typically in that late August time frame when the content is largely done. With Zelda, we’ve brought a game to E3 that’s not launching until 2017. It’s playing on development equipment. There are a lot of complexities when you’re dealing with that type of situation, so all of these things are what will need to be considered as we think about where this event goes. Certainly, from a Nintendo perspective, we love for fans—for average consumers, if you will—to be able to get their hands on our content. That’s why we do tours; that’s why we take our content on the road all the time. So from our standpoint, we’d love to see that type of evolution.

Can you talk about Nintendo’s early adoption of livestreaming through Nintendo Direct, done long before any other company used the format?

It’s Nintendo’s mentality to always push the envelopes to do things that others aren’t, but more importantly, we do things to best show off our content and to best communicate what’s unique about our content. We moved to the Nintendo Direct-type of program because we wanted to go in deep on our games, and share what we felt was the backstory and the compelling nature of the game. This year, we wanted to focus on hands-on through our Treehouse experts communicating the gameplay experience. Based on the numbers, I see that’s worked well. So we’re going to continue to push that envelope and look to bring new and different types of experiences. Sony had an orchestra at their E3 event this year. We had an orchestra when we were celebrating Zelda’s 25th Anniversary [in 2011]. So a lot of these ideas come around and then circulate within the industry. We take pride in often being the first to try some of them.

The Legend of Zelda: Breath of the Wild consistently had the longest lines at E3. Were you expecting this kind of outpouring from fans?

We certainly knew we had a fabulous game. We hoped that the show attendee would appreciate it. We did not anticipate four-hour lines, and we worked hard to do some things to try and improve the pace of the experience and get as many people through the experience as possible. But still, the reaction has been overwhelmingly positive and we appreciate the love that the attendees are showing for the game.

Can you talk about the cross-platform strategy for the new Zelda game?

This game has been in development for a number of years. As Mr. Miyamoto indicated, he wanted to change the Zelda conventions and to create something that would not only satisfy the historical fan of the series, but be compelling enough to bring new fans into the series. So that’s why you see this open air gameplay. This is why you see the crafting elements within the game in terms of cooking and making your own elixirs. You see over 100 shrines in the game, and in these shrines you’re rewarded, once you solve a puzzle, with items that can help you in your quest. These are all things that we believe are going to appeal to that consumer who’s maybe heard a little bit about Zelda but never jumped in. This will be their opportunity to get into the franchise.

What role do you feel Zelda will play in launching the new NX hardware?

We think it’s going to be a very effective way for us to reward the buyer—many of which have been waiting for this game—but [it’s] also the critical component of helping drive the NX. We’ve said that it will launch simultaneously on the two platforms. We haven’t said whether Zelda’s going to be a launch title or not for NX. So there’s some speculation there, but over the next number of months, we’ll be sharing more and more information specifically about the NX.

Why was E3 not the right place to showcase NX?

Once we made the decision to launch NX in March, we then thought through the beats of information. The first beat has to be the positioning and helping people understand the core concept. Doing that here at E3, we thought would be a little complicated, especially when the game we have for showing here at this event actually plays on the Wii U. Yes, it also plays on the NX, but we’re not prepared to show that on the NX. So all of these elements were taken into consideration to first say, “Okay, we’re going to make this largely about Zelda: Breath of the Wild, we’re going to showcase it on the Wii U. Let’s make that decision.” And then over the next number of months, we’ll decide the right times to share the proposition, give a sense of the launch titles, share the specifics of launch date, launch price, etc. There’s a lot of time between now and March 2017 to communicate that information.

Does that connect back to the Nintendo Direct option of being able to communicate to fans any time?

I would say yes and no. We do believe in communicating direct to the consumer. We’ve been doing that for years, but the decision around this E3 was much more about making sure we did a first-rate job of communicating how this Zelda has the potential to be another in a line of momentous events for the industry that Nintendo has brought forward. We needed to do that first before talking about NX.

We’ve seen Activision and Warner Bros. continue with toys-to-life, while Disney has left the business completely. How has amiibo been progressing?

We’re fortunate that our amiibo business continues to be quite strong. What we have found is that our strategy in having amiibo play across a variety of games and across both our handheld (with the new 3DS) and home console business has been very effective. In addition, we’ve been fortunate that our amiibo is motivating both a more casual type of consumer as well as the collector—someone who feels that they have to have every one. So that certainly also is something that’s helped our business. Our focus continues to be bringing new and unique amiibo, and we have three that are compatible with The Legend of Zelda: Breath of the Wild. We’ve also shown exactly how the Wolf Link amiibo that’s being sold right now with Twilight Princess works in the new Zelda game. We’re going to continue to bring these types of innovations, but the core element of gameplay across multiple platforms and across multiple titles is a differentiator versus what others are doing in the space.